Emerson Electric Co. Poised for Growth Ahead of Q4 Fiscal 2024 Earnings Report

Emerson Electric Co. EMR is set to announce its fourth-quarter fiscal 2024 results (ending September 30, 2024) on November 5, just before the market opens. Analysts expect revenues to reach $4.58 billion, reflecting a robust growth of 11.9% compared to the same quarter last year.

Stay informed on all quarterly releases with Zacks’ Earnings Calendar.

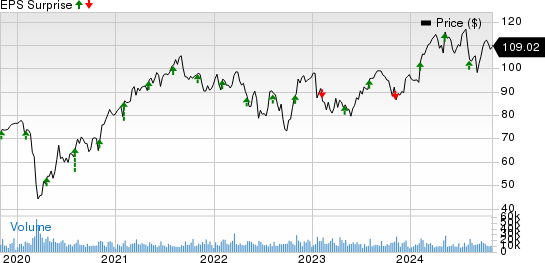

The expected earnings per share (EPS) stands at $1.47, consistent over the past 60 days, indicating a 14% increase year-over-year. In the previous quarter, the company’s earnings exceeded the Zacks Consensus Estimate by 0.7%. Within the last four quarters, EMR underperformed estimates once but achieved positive surprises on other occasions, yielding an average surprise of 6.3%.

Key Influencers on Emerson Electric’s Quarterly Performance

The strength in Emerson’s Final Control business is expected to positively impact its Intelligent Devices segment due to significant momentum in the energy and power markets. We foresee the Intelligent Devices segment revenues growing by 0.5% from the prior year’s quarter to $3.2 billion.

The Software and Control segment also benefits from robust control systems and software sales, as power, process, and hybrid markets show strength. Demand from the aerospace and defense sectors—fueled by rising government expenditure—should further enhance this division. We anticipate a remarkable 45.3% year-over-year revenue increase for this segment, bringing total revenues to $1.4 billion.

In fiscal 2023’s fourth quarter, Emerson acquired Afag and Flexim, enhancing its factory automation capabilities and expanding into high-demand industries such as automotive and medical sectors. Additionally, the acquisition of National Instruments in October 2023 is projected to augment its presence in rapidly growing markets like semiconductors and electric vehicles.

Total revenue estimates for Emerson are $4.6 billion, reflecting an 11.5% rise from last year. Adjusted earnings are forecasted at $1.46 per share, marking a 12.9% growth from the same quarter last year.

Nevertheless, rising costs related to acquisitions and restructuring may lead to margin pressures. We project sales costs to reach $2.2 billion, a 6.7% increase compared to the previous year. Furthermore, challenges related to foreign currency fluctuations from its global operations could impact profitability.

Emerson Electric Co. Price and EPS Surprise

Emerson Electric Co. price-eps-surprise | Emerson Electric Co. Quote

Earnings Whispers

Our analysis suggests that Emerson is likely to achieve an earnings beat this quarter. A positive Earnings ESP combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) increases the likelihood of this outcome, which applies in this case.

Earnings ESP: EMR has an Earnings ESP of +0.85% as the Most Accurate Estimate is at $1.48 per share, exceeding the Zacks Consensus Estimate of $1.47. Use our Earnings ESP Filter to find top stocks before their reports.

Zacks Rank: Currently, EMR holds a Zacks Rank of 3.

Compare with Other Industrial Companies

Avery Dennison Corporation AVY reported third-quarter adjusted earnings of $2.33 per share, slightly beating the Zacks Consensus Estimate of $2.32. The earnings saw a 9% year-over-year increase due to higher volume and enhanced productivity, although total revenues at $2.18 billion fell short of the expected $2.2 billion, showing a 4.1% annual gain.

A. O. Smith Corporation AOS matched earnings expectations for the third quarter at 82 cents per share, though this represents an 8.9% decrease from the previous year. Net sales of $902.6 million missed the consensus of $913 million, marking a year-over-year decline of 4% due to lower sales in China and decreased water heater sales in North America.

Another Stock to Watch

Another potential stock to consider is Tenaris S.A. TS, which currently shows an Earnings ESP of +10.22% and a Zacks Rank of 3. Tenaris is expected to announce its third-quarter 2024 results on November 6. Over the past four quarters, the company surpassed the Zacks Consensus Estimate in two instances, with an average surprise of 11.6%.

5 Stocks Projected to Double

Here are five stocks identified by Zacks experts as having the potential to increase by +100% or more in 2024. While past performance is not indicative of future results, previous selections have yielded remarkable gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of these stocks are not widely recognized yet, allowing investors a unique opportunity to enter early.

Discover These 5 Potential Winners >>

Emerson Electric Co. (EMR): Free Stock Analysis Report

Avery Dennison Corporation (AVY): Free Stock Analysis Report

A. O. Smith Corporation (AOS): Free Stock Analysis Report

Tenaris S.A. (TS): Free Stock Analysis Report

For the full article on Zacks.com, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.