SoFi Technologies’ Q3 Results Shine Despite Stock Slide

SoFi Technologies (NASDAQ: SOFI) experienced a drop in shares following its third-quarter report, even though the financial-service company delivered strong performance and optimistic guidance. After an impressive run since early October, the stock remains modestly up for the year.

Let’s examine SoFi’s recent results to determine if this presents a buying opportunity for investors.

Strong Performance Highlights

SoFi branded its Q3 as its best ever, showcasing remarkable results. Revenue soared 30% to $697.1 million, and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) increased by 90% to $186.2 million.

The tangible book value also experienced growth, rising 16% year over year to $4 per share and up 2% from the previous quarter.

The financial services segment was a key driver, with revenue more than doubling to $238.3 million. Its contribution profit leaped from $3.3 million to $99.8 million.

This growth stemmed mainly from its loan platform, which acts as a referral service. The segment’s platform-revenue fees surged fivefold to $55.6 million, and interchange revenue skyrocketed by 211% to $12 million.

Net-interest income (NII) for this segment rose by 66% to $154.1 million, fueled by a rise in customer deposits. Overall, SoFi saw a 33% growth in the number of financial products used, with annualized revenue per product increasing 53% to $81.

In the lending segment, revenue grew by 14% to $396.2 million, with NII increasing by 19%. Contribution profit climbed by 17% to $238.9 million, and total loan-origination volumes were up 23%.

Revenue from the technology segment also climbed 14% to $102.5 million, and contribution profit rose 2% to $33 million. Total clients jumped 17% to 160.2 million.

Overall, it was a strong quarter across all metrics for SoFi.

Image source: Getty Images.

Concerns about SoFi’s credit metrics have been reduced as the company reported a decline in its charge-off rate to 3.52% from 3.84% in the previous quarter. It sold some later-stage delinquencies but noted that its all-in annualized net charge-off rate would have decreased from 5.4% in Q2 to 5% in Q3 even without those sales.

The profile of personal loan borrowers showed an average income of $164,000, coupled with a weighted-average FICO score of 746. Student loan borrowers averaged $135,000 in income, with a FICO score of 765, indicating that SoFi is not lending to high-risk subprime borrowers.

Looking ahead, SoFi expects full-year adjusted net revenue to fall between $2.535 billion and $2.55 billion, marking a 22% to 23% growth rate. This outlook surpasses its earlier forecast of $2.43 to $2.47 billion, which represented 17% to 19% growth. Furthermore, adjusted EBITDA guidance has been raised to $640 million to $645 million, up from the previous estimate of $605 million to $615 million.

Should Investors Consider Buying Now?

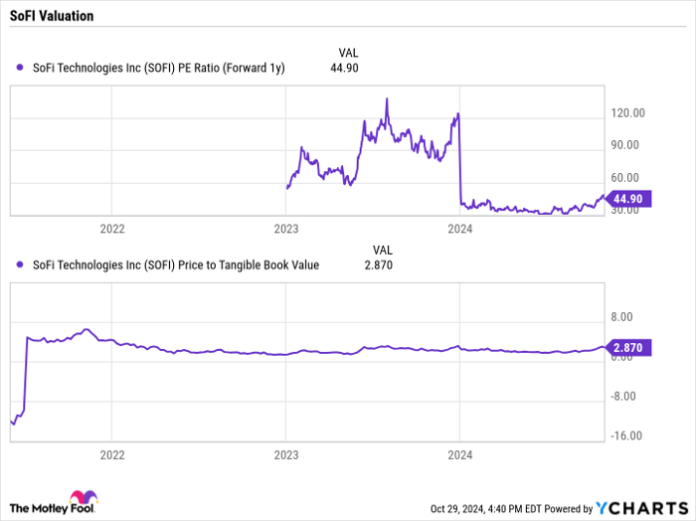

With a forward price-to-earnings (P/E) ratio of 45 times and a price-to-tangible book value (P/TBV) of approximately 2.6 times, SoFi does not appear cheap by traditional standards. Nevertheless, the company demonstrates strong growth and improved credit quality.

SOFI PE Ratio (Forward 1y) data by YCharts.

Despite a solid quarter, SoFi’s stock took a hit. Concerns over credit quality and slowing growth lingered, yet both metrics showed improvement in this quarter. With the Federal Reserve expected to start cutting rates and a stable economy, SoFi is likely well-positioned moving forward, especially given its dual role of originating loans and generating leads for other lenders.

That said, this stock is not cheap and could be at risk if the economy weakens. Therefore, it may be best to view it as a hold for now.

A Potential Investment Opportunity Awaits

Have you ever felt you missed out on investing in the biggest success stories? If so, we have something for you.

Occasionally, our team of experts issues a “Double Down” stock recommendation for companies poised for significant growth. If you think you’ve already missed your chance, this could be the perfect moment to invest.

- Amazon: If you invested $1,000 when we doubled down in 2010, you’d have $22,292!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $42,169!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $407,758!*

Right now, we’re issuing “Double Down” alerts for three outstanding companies, and this could be your last chance to get in.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.