Stanley Black & Decker Faces Challenges as Quarterly Earnings Fall Short

Shares of Stanley Black & Decker (NYSE: SWK) dropped 15.6% in October, as detailed in the latest S&P Global Market Intelligence report. The decline was a direct result of the company’s disappointing third-quarter 2024 earnings report, which signaled a setback in its recovery plans. Management indicated that it would take longer than expected to restore margins and reduce inventory to prior levels.

Analyzing the Investment Potential for Stanley Black & Decker

Investors are hopeful that Stanley Black & Decker will decrease its high inventory levels by boosting sales. Furthermore, the company is implementing a cost-reduction strategy aimed at cutting expenses by $2 billion by 2025.

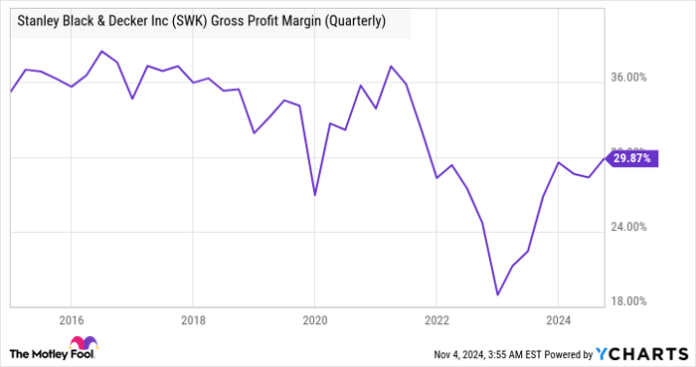

The tool manufacturer aims to restore its gross profit margin to at least 35% while enhancing its earnings and cash flow.

SWK Gross Profit Margin (Quarterly) data by YCharts

What Contributed to the Disappointing Third Quarter?

The third quarter presented challenges for Stanley, as the markets showed weakness. Sectors affected by rising interest rates, like consumer DIY tools and automotive products, saw declines that overshadowed gains in aerospace and industrial fasteners. Consequently, Stanley’s sales fell by 5% year-over-year and 2% on an organic basis. However, the adjusted gross margin improved to 30.5%, compared to 27.6% in the same quarter of 2023, marking a positive trend.

Image source: Getty Images.

Despite the improved margins, reaching the target of 35% will require time. This delayed recovery is evident in the sales results and CEO Don Allan’s insights during the earnings call: “We expect choppy markets will extend into the front half of next year until interest rate reductions have a greater effect.”

In addition, the increase in the quarterly inventories-to-sales ratio highlights that sales lagged behind inventory levels.

Fundamental Chart data by YCharts

Should You Consider Buying Stanley Black & Decker Stock?

On a positive note, management confirmed that the cost-cutting initiatives are progressing. Since the downturn is primarily in interest rate-sensitive markets, a potential decrease in interest rates could enhance its market position through 2025, leading to better margins and a lower inventory-to-sales ratio. Currently, trading at less than 20 times the midpoint of management’s free cash flow guidance for 2024, the stock appears to present a reasonable investment opportunity.

Don’t Miss This Second Chance for a Potentially Valuable Investment

If you’ve ever thought you lost out on investing in top-performing stocks, here’s your opportunity to learn more.

Occasionally, our expert analysts identify “Double Down” stock recommendations for companies poised for growth. If you’re concerned about having missed earlier chances, now may be the ideal time to invest before it’s too late. Consider these returns:

- Amazon: A $1,000 investment in 2010 would now be worth $22,292!*

- Apple: A $1,000 investment in 2008 now stands at $42,169!*

- Netflix: A $1,000 investment in 2004 has grown to $407,758!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and opportunities like this may not come around often.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.