Wall Street’s Uncertain Week: Bitcoin Surges and Mixed Tech Earnings

Wall Street had a mixed week, with indexes rising early in the week but closing lower on Thursday (October 31) due to concerns about rising AI costs and weak economic data.

Despite a weaker-than-expected US jobs report on Friday (November 1), the market opened higher, aided by a strong earnings report from Amazon (NASDAQ:AMZN), which concluded the week of earnings announcements with a substantial profit increase from its cloud and AI sectors.

Investors are now eyeing the upcoming election results on November 5 and anticipating a potential rate cut from the US Federal Reserve next week. Stay updated with the latest tech news in the Investing News Network’s recap below.

1. Bitcoin Approaches Record High

Bitcoin bounced back over the weekend after a dip last Friday, climbing above US$69,000 by Monday (October 28). This rise was driven by growing optimism about possible outcomes of the upcoming election, as evidenced by Trump’s favorable odds in betting markets. Bitcoin’s dominance increased to nearly 60 percent, marking its highest level since March 2021, partially boosted by strong ETF inflows.

The rally continued on Tuesday (October 29), driving Bitcoin past US$70,000, finally reaching US$71,540. By Wednesday (October 30), the cryptocurrency was approaching its all-time high, peaking at US$73,295, which led to some liquidations; however, robust exchange-traded fund inflows indicated sustained demand.

Chart via CoinGecko.

Bitcoin performance, October 26 to November 1, 2024.

However, profit-taking on Thursday led to a selloff, pushing Bitcoin’s price below US$70,000. The following 24 hours were marked by volatility, with Bitcoin’s price fluctuating from US$68,840 to US$71,500 and back to US$69,350 in just a day. By the end of the trading week, it closed at US$69,284, reflecting a 4.39 percent decline from its peak this week.

2. Tech Earnings Yield Mixed Results

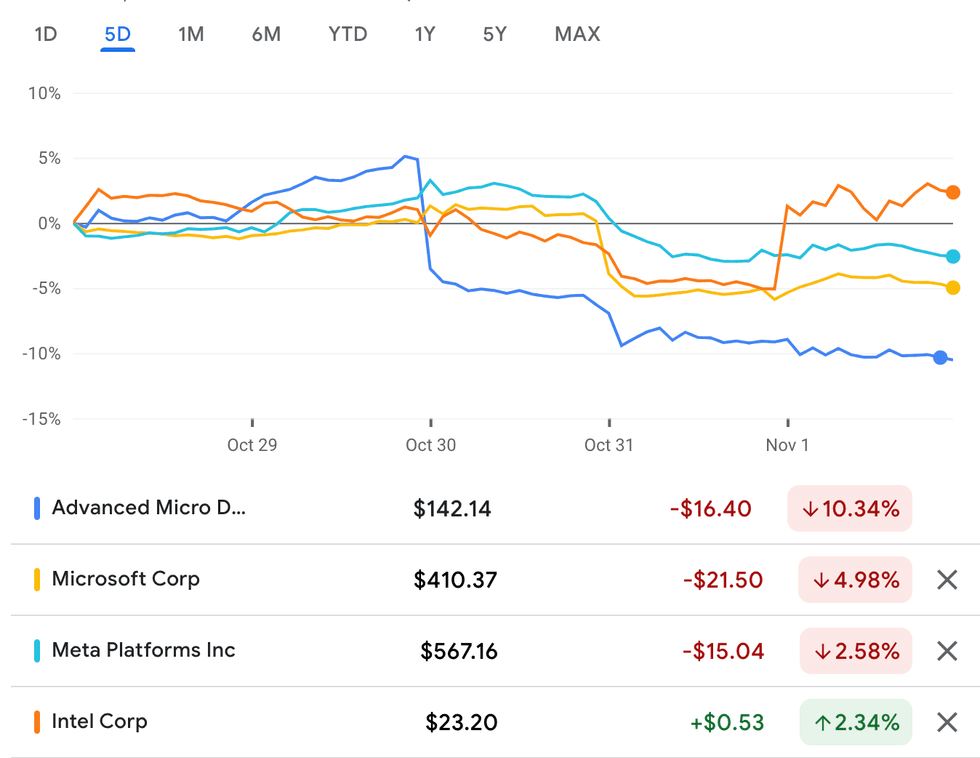

This week’s tech earnings reports presented a mixed picture, with many companies encountering investor skepticism. AMD (NASDAQ:AMD), which reported first on Tuesday (October 29), saw its stock price drop due to a disappointing sales forecast, despite surpassing revenue estimates and showing growth in data center chip sales.

Likewise, even with strong revenue growth, Microsoft’s (NASDAQ:MSFT) performance was overshadowed by worries about a potential slowdown in its Azure cloud business. Executives…

Tech Giants Face Mixed Reactions After Q3 Earnings Reports

Market Reactions Summary

After reporting disappointing figures, many tech companies are dealing with investor skepticism. Despite citing capacity constraints rather than decreased demand, one firm saw its share price drop by three percent in after-hours trading.

Chart via Google Finance.

AMD, Microsoft, Meta Platforms and Intel performance, October 28 to November 1, 2024.

Apple’s Promising Growth Meets Investor Caution

Apple (NASDAQ:AAPL) showed impressive results with its highest quarterly revenue growth in two years. However, a disappointing sales forecast and lukewarm feedback on its new AI features led to a 4.54 percent decline in share prices this week.

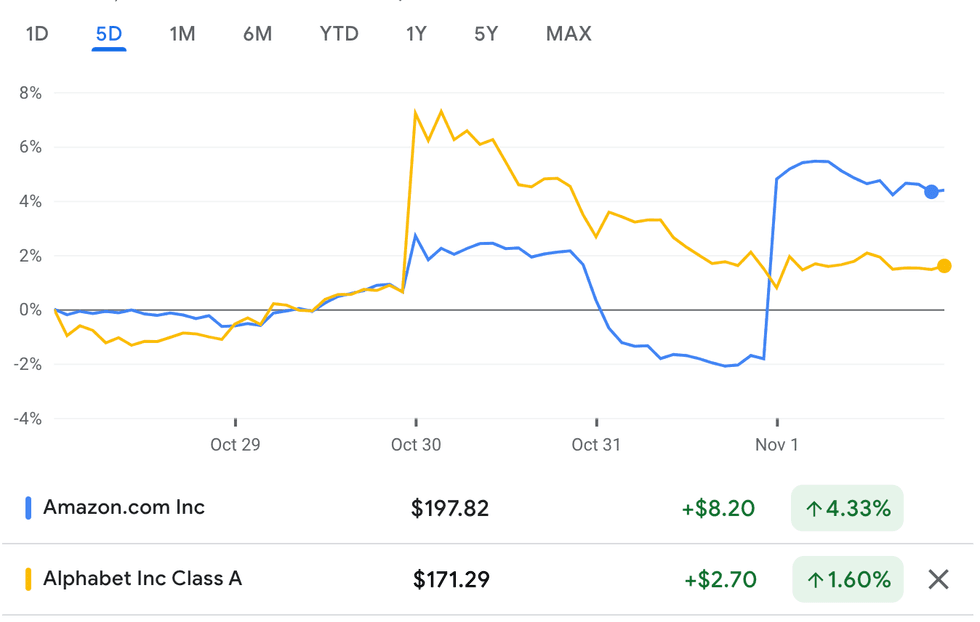

Alphabet and Amazon Thrive in Cloud Sector

Both Amazon and Alphabet (NASDAQ:GOOGL) reported solid revenue growth, driven largely by their cloud services. Alphabet’s Q3 report revealed total revenue of US$88 billion, up 15 percent from last year, and surpassing expectations of US$86.44 billion. A significant portion of this growth came from Google’s Cloud business, which expanded by 39 percent, largely due to increased interest in AI technologies.

On the downside, Alphabet reported a slowdown in search ad growth, which fell by 12 percent compared to a 14 percent drop in the previous quarter. Anticipated capital expenditures, steady at about US$13 billion per quarter this year, are projected to rise in 2025 but are expected to grow at a slower rate than in 2024. This has somewhat assuaged investor fears about AI spending affecting profits.

Chart via Google Finance.

Amazon and Alphabet performance, October 28 to November 1, 2024.

Amazon’s Robust Growth in AWS

Amazon’s Q3 report revealed a staggering 50 percent surge in operating profits for Amazon Web Services, reaching US$10.4 billion. Additionally, revenue climbed 19 percent to US$27.5 billion. Despite significant capital expenditures, shares rose by 6.75 percent following the announcement, likely due to the rapid expansion of AWS’s generative AI division, which is growing at a triple-digit rate according to CEO Andrew R. Jassy.

Meta and Intel Struggle with Investor Sentiment

In contrast, Meta (NASDAQ:META) experienced a 4.19 percent drop in its share price. This decline was linked to plans for increased capital spending and expected losses in its AI department, fueled by mounting investor impatience with its high spending on AI, particularly as its cloud business has yet to achieve similar profits as its competitors.

Meanwhile, Intel (NASDAQ: [Data Missing]

Intel’s Q3 Results Show Resilience Amidst Challenges

Intel (NASDAQ: INTC), despite a challenging financial environment, has shown signs of regaining investor confidence. The company’s Q3 results exceeded analysts’ expectations. However, it reported a 6 percent drop in revenue, totaling US$13.28 billion, along with substantial losses of US$16.6 billion, primarily due to ongoing restructuring efforts. As a result, Intel’s stock has risen by 2.34 percent this week.

Your Guide to Apple’s Recent Product Rollouts

Apple had a bustling week, launching several products that sparked mixed reactions. The introduction of Apple Intelligence on October 28 received a lukewarm response due to limited features, primarily enhancing only Photos and Writing tools. Many highly awaited features have been postponed until December, and customers must sign up for a waitlist for access.

Moreover, the company unveiled a new range of iMacs featuring M4 chips and built-in Apple Intelligence. However, the launch did not ignite much excitement in the market, resulting in Apple closing the trading day slightly below its opening price.

On Tuesday, Apple debuted the upgraded Mac mini, a compact desktop designed for versatility. It can work with non-Apple peripherals, allowing users to configure their setup as they wish, prompting a small increase in share value.

Wednesday’s highlight was the launch of the M4 Pro and M4 Max chips aimed at high-performance users. They offer improved memory bandwidth and additional GPU cores compared to the standard M4. However, preceding Apple’s Q3 earnings report on Thursday, the stock saw a dip of over one percent. Overall, the company’s stock has decreased by 4.54 percent this week.

Super Micro Computer Struggles with Financial Turmoil

Super Micro Computer (NASDAQ: SMCI) has faced significant challenges, with its shares plummeting 45.5 percent this week following the resignation of the auditing firm EY.

The firm terminated its relationship over concerns regarding Super Micro’s financial reporting. Following this news, reported by Reuters, the company’s shares dropped by 33 percent. Super Micro, which saw its valuation peak at US$118.81 in mid-March 2024 and enjoyed a 65 percent increase year-to-date prior to the incident, disputes EY’s allegations. Nonetheless, investor uncertainty has grown, reflecting deeper worries regarding the company’s financial practices.

Super Micro had already postponed its annual report filing in late August to review its financial controls after claims of potential account manipulation were raised by Hindenburg Research. A special committee was established to investigate, but EY stated they could “no longer rely on” the findings of this committee. Additionally, reports indicate that the US Department of Justice has opened an investigation into the company, adding to the turmoil.

Google Cloud Expands Its Reach Through New Partnership

Google Cloud recently announced a partnership with MANTRA, a web3 infrastructure provider, on Tuesday.

This collaboration aims to foster innovation in the real-world assets ecosystem, positioning Google Cloud as a crucial player in this emerging space. Further details on the partnership and its implications remain to be seen, but it highlights Google Cloud’s strategy to enhance its service offerings.

Google Cloud Partners with MANTRA Chain to Boost Real-World Asset Tokenization

In an important development in the blockchain space, MANTRA Chain, a Layer-1 blockchain that focuses on the tokenization of real-world assets (RWAs), has partnered with Google Cloud. Through this collaboration, developers will be able to utilize the Web3 portal to create solutions involving RWAs. This initiative seeks to enhance the adoption of RWAs across sectors such as finance and real estate.

Additionally, the two companies are gearing up to launch the MANTRA Incubator in 2025. This accelerator program aims to provide valuable resources and expertise to projects focused on real-world asset tokenization.

This partnership not only presents a new revenue opportunity for Google Cloud, but it also strengthens the company’s foothold in the Web3 arena. As MANTRA’s primary validator, Google Cloud will receive rewards for validating transactions and enhancing the security of the network. As the number of transactions on the MANTRA Chain increases, Google Cloud’s revenue is expected to grow correspondingly.

The collaboration represents a crucial advancement for both firms, underscoring the rising interest and potential for blockchain technology to revolutionize established industries.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.