Clean Energy Fuels Corp. Prepares for Q3 Earnings Release

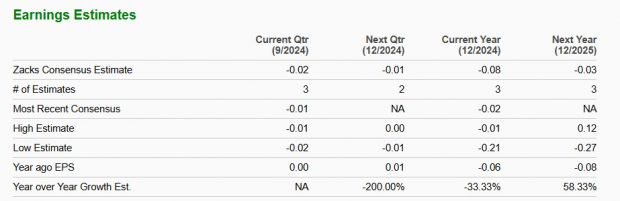

Natural gas supplier Clean Energy Fuels Corp. CLNE is set to announce its third-quarter 2024 results on Nov. 6, after the market closes. Analysts predict a loss of 2 cents per share, with revenues expected to reach $105.2 million, according to the Zacks Consensus Estimate.

Discover the latest EPS estimates and surprises on Zacks Earnings Calendar.

In the last month, estimates for this quarter have stayed the same. The projected loss stands in contrast to the break-even earnings recorded in the same quarter last year. Nevertheless, the revenue forecast indicates a year-over-year increase of 10.1%.

For the entire year, revenue estimates are at $414.5 million, suggesting a 2.5% year-over-year decline. The EPS forecast for 2024 remains at a loss of 8 cents, pointing to a significant erosion of approximately 33.3% compared to previous periods.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Over the past four quarters, the Newport Beach, CA-based renewable energy company managed to exceed EPS estimates three times, but fell short once, leading to an average earnings surprise of 60.4% as illustrated in the chart below.

Clean Energy Fuels Corp. Price and EPS Surprise

Clean Energy Fuels Corp. price-eps-surprise | Clean Energy Fuels Corp. Quote

Understanding Q3 Performance Expectations

The third-quarter results for Clean Energy are likely to reflect increased sales volume of renewable natural gas (RNG). Estimates suggest the total RNG volume could reach 60 million gallons, up from 56.7 million gallons in the same quarter last year. This expected rise in fuel sales, despite falling natural gas prices, is projected to enhance revenue streams.

According to their second-quarter results, CLNE showed some recovery. While reporting a net loss, the company achieved a positive non-GAAP EPS and an adjusted EBITDA of $18.9 million, improving from $12.1 million in the previous quarter. Robust operating cash flow of $21.4 million for the first half of 2024, a considerable increase from negative cash flow in the same timeframe last year, supports this trend. Further progress is anticipated in the upcoming quarter.

Nonetheless, Clean Energy is likely facing additional costs this quarter. Their total operating expenses rose 15% year-over-year to $134.3 million in the second quarter of 2024, a trend expected to continue between July and September of this year.

Recent Price Trends and Valuation Analysis

Over the past six months, Clean Energy stocks have outperformed both the industry and the S&P 500.

CLNE 6-Month Stock Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

However, from a valuation perspective, CLNE appears less attractive. Its Enterprise Value to EBITDA ratio does not present favorable comparisons to similar firms in the renewable energy sector, especially considering its market cap has dropped to $650 million from a previous high of $3.5 billion. The stock’s Value Score of D reflects its low share price and weak valuation appeal.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Evaluating Clean Energy’s Future: A Cautious Stance

As CLNE expands its control over RNG production through joint ventures with BP plc BP and TotalEnergies TTE, the company is in a favorable position to take advantage of growing renewable fuel demand. Its collaborations with major customers like Amazon AMZN and initiatives with Tourmaline for fueling stations in Canada further strengthen Clean Energy’s market presence. However, concerns exist regarding its valuation risks for potential investors.

Image Source: Clean Energy Fuels Corp.

Image Source: Clean Energy Fuels Corp.

Clean Energy’s reliance on third-party RNG suppliers continues to be a hurdle. Even with strategic alliances, proprietary production accounts for less than 10% of its total RNG sales, limiting possible profit margins and exposing the company to fluctuations in pricing and supply challenges.

In conclusion, while Clean Energy may attract high-risk investors seeking growth opportunities, those with lower risk tolerance should proceed with caution. As clean energy stocks gain attention amid a greater focus on environmental sustainability, CLNE’s stock may still have potential for recovery.

As the third-quarter earnings date approaches, investors are advised to pay close attention to Clean Energy’s revenue growth, sales volume, and overall financial performance prior to deciding on actions related to this penny stock.

5 Stocks Set to Double

Each stock featured here has been selected by a Zacks expert as a top pick likely to gain +100% or more in 2024. While not every recommendation is guaranteed to succeed, past selections have yielded impressive returns of +143.0%, +175.9%, +498.3%, and +673.0%.

Most of these stocks are currently off Wall Street’s radar, presenting an excellent opportunity for early investment.

Today, check out these 5 potential home runs >>

Want the latest stock recommendations from Zacks Investment Research? Download 5 Stocks Set to Double for free today.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

BP p.l.c. (BP): Free Stock Analysis Report

Clean Energy Fuels Corp. (CLNE): Free Stock Analysis Report

TotalEnergies SE Sponsored ADR (TTE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.