https://www.youtube.com/watch?v=lNfdXrGpkQo[/embed>

Vertiv Holdings Co: A Rising Star in AI Investments

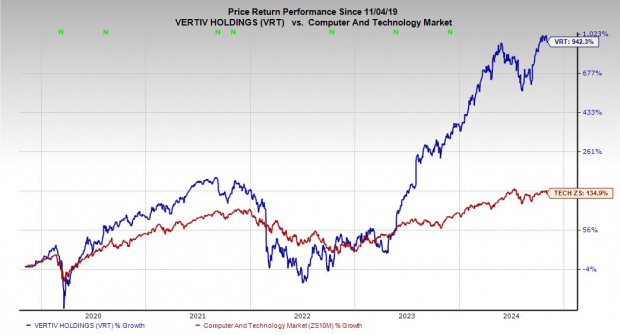

The stock of Vertiv Holdings Co VRT has surged 120% this year and an astounding 940% over the past five years, outpacing the broader Tech sector. Investors are increasingly drawn to Vertiv’s ability to thrive as the AI landscape evolves.

Vertiv plays a crucial role in maintaining the computing power that fuels our modern economy, supporting everything from data centers to AI applications.

The company operates in the background, providing essential infrastructure alongside partners like Nvidia, focusing on solving key challenges as AI expands rapidly.

On October 23, Vertiv reported another impressive quarter, driven by strong demand for its products and services in digital infrastructure, which includes power solutions, thermal management, and IT systems.

Why Investors Are Excited About Vertiv

Operating behind the scenes of big tech and AI, Vertiv provides crucial support as data centers and communication networks expand. Its wide array of services and products addresses power, cooling, and IT infrastructure needs.

Image Source: Zacks Investment Research

As demand for high-performance computing intensifies with the growth of data centers, Vertiv is more relevant than ever. Continuous operations are essential, and the need for efficiency in cooling and power management is paramount.

Partnering with industry leader Nvidia NVDA, Vertiv addresses critical challenges in data center efficiency and cooling solutions.

During the recent quarter, Vertiv reported strong underlying demand, as noted by CEO Giordano Albertazzi, highlighting the essential nature of its digital infrastructure offerings.

Positive Growth Prospects Driven by AI

Revenue for Vertiv increased by 19% in the third quarter, while adjusted earnings saw a remarkable growth of 46%. Organic orders rose approximately 37% over the last year. Notably, liquid cooling revenue is accelerating, boosting long-term growth projections.

With the escalating investment in AI from major companies like Nvidia, Meta, and Alphabet, Vertiv stands to benefit significantly as it aligns itself with this trend.

Image Source: Zacks Investment Research

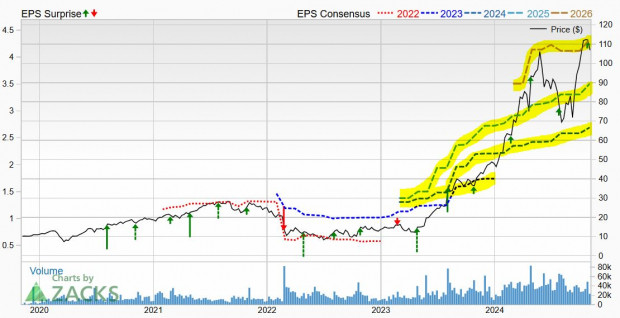

Since the release of its Q3 earnings, earnings estimates for Vertiv have been revised upwards, continuing a trend seen over the past two years.

The stock enjoys a Zacks Rank of #1 (Strong Buy) and has consistently exceeded EPS estimates for seven consecutive quarters.

Predictions suggest that adjusted earnings per share (EPS) will rise by 52% in FY24 and 30% in FY25, increasing from $1.77 in 2023 to $3.50 next year, following an impressive 230% growth last year.

In terms of revenue, Vertiv aims for a 14% boost in 2024, projected to add roughly $1 billion, followed by a 16% uptick in the subsequent year, raising revenue from $6.86 billion in 2023 to $9.08 billion in 2025.

Should Investors Consider Buying Vertiv Stock Now?

Over the past five years, Vertiv’s stock has increased by 940%, significantly outperforming Tech’s 135%, Meta’s 190%, and Alphabet’s 160%. In the last two years alone, VRT shares have risen by 630% and 120% year-to-date, far exceeding Meta’s 60% and Alphabet’s 22% gains in 2024.

Image Source: Zacks Investment Research

In the last year, Vertiv stock has outperformed its peers in the Computers – IT Services industry, surging 170% compared to their 22% average. While it has recently cooled down from an October peak, it currently trades about 17% below the average Zacks price target.

A recent dip in VRT has brought the stock from overbought conditions to more neutral levels, suggesting possible buying opportunities for interested investors.

Currently, VRT is trading slightly below its 21-day moving average, indicating that it may be time for traders and long-term investors to consider adding this promising stock to their portfolios.

Vertiv: A Stock Worth Watching Amid Market Trends

For traders seeking short-term opportunities, Vertiv’s recent price movements might present a promising entry point. However, long-term investors should approach timing the market with caution, as missing out can lead to missed gains when stocks experience upward momentum.

Image Source: Zacks Investment Research

Currently, Vertiv (VRT) is trading at a forward 12-month earnings multiple of 31.7X, which reflects a 20% discount from its prior highs.

Despite its strong performance, Vertiv offers a 14% value advantage over its peer group in the Computers – IT Services sector, which has seen a 5% decline over the past three years. Over the same period, Vertiv’s stock has skyrocketed by 300%.

Understanding Wall Street’s Confidence in Vertiv

The company’s robust product lineup is highly relevant to the fast-growing sectors of data centers, artificial intelligence, and emerging technologies such as cryptocurrencies.

In this favorable environment, it’s not surprising that all 12 brokerage firms tracking Vertiv have issued “Strong Buy” ratings, as reported by Zacks.

Top Stock Picks for Explosive Growth

A select group of experts from Zacks has identified one standout stock that is poised to potentially double in value. Each of these five chosen stocks has the potential for significant gains in the upcoming months.

This specific company, which targets younger consumers, achieved nearly $1 billion in revenue last quarter. A recent dip in its stock price might present an optimal buying opportunity.

While not every recommendation from Zacks will deliver profits, this particular pick shows promise, reminiscent of past winners like Nano-X Imaging, which climbed 129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Want to stay updated with the latest recommendations from Zacks Investment Research? Download your free report on 5 Stocks Set to Double now.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Vertiv Holdings Co. (VRT): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.