Why Billionaire Investors are Betting Big on Nu Holdings

Billionaire money managers have markedly different strategies when it comes to investing. On one hand, there’s Warren Buffett, who operates his holding company, Berkshire Hathaway, with approximately 45 stocks in its portfolio. In contrast, Israel Englander of Millennium Management oversees a vast collection of several thousand stocks. This diversity in approach includes Cathie Wood, the head of Ark Invest, known for her focus on disruptive technology stocks for Ark’s exchange-traded funds (ETFs). Despite their varying methods, all three investors share one significant quality: they own stock in Amazon and the emerging player Nu Holdings (NYSE: NU).

Buffett’s Early Recognition and Diverse Holdings

Warren Buffett or a team member identified Nu’s potential early on, investing $500 million in the company prior to its public offering in 2021. Today, Berkshire Hathaway holds 107,118,784 shares of Nu, representing 2.2% ownership of the company, although this constitutes only 0.5% of Berkshire’s overall equity portfolio. Cathie Wood has invested in Nu as well, owning 1,238,918 shares through Ark’s Fintech Innovation ETF, which represents 2.1% of her portfolio. Meanwhile, Millennium Management increased its stake in Nu to 39,192,266 shares, marking a significant growth of 371% from the previous quarter.

Nu Holdings: A New Force in Digital Banking

Nu is an all-digital bank based in Brazil and has recently made inroads into Mexico and Colombia. While these international markets are still developing, Nu’s growth trajectory within Brazil is impressive. It added 5.2 million new customers in the second quarter of 2024, bringing its total customer count to 104.5 million, predominantly in Brazil with 95.5 million customers. Just over a decade ago, Nu emerged as a challenger to traditional banking, offering accessible services when a significant portion of the population lacked bank accounts. Its innovative model is more flexible and customer-friendly than conventional banks, aligning well with Buffett’s investment philosophy.

Expanding Success Outside Brazil

Outside Brazil, Nu has about 9 million customers, with 7.8 million based in Mexico. Impressively, its performance in Mexico has outpaced its early results in Brazil. In the most recent quarter, Nu gained 1.2 million new customers in Mexico, reflecting a robust 15% growth from the previous quarter.

Revenue Growth Tied to Higher User Engagement

Nu’s accelerating growth is also reflected in its financial metrics, with a year-over-year revenue increase of 65% in the second quarter. This growth is complemented by rising customer engagement; active users are utilizing more of Nu’s services, which has led to a 30% year-over-year increase in average revenue per active user. Such metrics indicate not only customer satisfaction but also the potential for continued financial success.

Profits from a Smart Business Model

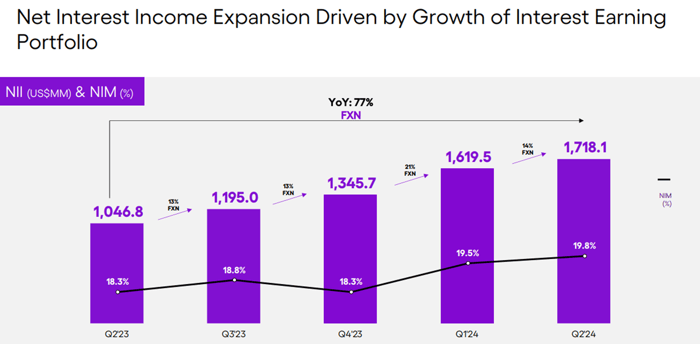

Initially considered a risky prospect due to its lack of profitability at the time of its IPO, Nu has declared GAAP net income for six consecutive quarters, showcasing remarkable growth during this period. Operating as a digital bank allows Nu to minimize costs associated with physical branches, maintaining a stable cost of service amidst rapid expansion. Net interest income saw a 77% surge year over year in the second quarter, with the margin expanding from 18.3% to 19.8%.

Valuation: A Promising Opportunity

Despite its stock nearly doubling over the past year, Nu’s current trading price suggests a forward, one-year price-to-earnings (P/E) ratio of less than 26, which appears attractive in comparison to other growth stocks like Amazon, which trades at a forward P/E of 32. The enthusiasm among these billionaires for Nu stock shows they believe in its potential, making it a compelling option for growth-oriented investors.

Is Now the Right Time to Invest in Nu Holdings?

Before considering an investment in Nu Holdings, it’s important to evaluate the latest analyst insights.

The Motley Fool Stock Advisor team recently identified what they believe are the 10 best stocks for investors today, none of which include Nu Holdings. These top 10 picks are anticipated to deliver substantial returns in the years ahead.

For context, consider when Nvidia made this list on April 15, 2005: if you had invested $1,000 at that time, it would now be worth $813,567!*

Stock Advisor offers detailed guidance for investors, covering portfolio building and offering two new stock picks monthly. Since 2002, its recommendations have significantly outperformed the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of October 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is on the board of The Motley Fool. Jennifer Saibil owns shares in Nu Holdings. The Motley Fool has positions in and recommends Amazon and Berkshire Hathaway. They also recommend Nu Holdings. For more information, refer to our disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.