Kraft Heinz Faces Downgrade as Funds Adjust Their Holdings

Deutsche Bank Lowers Outlook for Kraft Heinz Stock

Fintel reports that on October 31, 2024, Deutsche Bank downgraded their outlook for Kraft Heinz (XTRA:KHNZ) from Buy to Hold.

Analyst Predictions Indicate Potential Growth

As of October 22, 2024, the average one-year price target for Kraft Heinz is 36.33 €/share. The forecasts vary, ranging from a low of 27.96 € to a high of 54.37 €. This average suggests a potential rise of 11.77% from its latest reported closing price of 32.50 € / share.

Kraft Heinz’s Revenue Outlook Improves

The projected annual revenue for Kraft Heinz is 27.896 million euros, reflecting an increase of 6.76%. Additionally, the forecast for annual non-GAAP EPS is 2.90.

Fund Holding Updates Indicate Increased Interest

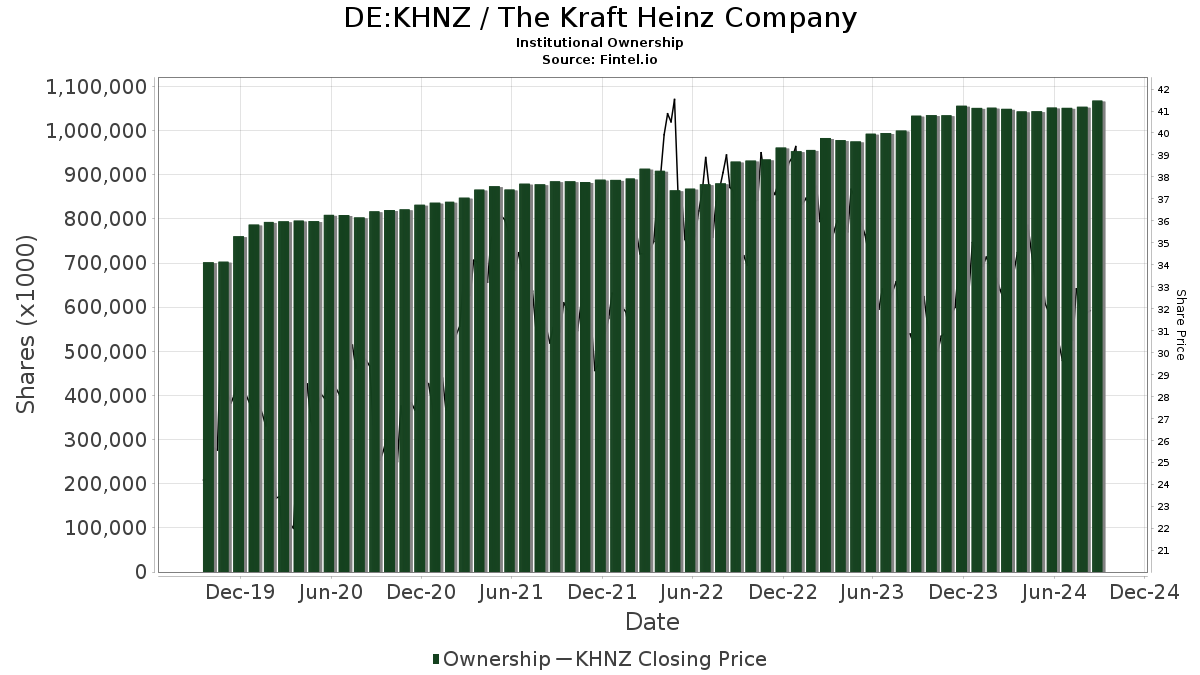

Currently, 2,010 funds or institutions report positions in Kraft Heinz, marking an increase of 28 owners, or 1.41%, in the last quarter. The average portfolio weight dedicated to KHNZ across all funds is 0.25%, showing a growth of 4.92%. Institutional ownership has increased by 3.13% over the last three months, totaling 1,073,239K shares.

Key Shareholders and Their Movements

Berkshire Hathaway remains the largest shareholder, holding 325,635K shares, which accounts for 26.93% of the company with no changes noted over the last quarter.

Bank of America owns 29,368K shares, equating to 2.43% ownership. Previously, they reported 29,938K shares, reflecting a decrease of 1.94% and a significant 79.92% drop in their allocation.

Invesco holds 25,006K shares, which represents 2.07% ownership and shows an increase of 2.39% from the prior quarter, despite a 92.24% reduction in their overall allocation.

The Vanguard Total Stock Market Index Fund Investor Shares owns 24,929K shares, maintaining 2.06% ownership, with a modest 0.32% increase in shares owned, but a 14.82% decline in allocation.

Invesco QQQ Trust, Series 1 holds 23,387K shares representing 1.93% ownership, reflecting a 2.77% increase since their last filing and a 19.16% drop in portfolio allocation over the same period.

Fintel provides one of the most extensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

The data covers global markets and includes fundamentals, analyst reports, ownership information, fund sentiment, options data, insider trades, and more. Our exclusive stock selections are supported by advanced, backtested quantitative models aimed at enhancing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.