At ETF Channel, we analyzed the holdings within various ETFs and compared their trading prices with analyst target forecasts for the next year. For the iShares Core MSCI EAFE ETF (Symbol: IEFA), the projected analyst target price stands at $81.06 per unit.

Recent Price and Analyst Predictions

Currently trading at about $73.79 per unit, IEFA shows a potential upside of 9.85% based on the average target prices assigned to its underlying holdings. Three companies within this ETF are noted for their significant upside: Melco Resorts & Entertainment Ltd (Symbol: MLCO), Teva Pharmaceutical Industries Ltd (Symbol: TEVA), and InMode Ltd (Symbol: INMD).

Significant Upside for Key Holdings

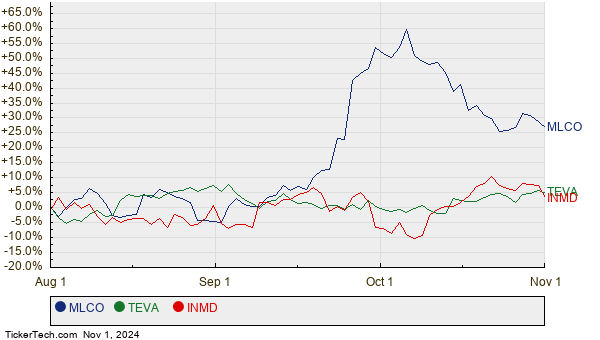

Melco Resorts (MLCO) is currently priced at $6.72 per share, with analysts projecting a 45.83% increase to an average target price of $9.80. Similarly, Teva (TEVA) is trading at $18.44, suggesting a 23.82% upside to the target price of $22.83. InMode (INMD) is priced at $17.08, with a target of $20.83, representing a 21.97% increase. Below is a chart detailing the twelve-month price movements for these three stocks:

Current Analyst Target Price Summary

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Core MSCI EAFE ETF | IEFA | $73.79 | $81.06 | 9.85% |

| Melco Resorts & Entertainment Ltd | MLCO | $6.72 | $9.80 | 45.83% |

| Teva Pharmaceutical Industries Ltd | TEVA | $18.44 | $22.83 | 23.82% |

| InMode Ltd | INMD | $17.08 | $20.83 | 21.97% |

Analyzing the Analyst Optimism

Are the analysts’ target prices reasonable or overly optimistic? It’s essential to consider if their forecasts account for recent company and industry changes or if they may need adjustments. A price target that is significantly higher than the current trading price can suggest confidence in growth but may also lead to price downgrades if circumstances shift. These considerations warrant further research by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• RVMD shares outstanding history

• THD Options Chain

• ARES Dividend History

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.