Devon Energy Set for Yearly Revenue and Earnings Decline, But History Shows Earnings Surprises

Devon Energy Corporation DVN is slated to announce its third-quarter 2024 results on Nov. 5, after market close, with expectations of a decrease in both revenue and earnings compared to last year.

Keep track of all quarterly releases: Refer to Zacks Earnings Calendar.

The Zacks Consensus Estimate places DVN’s third-quarter revenue at $3.86 billion, reflecting a 2% drop from the same period last year.

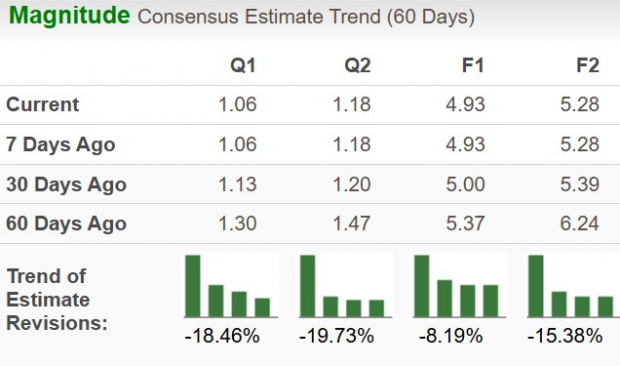

For earnings, the consensus estimate is set at $1.06 per share, representing a substantial 35.8% annual decline. Notably, this estimate has decreased by 18.46% over the last two months.

Image Source: Zacks Investment Research

History of Positive Earnings Surprises

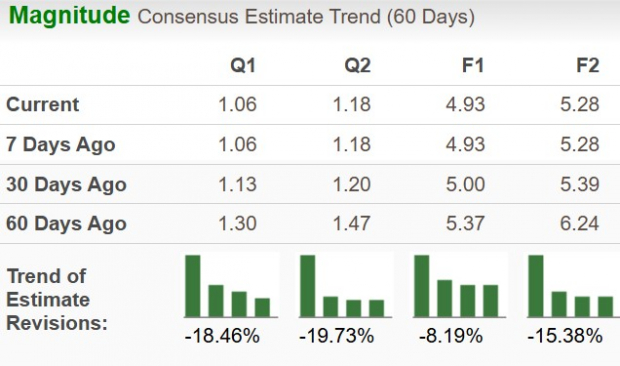

Devon’s earnings have outperformed the Zacks Consensus Estimate for the last four quarters, achieving an average surprise of 5.49%.

Image Source: Zacks Investment Research

Insights from the Zacks Model

The evidence does not strongly favor an earnings beat for Devon Energy this quarter. For an earnings surprise, a positive Earnings ESP along with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) is ideal, but currently, Devon falls short.

Earnings ESP: Devon has an Earnings ESP of -0.70%.

Zacks Rank: Devon Energy holds a Zacks Rank of #3. Check out the complete list of today’s Zacks #1 Rank stocks.

Factors Shaping DVN’s Q3 Earnings Potential

Devon continues to thrive thanks to its diverse assets and high-margin properties. The introduction of new wells in the first three quarters of 2024 is likely to have significantly contributed to production levels. Additionally, the acquisition of Grayson Mill Energy should enhance production volumes.

Effective cost management is anticipated to positively influence third-quarter earnings by keeping operating expenses within guidance and improving profit margins. Moreover, operational efficiency gains, particularly in the Delaware area during the first half of 2024, are expected to persist into Q3, further enhancing the company’s performance.

Strong free cash flow is also projected to continue, benefiting shareholders, especially as ongoing stock repurchases reduce the total number of outstanding shares, potentially boosting earnings.

Price Performance and Valuation Analysis

In the past six months, DVN’s stock has dropped by 23.2%, contrasted with a 5.1% decline in the industry.

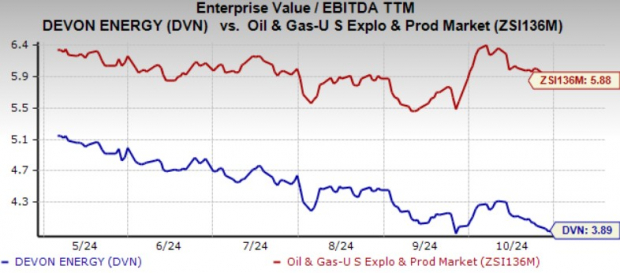

Image Source: Zacks Investment Research

At present, Devon shares trade at a trailing 12-month Enterprise Value/Earnings before Interest Tax Depreciation and Amortization (EV/EBITDA TTM) of 3.89X, notably lower than the industry average of 5.88X.

Image Source: Zacks Investment Research

In comparison, other industry players like APA Corporation APA and EOG Resources Inc. EOG exhibit higher valuations, with trailing 12-month EV/EBITDA multiples of 5.42 and 5.13, respectively.

Investment Considerations

Devon’s extensive domestic assets play a key role in driving its performance. The acquisition of Grayson Mill Energy enhances its capability to achieve high-margin production and robust free cash flow in the long run. With manageable debt levels and reduced annual interest expenses, financial flexibility looks promising.

The company’s current ratio of 1.11 reflects its ability to cover immediate debt obligations. Additionally, declining interest rates are likely to benefit borrowing costs, positively impacting future projects.

However, the competitive nature of the oil and gas market may restrict Devon’s ability to secure new drilling rights due to stronger competitors with greater resources.

Conclusion

Devon’s solid domestic asset base, coupled with a mix of oil, natural gas, and NGL production, supports strong margins. Even though the company currently trades at a discount, existing shareholders may find it wise to hold onto their investments.

Research Head Highlights Top Stock Pick

From a vast selection of stocks, five Zacks experts have identified their favorite investments expected to soar over 100% in the coming months. Among them, Director of Research Sheraz Mian has singled out one with the most explosive potential.

This standout company appeals to millennial and Gen Z consumers, achieving nearly $1 billion in revenue last quarter. Recent market adjustments present a prime opportunity for engagement. While not every elite selection turns out successful, this particular stock could greatly exceed previous Zacks’ Stocks Set to Double, such as Nano-X Imaging, which surged 129.6% in just over nine months.

Free: Examine Our Top Stock and 4 Runners Up

For the latest recommendations from Zacks Investment Research, download the report on 5 Stocks Set to Double.

Devon Energy Corporation (DVN) : Free Stock Analysis Report

APA Corporation (APA) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

For more details on this article, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.