Regions Financial Gets an Upgrade: Investors Eye Potential Gains

Fintel reported on October 31, 2024, that Keefe, Bruyette & Woods enhanced their rating for Regions Financial (NYSE:RF) from Market Perform to Outperform.

Analysts Forecast an 8.61% Gain

As of October 21, 2024, the average one-year price target for Regions Financial stands at $25.92 per share. This projection ranges from a low of $17.52 to a high of $31.50, implying an increase of 8.61% from the latest closing price of $23.87 per share.

Check out our leaderboard for companies with the highest potential price targets.

Revenue and Earnings Projections

Regions Financial’s projected annual revenue is estimated at $8,030 million, reflecting a substantial increase of 22.48%. Additionally, the anticipated annual non-GAAP earnings per share (EPS) is set at 2.67.

Institutional Sentiment Toward Regions Financial

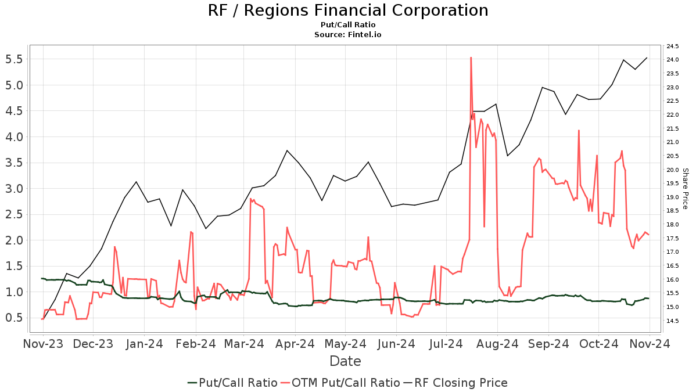

A total of 1,524 funds or institutions reported holdings in Regions Financial, showing a rise of 11 owners, or 0.73%, over the last quarter. The average portfolio weight for all funds invested in RF is 0.18%, which has increased by 0.18%. Institutional ownership rose 1.21% in the past three months, totaling 815,046K shares.  The put/call ratio for RF is 0.87, indicating a bullish sentiment among investors.

The put/call ratio for RF is 0.87, indicating a bullish sentiment among investors.

Wellington Management Group LLp holds 49,119K shares, making up 5.39% of the company’s total. This is a decrease from their previous ownership of 53,520K shares, amounting to a drop of 8.96%. The firm’s allocation in RF has decreased significantly by 87.59% over the last quarter.

The Vanguard Equity Income Fund (VEIPX) currently holds 30,981K shares, which is 3.40% ownership. Previously, this fund owned 33,567K shares, reflecting a decrease of 8.35%, and has similarly reduced its RF allocation by 9.49% in the last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) has 28,847K shares, accounting for 3.17% ownership, down from 29,263K shares, or a decline of 1.44%. This fund has lowered its allocation by 8.69% over the past three months.

Charles Schwab Investment Management holds 26,971K shares, representing 2.96% ownership, up from 26,740K shares, which shows a slight increase of 0.85%. However, their RF portfolio allocation reduced by 33.88% recently.

JP Morgan Chase holds 24,010K shares, or 2.64% of the company. This is an increase from the previous amount of 22,841K shares, marking a 4.87% rise, though their allocation has decreased by 84.77% over the last quarter.

About Regions Financial

(This description is provided by the company.)

Regions Financial Corporation is a key player in the financial landscape, with $147 billion in assets. As a member of the S&P 500 Index, it ranks among the largest full-service consumer and commercial banking providers. Regions serves clients throughout the South, Midwest, and Texas, operating over 1,300 banking offices and 2,000 ATMs through its subsidiary, Regions Bank. The bank is committed to equal housing lending and is a proud member of the FDIC.

Fintel provides a thorough investing research platform for individual investors, traders, financial advisors, and small hedge funds.

The platform’s extensive data includes fundamentals, analyst reports, ownership metrics, fund sentiment, options sentiment, insider trading, and other crucial investment insights. Its focus on exclusive stock picks utilizes advanced, backtested quant models aimed at enhancing profits.

To learn more, click here.

This story first appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.