Oversold Stocks in Consumer Staples: A Potential Buying Opportunity

The consumer staples sector is showing signs of undervaluation, presenting potential buying opportunities for investors. The Relative Strength Index (RSI) helps identify stocks that may be oversold, meaning they could be poised for a rebound.

The RSI is a momentum indicator that analyzes price changes, comparing days when prices rise to those when they fall. According to Benzinga Pro, an asset is generally labeled as oversold when the RSI falls below 30.

Below is a current list of key stocks in this sector that have an RSI near or below 30.

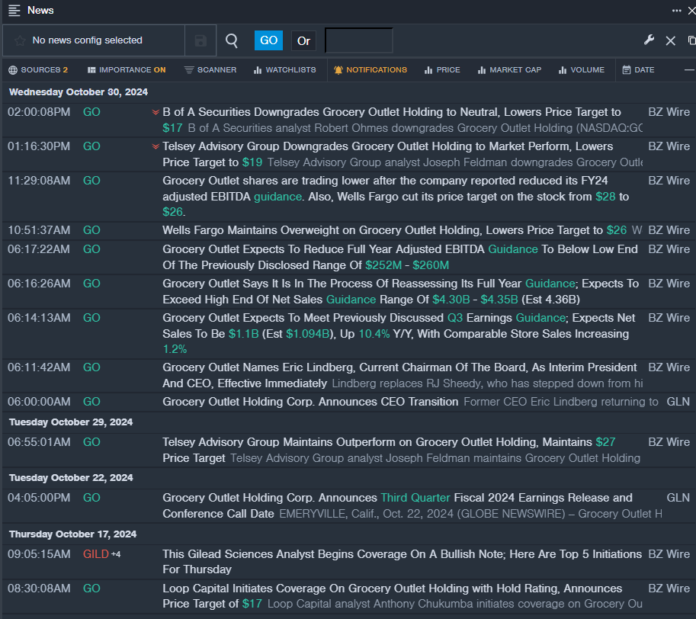

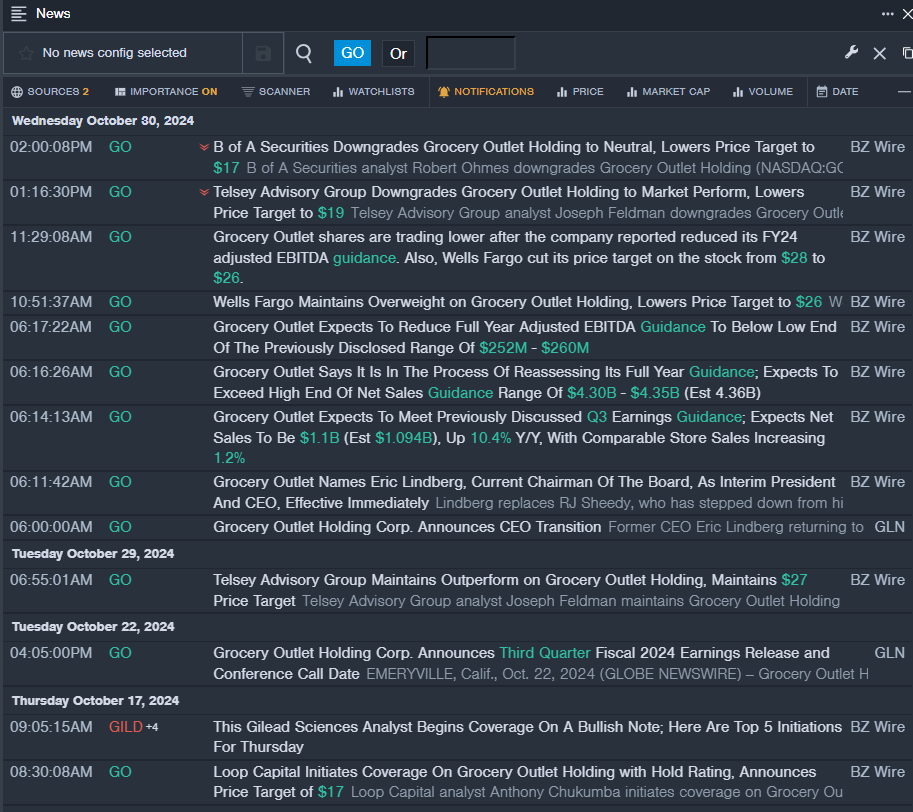

Grocery Outlet Holding Corp GO

- On Oct. 30, Grocery Outlet lowered its FY24 adjusted EBITDA forecast. The stock dropped about 21% over the last month, reaching a 52-week low of $13.60.

- RSI Value: 20.34

- GO Price Action: Shares fell 16.3% to close at $13.90 on Wednesday.

- Benzinga Pro’s real-time alerts provided updates on Grocery Outlet.

Reynolds Consumer Products Inc REYN

- Reynolds Consumer Products announced steady earnings for the third quarter on Oct. 30. CEO Lance Mitchell stated, “Our leadership in household products is strong, driving our positive financial performance.” Despite this, the stock experienced an 11% decline over the past month, hitting a 52-week low of $25.08.

- RSI Value: 16.82

- REYN Price Action: Shares dropped 6.2% to end at $27.69 on Wednesday.

- Benzinga Pro’s charting tools tracked the trend in Reynolds Consumer Products stock.

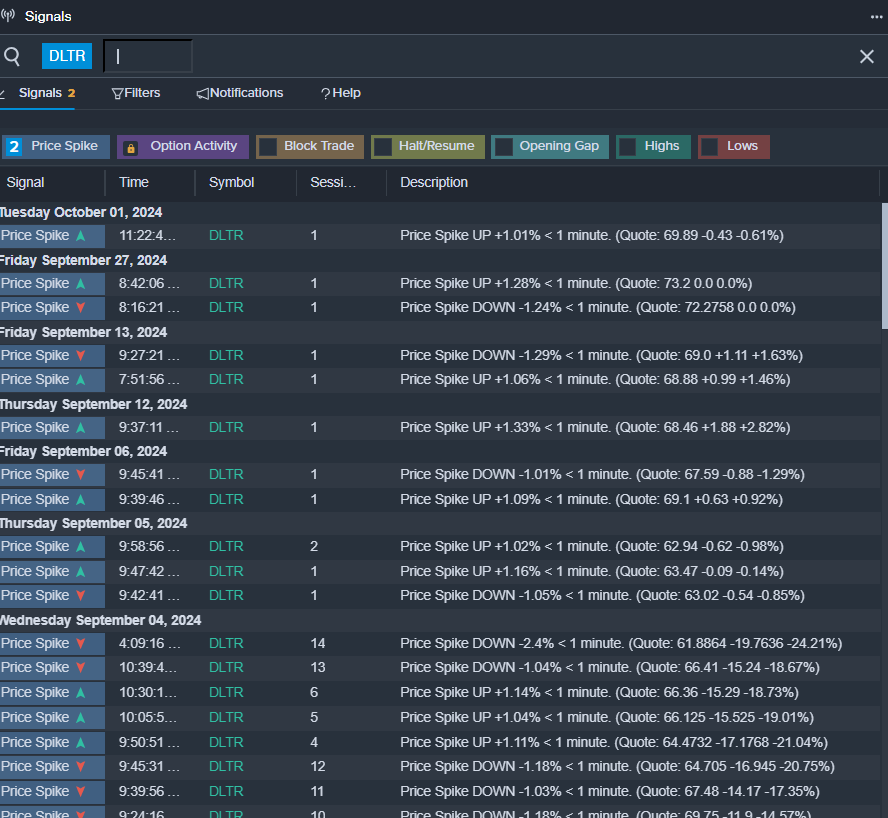

Dollar Tree Inc DLTR

- On Oct. 22, analyst Greg Melich from Evercore ISI maintained an In-Line rating for Dollar Tree, lowering the price target from $105 to $100. The stock dropped approximately 10% in the past month, reaching a 52-week low of $60.82.

- RSI Value: 26.15

- DLTR Price Action: Shares decreased 1.8% to finish at $63.31 on Wednesday.

- Benzinga Pro’s alerts indicated a potential breakout for Dollar Tree’s stock.

Read More:

Market News and Data brought to you by Benzinga APIs