PayPal’s Earnings Report: A Mixed Bag Fuelling Debate on the Stock

Shares of PayPal (NASDAQ: PYPL) fell following its Q3 earnings announcement, yet the stock has surged over 50% since August. This slight decline prompts the question: is now a good time to buy the stock on a dip?

Understanding Earnings: Margins vs. Growth

Despite a disappointing forecast, PayPal increased its outlook for the third time this year. The company now expects adjusted earnings per share (EPS) to rise in the high teen percentages, alongside a mid-single-digit expansion in transaction margins. This adjustment reflects a strong performance in Q3 and a slightly improved forecast for Q4.

For Q4, PayPal anticipates low single-digit revenue growth, with adjusted EPS declining by low to mid-single digits due to increased discretionary spending. Analysts had estimated a 5.4% revenue growth for the fourth quarter based on data from LSEG.

A key reason for the expected slow revenue growth lies in PayPal’s strategy to prioritize wider margins. This focus pertains particularly to its Braintree unit, which provides payment services to e-commerce businesses. The company plans to continue this strategy into 2025 before establishing a new growth baseline.

In the recent quarter, PayPal’s revenue increased 6% to $7.8 billion, while total payment volume (TPV) rose 9% to $422.6 billion. Payment transactions climbed 6% to 6.6 billion, with an impressive 9% rise in transactions per active account, reaching 61.4 over the last year.

Branded checkout TPV grew by 6% on a constant currency basis, consistent with the previous quarter, while unbranded TPV saw an 11% increase, down from 19% in Q2. Venmo’s TPV matched last quarter’s growth at 8%.

Active accounts saw a modest increase of 0.9% year over year, totaling 432 million, with a slight 0.6% rise from the previous quarter.

Transaction margin dollars, akin to gross profit margin, increased by 8% to $3.65 billion. Investors have closely monitored this figure, especially as recent years saw revenue growth coming largely from lower-margin sources. Under CEO Alex Chriss, the focus is now shifting to enhancing gross profit instead of prioritizing revenue alone.

Adjusted EPS jumped 22% to $1.20, surpassing the analyst consensus of $1.07.

In this quarter, PayPal generated free cash flow of $1.4 billion after capital expenditures and repurchased $1.8 billion in stock. By quarter’s end, the company held $3.8 billion in net cash and investments.

Image source: Getty Images.

Assessing the Opportunity: Buy the Dip?

Though investors may be wary of PayPal’s decision to temporarily reduce revenue growth in favor of improving margins, this long-term strategy could prove beneficial. CEO Chriss aims to transform PayPal from primarily a payments company into a comprehensive commerce platform servicing major players like Amazon and Shopify, along with payment providers such as Adyen and Finserv, thanks to new partnerships established recently.

Innovation remains key, exemplified by features like Fastlane, which streamlines the checkout process across various merchants without requiring account setup, showing promising early adoption since its August launch. The PayPal Everywhere service, which offers cash-back incentives on PayPal debit cards, rolled out last month and is expected to foster growth.

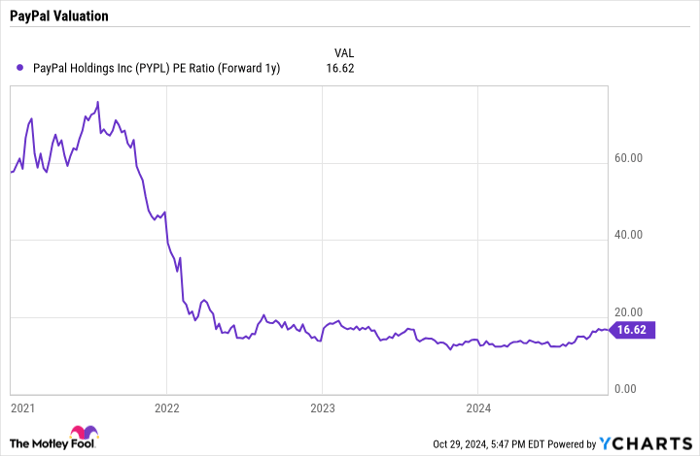

Despite its solid recent performance, PayPal’s stock is still regarded as attractively valued, with a forward price-to-earnings (P/E) ratio of approximately 16.6 and a forward price-to-sales (P/S) ratio of just 2.4 based on 2025 projections.

PYPL PE Ratio (Forward 1y) data by YCharts

Under Chriss’s leadership, PayPal is taking deliberate steps towards profitable growth and continuous innovation—a recipe for long-term success. Investors now have an opportunity to join the journey as the company evolves.

Consequently, I would recommend considering buying the stock at its current price.

Don’t Miss a Potentially Lucrative Investment Opportunity

Have you ever felt like you missed your chance to invest in successful companies? If so, we have some exciting news.

Occasionally, our analyst team issues a “Double Down” stock recommendation for companies they believe are on the verge of significant growth. This could be your chance to invest before it’s too late, and the data speaks volumes:

- Amazon: Investing $1,000 when we doubled down in 2010 would now be worth $21,706!

- Apple: A $1,000 investment when we doubled down in 2008 would yield $43,529!

- Netflix: Investing $1,000 when we doubled down in 2004 would now be worth $406,486!

Right now, we are issuing “Double Down” alerts for three exceptional companies. Don’t miss your chance!

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in PayPal. The Motley Fool has positions in and recommends Adyen, Amazon, PayPal, and Shopify. The Motley Fool recommends the following options: long January 2027 $42.50 calls on PayPal and short December 2024 $70 calls on PayPal. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.