NVIDIA Corporation: A Strong Buy Amidst AI Boom

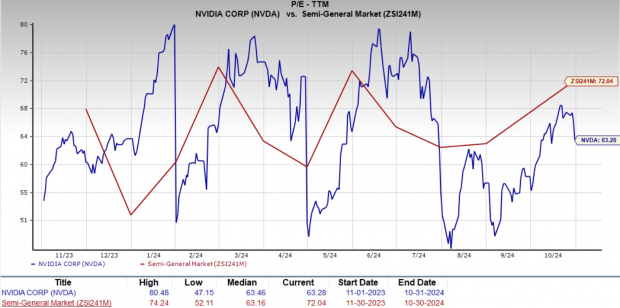

NVIDIA Corporation’s current valuation indicates the stock is priced lower than the industry average. Currently, NVDA shares trade at a trailing 12-month price-to-earnings (P/E) ratio of 63.28, notably below the Zacks Semiconductor – General industry average, which stands at 72.04.

Image Source: Zacks Investment Research

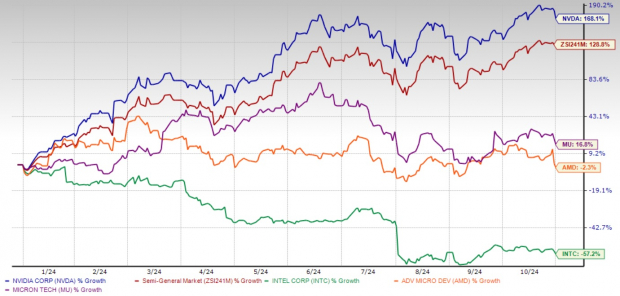

Adding to this attractive valuation is NVIDIA’s remarkable year-to-date (YTD) performance. The company’s shares have soared 168.1% YTD, significantly outpacing the industry’s overall rise of 128.8%. This strong performance has elevated NVIDIA to the forefront of the semiconductor industry, where competitors like Intel Corporation (INTC), Advanced Micro Devices, Inc. (AMD), and Micron Technology, Inc. (MU) have struggled.

While Micron’s stock is up 16.8% YTD, Intel and AMD shares have dropped by 57.2% and 2.3%, respectively. Given NVIDIA’s impressive outperformance and attractive valuation, many investors may wonder if it’s still worth buying NVDA stock now.

Analyzing YTD Price Return Performance

Image Source: Zacks Investment Research

The Drivers Behind NVIDIA’s Stock Growth

The surge in NVIDIA’s stock can largely be linked to its critical role in the rapidly expanding artificial intelligence (AI) sector, particularly in generative AI. Demand for generative AI applications is projected to increase dramatically, with Fortune Business Insights estimating that the global generative AI market could reach $967.6 billion by 2032. This marks a compound annual growth rate (CAGR) of 39.6% from 2024 to 2032, boosting the need for NVIDIA’s powerful graphic processing units (GPUs) that are essential for AI innovation.

NVIDIA’s advanced GPUs offer exceptional processing power, allowing AI models to scale effectively. These next-generation chips are increasingly crucial for businesses investing in AI technologies. With unmatched capabilities, NVIDIA positions itself as a leading provider of the essential technology that drives AI applications.

Diverse Opportunities Supporting NVIDIA’s Future Growth

NVIDIA’s contributions extend well beyond AI. Its GPUs play a vital role in various sectors, including automotive, healthcare, and manufacturing. In the automotive industry, NVIDIA technology supports the development of autonomous vehicles, a sector predicted to grow rapidly in the next decade. Similarly, in healthcare, NVIDIA’s GPUs enhance medical imaging and diagnostics, significantly improving patient outcomes. This diverse application landscape solidifies NVIDIA as a robust growth entity in the technology domain.

Additionally, NVIDIA’s data center solutions are gaining momentum. With organizations increasingly investing in cloud and edge computing, there is a rising demand for strong data center infrastructure, making this segment a key revenue driver. This growth potential will be further amplified as businesses advance their digital initiatives, enhancing NVIDIA’s long-term prospects.

Financial Strength and Promising Outlook for NVIDIA

NVIDIA’s financial results have been nothing short of impressive. In its second-quarter fiscal 2025 report, the company announced a significant 122% revenue increase compared to the previous year, coupled with a 152% rise in non-GAAP earnings per share (EPS). This demonstrates NVIDIA’s strong ability to meet market demands effectively.

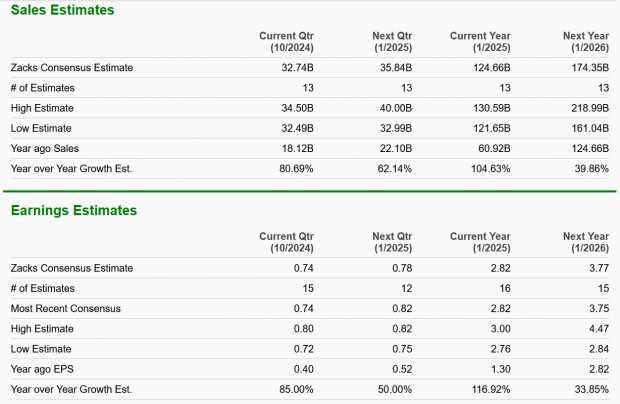

For the upcoming third quarter, forecasts predict NVIDIA’s revenues will skyrocket to $32.5 billion, a rise from $18.12 billion from the same quarter last year. This growth trajectory bolsters NVIDIA’s status as a key player in semiconductor technology for AI. Analysts project continued growth for fiscal years 2025 and 2026, reflecting confidence in the company’s leading edge across various sectors, including gaming, automotive, and professional visualization.

Image Source: Zacks Investment Research

On top of its growth, NVIDIA boasts a solid financial foundation. As of July 2024, the company held a cash reserve of $34.8 billion, up from $31.44 billion in April. This healthy balance sheet positions NVIDIA to withstand market fluctuations while continuing to invest in growth opportunities. In an ever-evolving tech landscape, such financial stability enhances NVIDIA’s ability to seize future potential.

Final Thoughts: Investing in NVIDIA Stocks

Given NVIDIA’s strong foothold in AI, robust financial health, and diverse market applications, the stock presents an attractive buying opportunity. Impressive financial results, a solid outlook, and significant cash reserves position NVIDIA for continued success.

As demand for AI technology surges and the applications of NVIDIA’s innovations expand across industries, NVDA stock becomes an appealing prospect for those seeking to benefit from advancing technologies. Now might be the ideal time to consider investing in NVIDIA to harness its promising long-term potential.

Currently, NVIDIA holds a Zacks Rank #2 (Buy) with a Growth Score of A. Research indicates that stocks rated A or B in combination with a Zacks Rank of #1 (Strong Buy) or #2 tend to represent strong investment opportunities. NVDA stock currently appears to be an appealing investment choice.

Zacks Research Highlights the Top Stock with Doubling Potential

Our expert team has identified five stocks with significant potential for growth, one of which has been singled out as most likely to double in value. This standout stock is from one of the most innovative financial firms, boasting a fast-growing customer base of over 50 million and a variety of cutting-edge solutions, setting it up for substantial future returns. While not all selections guarantee success, this one might outperform previous Zacks’ stocks like Nano-X Imaging, which surged +129.6% in under nine months.

For more recommendations, feel free to download our report on 5 Stocks Set to Double.

For more stock analysis, please see:

Intel Corporation (INTC): Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.