The Magnificent Seven: Earnings Insights from the Latest Reports

As this week unfolds, three of the Magnificent Seven companies have shared their third-quarter earnings.

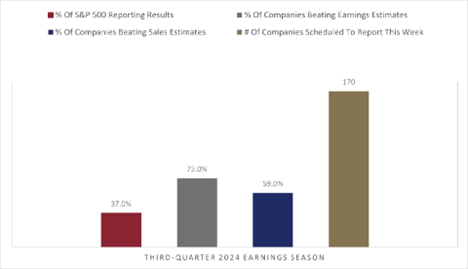

The current earnings season for the S&P 500 is proving to be interesting. According to FactSet, 37% of companies have reported results, with 75% exceeding earnings estimates and 59% surpassing sales forecasts.

However, as 170 more S&P 500 companies report this week, the outlook shifts. Notably, five of the Magnificent Seven are in the spotlight: Alphabet Inc. (GOOGL), Amazon.com, Inc. (AMZN), Apple, Inc. (AAPL), Meta Platforms, Inc. (META), and Microsoft Corporation (MSFT).

Another member, AI chip leader NVIDIA Corporation (NVDA), will share its earnings on November 21. Meanwhile, Tesla, Inc. (TSLA) reported its earnings last week, which we reviewed in last Thursday’s Market 360.

Wall Street keeps a close eye on these companies because they aren’t typical tech stocks. They significantly benefited from the surge of interest in artificial intelligence and hold a considerable portion of the S&P 500’s market value.

Investors are eager to learn if these companies’ investments in AI are translating into profits.

In today’s Market 360, we’ll examine earnings reports from Alphabet, Meta Platforms, and Microsoft, and assess whether they are attractive investment opportunities. Stay tuned for analyses on Amazon and Apple in Saturday’s Market 360.

After the markets closed on Tuesday, Alphabet exceeded Wall Street expectations with its results.

For the third quarter, Alphabet reported earnings of $2.12 per share on sales of $88.3 billion, up from earnings of $1.55 per share and revenue of $76.7 billion the previous year. This marks a 36.8% increase in earnings and a 15.1% increase in revenue year-over-year. Analysts projected earnings per share of $1.85 and revenue of $86.22 billion, resulting in a 14.7% surprise in earnings and a 2.4% surprise in revenue.

The chart below illustrates how Alphabet’s Q3 revenue compares to previous quarters.

Diving deeper, Google’s advertising revenue grew by 10.4% to $65.85 billion, surpassing expectations of $65.5 billion. YouTube ad revenue also rose by 12.2% to $8.9 billion. Notably, Google Cloud revenue increased by an impressive 34.97% year-over-year to $11.4 billion, exceeding analyst predictions.

During the earnings call, CEO Sundar Pichai remarked:

Our commitment to innovation, as well as our long-term focus and investment in AI, are paying off with consumers and partners benefiting from our AI tools.

In Search, our new AI features are expanding what people can search for and how they search for it. In Cloud, our AI solutions are helping drive deeper product adoption with existing customers, attract new customers, and win larger deals.

It’s worth mentioning the challenges Alphabet faces with the Department of Justice (DOJ). Recently, the DOJ won a case concerning Alphabet’s dominance in the search engine market, declaring it an unlawful monopoly. This outcome has led to discussions about potential breakups and the implications for the company moving forward.

Big Earnings Reports: What They Mean for Alphabet, Meta, and Microsoft

The Department of Justice (DOJ) has taken a strong stance against Alphabet. However, ongoing talks about “remedies” may struggle as Alphabet’s search engine remains unmatched in quality. Its monopoly appears secure unless major court interventions occur. Analysts predict that the DOJ will find it hard to dismantle Alphabet, as the company’s advertising revenue contributes a significant portion of its total income.

Despite potential legal challenges, Alphabet’s earnings report was robust, leading to a 7.4% share price increase on Wednesday. GOOGL currently holds a Total Grade of “C” in Stock Grader, indicating a “Hold” status. Current investors should hold their shares yet keep an eye out for alternative investment opportunities.

Meta Platforms Surprises Investors

Meta Platforms shared its third-quarter earnings on Tuesday evening, showing a 19% year-over-year revenue increase to $40.59 billion, which outperformed the expected $40.31 billion.

Moreover, earnings per share surged by 37% to $6.03, significantly exceeding analysts’ forecast of $5.29. The number of daily active users on Facebook also grew by 5% to 3.29 billion, just shy of the 3.31 billion expectation.

Still, concerns surfaced when CFO Susan Li noted expectations for substantial capital expenditure rises in 2025, creating unease among investors. CEO Mark Zuckerberg commented that AI advancements are central to the company’s current strategies:

Across Facebook and Instagram, advances in AI continue to improve the quality of recommendations and drive engagement… AI is also going to significantly evolve our services for advertisers in some exciting ways.

For the fourth quarter, Meta estimates revenues between $45 billion and $48 billion, which would represent a 21.6% increase from last year’s fourth-quarter revenues of $36.5 billion to $40 billion. Yet, with the capital expenditure estimates raised to between $38 billion to $40 billion, up from $37 billion to $40 billion, META shares fell by 4.1% on Wednesday. Currently, META enjoys a Total Grade of “A” in Stock Grader, marking it as a “Strong Buy,” suggesting it might be a good opportunity to purchase shares on a dip.

Microsoft Sees Mixed Results

Microsoft released its earnings for the first quarter of its fiscal year 2025, reporting $3.30 earnings per share and revenue of $65.6 billion. This reflects a significant year-over-year increase from $2.99 per share and $56.5 billion revenue. This translates to earnings growth of 10.4% and revenue growth of 16.1%, surpassing analyst expectations of $3.10 per share on $64.56 billion revenue.

A key highlight was the strong performance of the Intelligent Cloud segment, which saw revenue growth of 21% year-over-year, reaching $24.1 billion. Microsoft noted that Azure and associated cloud services’ revenue grew 33%, slightly above expectations of 32.8%.

CEO Satya Nadella emphasized the transformative role of AI in business:

AI-driven transformation is changing work, work artifacts, and workflow across every role, function, and business purpose. We are expanding our opportunity and winning new customers as we help them apply our AI platforms and tools to drive new growth and operating leverage.

Looking to the second quarter, Microsoft projects revenue between $68.1 billion and $69.1 billion. However, the Intelligent Cloud revenue expectation of $25.55 to $25.85 billion falls short of hopes for stronger growth, prompting a 6.1% drop in the stock price. MSFT received a Total Grade of “C” in Stock Grader, indicating a “Hold” status, consistent throughout much of this year.

Market Reactions and Future Forecast

Due to mixed earnings reports from Microsoft and Meta, the broader market reacted negatively. The Dow fell by 0.9%, the S&P 500 dropped 1.9%, and the NASDAQ experienced a 2.8% decline. The market may continue to witness fluctuations, especially with the presidential election just days away.

Investors can potentially take advantage of upcoming volatility. I hosted a “Day-After Summit” with Charles Sizemore, Chief Investment Strategist at The Freeport Society, who provides insights based on Wall Street movements. He is offering a free post-election trade, designed to be beneficial regardless of the election outcome. As election day approaches, ensuring your portfolio is prepared for potential market changes is crucial.

If you haven’t yet, click here now to access a replay of our “Day-After Summit.”

Louis Navellier

Editor, Market360

Disclosure: As of the date of this message, the Editor owns shares in Microsoft Corporation (MSFT) and NVIDIA Corporation (NVDA).