Palantir Technologies Inc. Set to Release Q3 2024 Earnings: Key Expectations and Insights

Palantir Technologies Inc. (PLTR) will announce its third-quarter 2024 results on November 4, after the market closes.

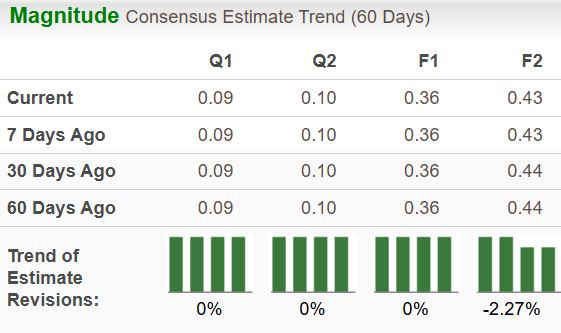

Analysts predict earnings of 9 cents per share, representing a 28.6% increase compared to the same period last year. The expected total revenue stands at $705.1 million, indicating a 26.3% year-over-year growth. Recently, there has been little change in analyst estimates.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Stay informed on quarterly updates: Check the Zacks Earnings Calendar.

Palantir has a strong track record, with earnings surpassing the Zacks Consensus Estimate once in the previous four quarters and matching it three times, resulting in an average earnings surprise of 4.2%.

Palantir’s Historical Performance in Price and Earnings

Palantir Technologies Inc. price-eps-surprise | Palantir Technologies Inc. Quote

Limited Potential for Q3 Earnings Surprise

Currently, our model does not indicate a strong possibility for an earnings beat this quarter. A positive Earnings ESP paired with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) improves the likelihood of an earnings surprise. However, PLTR does not meet this criteria. You can explore stocks with better prospects using our Earnings ESP Filter.

PLTR has an Earnings ESP of -1.22% and holds a Zacks Rank of #3. For a comprehensive list of Zacks #1 Rank stocks, visit our site.

Robust Business Growth Anticipated in Q3

We foresee a notable year-over-year improvement in Palantir’s revenues, attributed to strong business from current and new customers. The growth is expected in both the Government and Commercial sectors.

The projected revenues for the Government sector are $377.3 million, suggesting a 22.7% increase from last year. Meanwhile, the Commercial sector is expected to generate $329.7 million, indicating a 31.6% growth year-over-year.

Palantir Stock Valuation Under Scrutiny

Palantir’s shares have surged by 154.4% year-to-date, significantly outperforming its industry growth of 28.1% and the Zacks S&P 500 composite rise of 22.5%. This notable performance reflects ongoing investor interest in AI-focused companies. For context, other prominent AI stocks such as NVIDIA (NVDA) and SoundHound AI (SOUN) have seen increases of 181.4% and 157.1%, respectively.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Despite this success, it is essential to recognize that Palantir appears expensive at its current valuation. The company’s 12-month EV-to-EBITDA stands at 387.07X, compared to an industry average of 50.29X. Similarly, the forward 12-month Price/Earnings ratio for Palantir is 103.67X, well above the industry average of 39.9X.

Investment Outlook

Palantir’s AI strategy, which integrates its Foundry and Gotham platforms, is comprehensive and aims to strengthen AI adoption in both governmental and commercial sectors. The company focuses on AI-driven information warfare and cybersecurity, enabling it to grow amid changing global security demands. In the government realm, Palantir aligns its AI initiatives with U.S. defense priorities, while the company’s AI Platform (AIP) boot camps have been crucial for acquiring over 1,000 clients in the commercial sector.

In the second quarter of 2024, Palantir recorded a 23% year-over-year growth in government revenues due to heightened demand for its AI products. U.S. commercial revenues experienced a substantial 55% surge, driven by the success of their AI platforms. Furthermore, the company reported an 88% year-over-year increase in operating income, alongside a 1,200 basis points rise in adjusted operating margin, signaling effective cost management and stronger government contracts.

Timing is Key for Potential Investors

Palantir’s guidance for Q3 suggests a modest 3% sequential increase in revenues, indicating a potential slowdown in growth later in the year. Nonetheless, the company continues to be positioned for sustained expansion through its focus on AI in information security.

Given the current high valuation metrics for the stock, it may be wise for investors to wait for a more favorable market correction before making investment decisions. While Palantir’s fundamentals remain sound, a better buying opportunity could arise if market fluctuations lead to a price reduction.

5 Stocks Poised for Doubling Potential

Each stock was selected by a Zacks expert as a top contender to gain over +100% in 2024. While past performance does not guarantee future results, previous picks have soared by +143.0%, +175.9%, +498.3%, and +673.0%.

Many of these stocks are currently under the radar of Wall Street, presenting a unique opportunity for early investors. Discover these 5 potential high performers now >>

Want the latest investment ideas from Zacks Investment Research? Download the report on 5 Stocks Poised to Double for free today.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Palantir Technologies Inc. (PLTR): Free Stock Analysis Report

SoundHound AI, Inc. (SOUN): Free Stock Analysis Report

View the original article on Zacks.com here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.