Exploring Options: A Deep Dive into Paycom Software Inc’s Put Strategy

Is Selling Puts a Better Strategy Than Paying Full Price for PAYC?

Investors interested in purchasing Paycom Software Inc (Symbol: PAYC) stock at the current market price of $209.84 per share may want to consider selling puts as an alternative strategy. A notable option to consider is the January 2027 put with a $165 strike, currently offering a bid price of $19.30. By selling this put, investors can collect a premium that translates to an 11.7% return on the $165 commitment, which is equivalent to an annualized return of 5.3%—often referred to as the YieldBoost.

When an investor sells a put, they do not get the same upside as owning shares outright. Instead, they only acquire the stock if the put option is exercised. The buyer will exercise the option at the $165 strike price if it is more advantageous than selling at the current market price. Unless Paycom’s share price declines by 22.1% and the put option is executed, the put seller’s only benefit lies in collecting the premium, amounting to a 5.3% annualized return.

This 5.3% annualized return notably surpasses Paycom’s 0.7% annualized dividend yield by a margin of 4.6%, based on the current stock price. Moreover, purchasing the stock to secure dividends exposes the investor to greater risk, necessitating a drop of 22.07% in share price to reach the $165 strike price.

It’s crucial to remember that dividends can be unpredictable and often fluctuate with the company’s profitability. To assess Paycom’s dividend reliability, examining its dividend history can provide insight into whether the current 0.7% yield is sustainable moving forward.

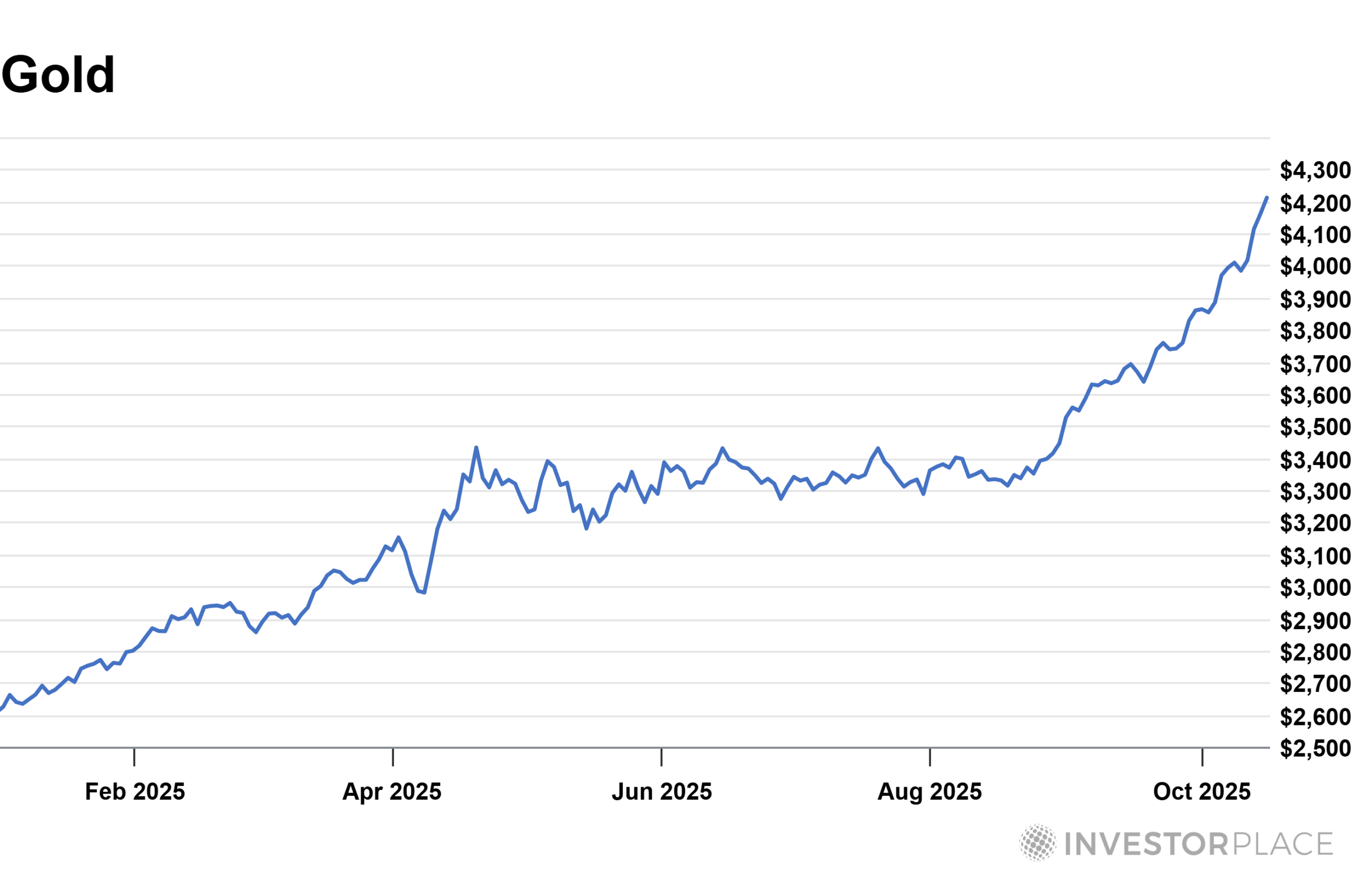

The chart detailing Paycom Software Inc’s trading history over the past twelve months highlights the position of the $165 strike relative to the stock’s past performance:

By examining the historical volatility, which we calculated at 36% based on the last 250 trading days, investors can better evaluate whether selling the January 2027 put option for a 5.3% annualized rate of return aligns with their risk-reward strategy. For further put options and expirations, check out the PAYC Stock Options page on StockOptionsChannel.com.

![]() Top YieldBoost Puts of the S&P 500 »

Top YieldBoost Puts of the S&P 500 »

Also see:

• IVRA Videos

• APO shares outstanding history

• Institutional Holders of OGI

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.