Constellation Energy Set to Release Q3 2024 Earnings: What to Expect

Constellation Energy Corporation CEG will announce its third-quarter 2024 earnings on November 4.

Stay updated with all quarterly releases: Check out the Zacks Earnings Calendar.

Revenue and Earnings Projections for Q3

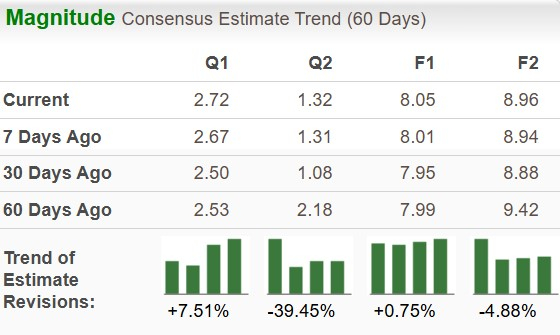

The Zacks Consensus Estimate for CEG’s third-quarter revenues stands at $6.21 billion, reflecting a year-over-year growth of 1.59%. Meanwhile, the consensus estimate for earnings is set at $2.72 per share, which represents a 20.35% decline compared to the previous year. However, in the past 60 days, this earnings estimate has risen by 7.5%.

Image Source: Zacks Investment Research

Earnings Surprise Track Record

Recently, Constellation Energy has exceeded the Zacks Consensus Estimate in two out of its last three quarters, with an average surprise of 10.86%.

Forecasting an Earnings Beat

Our model indicates a potential earnings beat for Constellation Energy this quarter. A combination of a positive Earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) suggests favorable outcomes. Currently, Constellation Energy maintains a Zacks Rank of #3.

Constellation Energy Corporation Price and EPS Surprise

Constellation Energy Corporation price-eps-surprise | Constellation Energy Corporation Quote

Utilize our Earnings ESP Filter to identify the best stocks to consider ahead of earnings announcements.

Earnings ESP: CEG has an Earnings ESP of +3.92%.

Zacks Rank: Constellation Energy carries a Zacks Rank of #3. A full list of today’s Zacks #1 Rank stocks is available here.

Drivers of CEG’s Q3 Performance

The company’s earnings this quarter are likely bolstered by its efficiently operating nuclear fleet, which has maintained an annual nuclear capacity factor exceeding 94% over the last five years, compared to an average of nearly 91% nationwide. This capacity and availability should continue to provide ample clean electricity to Constellation’s customers.

Additionally, Constellation Energy aims to boost net income in 2024-2025 through organic initiatives such as wind repowering, nuclear uprates, renewals of nuclear licenses, and clean hydrogen production.

With a significant presence in providing clean electricity to almost 21% of the Competitive Commercial & Industrial (C&I) customers in the U.S., rising demand in this sector may further enhance the company’s results.

Significance of Nuclear Power in the U.S.

According to the U.S. Environmental Protection Agency, nuclear reactors account for nearly 20% of the country’s electricity usage. Despite the risks associated with nuclear power, new reactors are being developed, and dormant units are being revived to supply clean energy.

Recently, Constellation Energy decided to restart the Three Mile Island Unit 1, which had been offline for five years due to economic constraints, to fulfill Microsoft Corporation’s long-term power supply needs.

With increasing demand from AI-driven data centers, tech giants like Amazon are teaming up with Dominion Energy to explore small modular nuclear reactors to ensure a consistent supply of clean energy.

Stock Performance Overview

CEG shares have increased by 41.7% over the past six months, significantly outperforming the industry, which has risen by 22.4%.

Image Source: Zacks Investment Research

Current Valuation Insights

Currently, the company’s Price-to-Earnings (P/E) ratio stands at 29.93, which is above the industry average of 24.04.

Image Source: Zacks Investment Research

Investment Considerations

Constellation Energy is in a strong position to leverage the growing demand from major AI-driven centers, which will require reliable and clean energy for data operations. Many tech firms are seeking to establish their data centers near Constellation’s nuclear plants to ensure a steady clean power supply.

The company’s current ratio is 1.35, highlighting its capability to meet short-term financial obligations. Additionally, declining interest rates will aid this capital-intensive business in financing future projects.

However, Constellation Energy operates in a highly regulated space, which can lead to challenges from legislative and regulatory changes. Weather variability and seasonal factors may also impact its operations.

Conclusion

With investments aimed at enhancing clean energy production and expanding operations, Constellation Energy is well-positioned for future growth. The surging demand from data centers is expected to further boost its prospects.

Despite potential challenges, the company’s strong production assets make it a compelling addition to investment portfolios.

Expert Stock Picks

Our experts have identified five stocks with the highest potential for significant growth in the coming months. Among these, Zacks’ Director of Research, Sheraz Mian, highlights one stock expected to rise dramatically.

This standout choice belongs to an innovative financial firm with a rapidly expanding customer base of over 50 million and an array of advanced solutions. While not every stock on this elite list will succeed, this one could outperform past Zacks’ successful picks, such as Nano-X Imaging, which surged by +129.6% in under nine months.

Free to view: Discover Our Top Stock and Four Alternatives

Want to receive the latest investment recommendations from Zacks Investment Research? Download the report “Five Stocks Set to Double” for free today.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Constellation Energy Corporation (CEG) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report

For the full article, click here to visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.