U.S. Steel Corporation Reports Third Quarter Earnings: A 60% Decline in Profit

United States Steel Corporation (X) reported earnings of $119 million, or 48 cents per share, for the third quarter of 2024. This represents a significant decrease of approximately 60% compared to the previous year’s profit of $299 million, or $1.20 per share. When adjusted for one-time items, the earnings per share were 56 cents, down from $1.40 in the same quarter last year. Despite the decline, this figure exceeded the Zacks Consensus Estimate of 45 cents.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

The company’s revenues also experienced a downturn, falling around 13% year over year to $3,853 million, yet still surpassing the Zacks Consensus Estimate of $3,736 million.

U.S. Steel’s total shipments for the quarter totaled 3,516,000 tons, marking a 7% decline from the previous year and falling short of expectations, which were estimated at 3,619,000 tons.

Financial Performance Overview

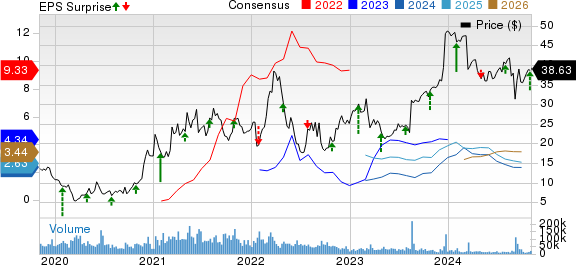

United States Steel Corporation Price, Consensus and EPS Surprise

United States Steel Corporation price-consensus-eps-surprise-chart | United States Steel Corporation Quote

Segment Highlights

Flat-Rolled: The Flat-Rolled segment generated an EBIT of $106 million this quarter, down from $225 million in the previous year. Shipments decreased by about 11.7%, totaling 1,905,000 tons. The average price realized per ton was $993, reflecting a drop of around 4.2% year over year, yet exceeding our estimate of $940.

Mini Mill: This segment reported a loss of $28 million compared to a profit of $42 million a year prior. Shipments increased to 602,000 tons, up about 7.3%. The average price realized per ton was $800, down by approximately 11.2% year over year, falling short of our estimate of $806.

U.S. Steel Europe: This segment posted a profit of $7 million, improving from a $13 million loss one year ago. However, shipments decreased around 6.2% to 899,000 tons. The average price realized per ton was $802, down 5.2% from last year but greater than our estimate of $750.

Tubular: The Tubular segment recorded a loss of $4 million this quarter compared to a profit of $87 million last year. Despite a shipment increase of roughly 5.7% to 110,000 tons, the average realized price per ton dipped about 38.3% to $1,805, not meeting our estimate of $1,886.

Financial Position

At the end of the quarter, U.S. Steel had cash and cash equivalents of $1,773 million, a decline of about 45% from the prior year. The company’s long-term debt stood at $4,068 million, reflecting a slight decrease of 1.5%.

Future Outlook

U.S. Steel projects adjusted EBITDA for the fourth quarter to range between $225 million and $275 million. The North American Flat-Rolled unit is expected to see modest declines due to lower average selling price projections. On the other hand, an improvement in the Mini Mill segment is anticipated, despite accounting for $25 million in startup and construction-related costs at BR2. Conversely, results in Europe may decrease as a result of unfavorable CO2 allocations and weak demand. The Tubular segment is expected to remain stable compared to the third quarter.

Stock Performance

Over the past year, U.S. Steel’s stock has risen by 11.9%, contrasting with an 8.7% decline in the industry.

Image Source: Zacks Investment Research

Company Ranking and Comparisons

U.S. Steel currently holds a Zacks Rank #3 (Hold).

In the basic materials sector, other notable stocks include IAMGOLD Corporation (IAG), Kinross Gold Corporation (KGC), and Barrick Gold Corporation (GOLD).

IAMGOLD is set to announce third-quarter results on Nov. 7, with the consensus estimate for earnings at 11 cents. The company has beaten expectations in three of the last four quarters, averaging a surprise of 200%. IAG has a Zacks Rank #1 (Strong Buy). Meanwhile, Kinross Gold will report on Nov. 5, and the earnings estimate stands at 17 cents, with a successful track record against estimates over the last four quarters, averaging a 29.1% surprise rate. KGC has a Zacks Rank #2 (Buy). Barrick Gold will disclose its earnings on Nov. 7, with consensus earnings estimated at 33 cents; it carries a Zacks Rank #2 and has consistently surpassed estimates in recent quarters, averaging a surprise of 21.2%.

Research Chief Names “Single Best Pick to Double”

Five top analysts from Zacks have selected their favorite stocks projected to surge by 100% or more soon. Among these, Director of Research Sheraz Mian has identified one specific company with the most promising potential for explosive growth.

This company targets millennial and Gen Z consumers, boasting nearly $1 billion in revenue last quarter. The recent stock price pullback presents an opportune moment for investment. While not every pick turns out to be a winner, this one is expected to exceed previous Zacks predictions like Nano-X Imaging, which skyrocketed by 129.6% in under nine months.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

United States Steel Corporation (X): Free Stock Analysis Report

Kinross Gold Corporation (KGC): Free Stock Analysis Report

IAG: Free Stock Analysis Report

Barrick Gold Corporation (GOLD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.