Upcoming Earnings Report: What to Expect from Pinterest, Inc.

Pinterest, Inc. (PINS) is set to unveil its third-quarter 2024 results on November 7, shortly after the market closes. On average, the company has surprised investors with earnings performance, delivering a trailing four-quarter earnings surprise of 20.92%. In the most recent quarter, Pinterest achieved an earnings surprise of 3.57%.

Keep track of quarterly releases: Check out Zacks Earnings Calendar.

Analysts anticipate Pinterest will experience growth in annual revenue, largely driven by increased user engagement across the United States, Canada, and Europe. New AI-powered tools, a greater emphasis on personalized content, and enhanced operational efficiency are factors expected to contribute positively to this growth.

What’s Influencing Pinterest’s Performance

During this quarter, Pinterest launched two exciting features—collage remixing and collage sharing—within its well-liked collage toolkit. These additions allow users to create and share more lively and engaging content.

Furthermore, the company is implementing various strategies to increase actionable content from a diverse array of publishers and retailers. This initiative has led to better engagement metrics, including sessions, impressions, and saves, across all geographic regions. These efforts are anticipated to significantly support revenue growth.

In terms of operational enhancements, Pinterest is concentrating on refining its processes and utilizing advanced AI models to improve content relevancy and personalization. The integration of third-party advertisements is also designed to bolster advertising revenue, particularly in under-monetized international markets. Collectively, these developments are expected to positively influence the upcoming quarterly results.

The estimated average revenue per user (ARPU) is projected to be $7.21 in the United States and Canada, while for Europe, it’s estimated at $1.10. Additionally, the number of monthly active users (MAUs) in the United States and Canada is expected to reach 98.2 million, with European MAUs approximated at 136.3 million. For the rest of the world, the estimate stands at 289.3 million MAUs.

For the September quarter, the Zacks Consensus Estimate forecasts total revenues of $897.07 million, indicating growth from the $763.2 million reported during the same period last year. Analysts expect adjusted earnings per share to reach 34 cents, an increase from 28 cents in the previous year.

Insights on Earnings Predictions

Current analysis suggests that the likelihood of Pinterest achieving an earnings beat this quarter is uncertain. For an earnings beat, a combination of a positive Earnings ESP along with a Zacks Rank #1 (Strong Buy), #2 (Buy), or #3 (Hold) is typically required; however, Pinterest does not meet these criteria this time.

Earnings ESP: The Earnings ESP, representing the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, stands at 0.00%, with both estimates currently at 34 cents. You can find top stocks to consider before earnings reports with our Earnings ESP Filter.

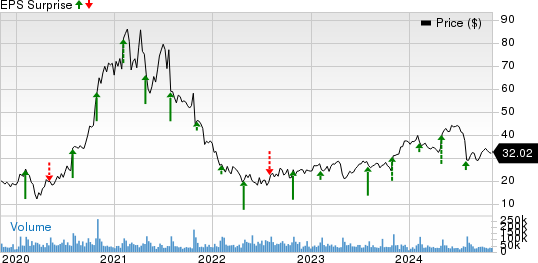

Pinterest, Inc. Price and EPS Surprise

Pinterest, Inc. price-eps-surprise | Pinterest, Inc. Quote

Zacks Rank: Pinterest holds a Zacks Rank of #3.

Other Stocks Worth Watching

Here are several companies that may be worth considering, as they possess the right elements for a potential earnings beat this quarter:

The Earnings ESP for Fortinet (FTNT) is +1.25%, and it currently holds a Zacks Rank of 2. Fortinet will report its earnings on November 7.

Additionally, Qualcomm Technologies, Inc. (QCOM) has an Earnings ESP of +0.48% and a Zacks Rank of 2, with earnings set for November 6.

Arista Networks, Inc. (ANET) sports an Earnings ESP of +0.72% and a Zacks Rank of 1, also reporting on November 7.

Stock Picks from Research Experts

Our research team has identified the “Single Best Pick to Double” from thousands of stocks. Five Zacks experts chose their favorites, and Director of Research Sheraz Mian selected one with explosive upside potential.

This company targets millennial and Gen Z markets, bringing in nearly $1 billion in revenue last quarter. A recent dip in price presents an excellent investment opportunity. While not all our recommended stocks will succeed, previous picks, like Nano-X Imaging, which soared +129.6% in less than nine months, indicate the potential for significant growth.

Free: Explore Our Top Stock and 4 Additional Recommendations

Looking for the latest insights from Zacks Investment Research? Download 5 Stocks Set to Double for free.

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Fortinet, Inc. (FTNT): Free Stock Analysis Report

Arista Networks, Inc. (ANET): Free Stock Analysis Report

Pinterest, Inc. (PINS): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.