W.P. Carey Cuts Dividend: A Strategic Shift in Focus

After 24 years of annual dividend increases, W.P. Carey (NYSE: WPC) recently faced a crucial turning point by reducing its dividend just short of achieving 25 consecutive increases. This decision rattled investors, but the company is positioned to show that this move is a reset, not a retreat. Here’s why this high-yield REIT remains a compelling investment opportunity.

Navigating Challenges in Office Properties

W.P. Carey operates as a net-lease REIT, which significantly influenced its exit from the office sector. In net-lease agreements, tenants handle most expenses, yet landlords face substantial risks if leases aren’t renewed. The pandemic has heightened these risks in the office space, making it a challenging area for the company.

Image source: Getty Images.

Office properties often demand significant investment at lease end. They are generally larger than single-tenant retail units, and tenants often expect upgrades to renew their leases. When vacancies occur, the costs to make properties appealing to new tenants can be substantial. Because of these factors, office assets represent a higher risk within net leases.

Recognizing these market shifts, Realty Income (NYSE: O) made a strategic decision years ago to divest its office properties. Since Realty Income is about four times larger than W.P. Carey, the impact of this decision was minimal for them; office rentals constituted only 16% of W.P. Carey’s overall rents prior to exiting that market.

The Necessity of a Dividend Reset

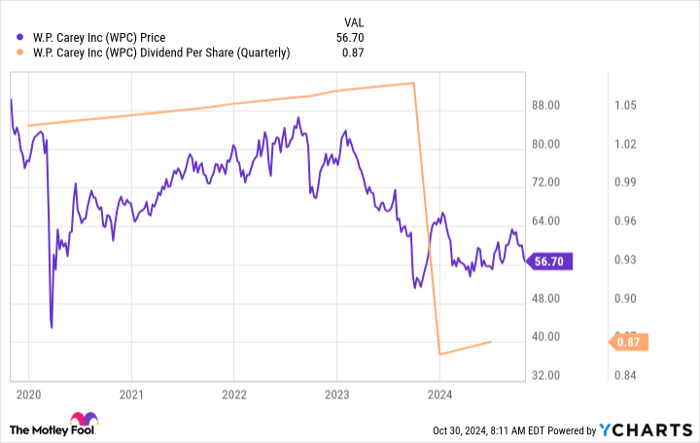

Losing 16% of its rental income meant W.P. Carey had no choice but to reduce its dividend. However, it’s vital to recognize that this move was part of a larger strategy to enhance the company’s long-term viability. Aside from the office sector, W.P. Carey’s remaining assets are performing well. The REIT is committed to evolving its business and began increasing the dividend again just a quarter after the cut, continuing to raise it each quarter since.

This indicates to investors that the dividend cut was not a sign of weakness but rather a strategic reset. With the office segment now behind them, W.P. Carey may actually be on stronger footing going forward. Investors should pay attention; management is sending a clear message here.

WPC data by YCharts

After the dividend reset, the REIT could have opted for a static dividend and left investors uncertain about its trajectory. Instead, W.P. Carey reaffirmed its commitment to dividend growth. Exiting the office sector has freed up capital, which the company aims to reinvest into new properties, thus fueling future dividend hikes. However, timing will play a critical role as property acquisitions are often lengthy processes that might extend beyond a year.

Decoding W.P. Carey’s Clear Messages

Resetting the dividend prior to achieving 25 annual increases was likely a strategic choice. While this decision is uncomfortable for investors, it clarifies the situation. The company’s decision to reinstate dividend increases soon after the reduction is an encouraging development. As W.P. Carey utilizes the cash gained from divesting office properties to make new investments, its true growth potential will become clearer. Investors seeking steady income may want to consider this 6.2% yielding REIT while market reactions still hang heavy from the dividend cut. The reset may be obscuring optimistic developments.

Seize the Opportunity Now

If you’ve ever felt like you missed out on notable investment opportunities, here’s your chance to reconsider.

Our analyst team occasionally identifies “Double Down” stocks, companies poised to see significant growth. Those concerned about missing their chance might find that now is the opportune moment to invest. The figures demonstrate this potential:

- Amazon: Invested $1,000 in 2010 would be worth $21,706 now!*

- Apple: A $1,000 investment in 2008 would now be $43,529!*

- Netflix: If you invested $1,000 in 2004, it would be worth $406,486!*

Right now, we are highlighting three companies for our “Double Down” alerts, and such opportunities may not come around often.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

Reuben Gregg Brewer has positions in Realty Income and W.P. Carey. The Motley Fool has positions in and recommends Realty Income. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.