KLA Receives Positive Outlook Upgrade from Oppenheimer

Oppenheimer Sees Strong Potential for KLA Stock

On October 31, 2024, Oppenheimer upgraded their rating for KLA (XTRA:KLA) from Perform to Outperform. This change suggests a more favorable view of the company’s future.

Analyst Price Forecast Indicates 22.31% Increase Ahead

As of October 21, 2024, the average one-year price target for KLA stands at 785.48 €/share. Predictions vary with a low of 628.98 € and a high of 896.07 €. The average target indicates a potential increase of 22.31% from the most recent closing price of 642.20 € per share.

Exploring Fund Sentiment Around KLA

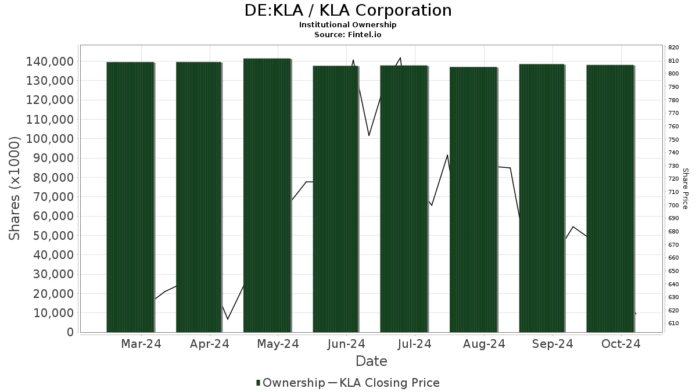

Currently, 2,637 funds or institutions have reported positions in KLA, marking an increase of 42 owners or 1.62% during the last quarter. Funds dedicated to KLA now have an average portfolio weight of 0.53%, rising by 2.48%. Overall, institutional ownership expanded by 2.59% in the past three months, totaling 138,669K shares.

What Other Shareholders Are Doing

Primecap Management owns 5,516K shares, equating to 4.12% ownership of KLA. This is down from 5,785K shares previously, representing a decrease of 4.88%. Despite this drop, Primecap increased its portfolio allocation in KLA by 9.24% in the last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) holds 4,253K shares, which accounts for 3.17% ownership. This is a slight rise from the previous 4,250K shares, which is a 0.06% increase. Last quarter, VTSMX boosted its allocation in KLA by 14.84%.

Capital International Investors, meanwhile, possesses 4,093K shares (3.05% ownership), down from 4,693K shares, marking a 14.67% decrease. However, this firm also increased its portfolio allocation in KLA by 4.63% over the last quarter.

Slight contributions have been noted by Vanguard 500 Index Fund Investor Shares (VFINX) and Vanguard PRIMECAP Fund Investor Shares (VPMCX). The former holds 3,456K shares (2.58% ownership), up from 3,408K, an increase of 1.38%, while the latter holds 3,362K shares with a 2.51% stake, which is a decrease from 3,498K shares by 4.02%. Both funds increased their allocations in KLA in the latest quarter.

Fintel is a leading investing research platform designed for individual investors, traders, financial advisors, and small hedge funds. We provide comprehensive data and analysis covering fundamentals, ownership trends, and more to enhance investment decisions.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.