Craig-Hallum Sets Strong Buy on PolyPid, Forecasting Over 267% Upside

Analyst Predicts Significant Growth for Biopharma Company

Fintel reports that on November 4, 2024, Craig-Hallum initiated coverage of PolyPid (NasdaqCM:PYPD) with a Buy recommendation.

Analyst Price Forecast Indicates 267.57% Upside Potential

As of October 22, 2024, the average one-year price target for PolyPid is $12.24 per share. This target spans from a low of $10.10 to a high of $14.70. If achieved, the average target reflects an impressive increase of 267.57% from its last reported closing price of $3.33 per share.

For those interested, check out our leaderboard featuring companies with the most substantial price target upside.

The company’s projected annual revenue stands at $9 million, while the expected non-GAAP EPS is -0.98.

What is the Fund Sentiment?

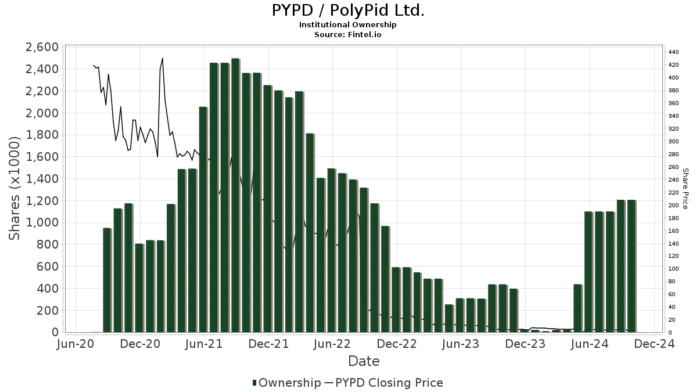

Currently, 14 funds or institutions hold positions in PolyPid, marking an increase of 3 owners, or 27.27%, from the last quarter. The average portfolio weight dedicated to PYPD across all funds is 0.20%, showing a rise of 20.05%. Over the past three months, total shares held by institutions rose by 33.52%, reaching 1.47 million shares.

What are Other Shareholders Doing?

Rosalind Advisors currently holds 679,000 shares, accounting for 9.98% ownership of the company. This marks a significant uptick from their previous holdings of 417,000 shares, representing an increase of 38.63%. Moreover, this firm has boosted its portfolio allocation in PYPD by 8.45% over the last quarter.

AIGH Capital Management maintains 479,000 shares, constituting 7.04% of the company, with no changes from the last quarter.

DAFNA Capital Management holds 185,000 shares, equating to 2.72% ownership, but reported a slight decrease of 0.32% from previous filings. The firm reduced its allocation to PYPD by 2.21% over the past quarter.

ADAR1 Capital Management owns 104,000 shares, which represents 1.53% ownership. In addition, Yelin Lapidot Holdings Management holds 11,000 shares, making up 0.16% ownership, with no changes noted in the last quarter.

About PolyPid

(This description is provided by the company)

PolyPid Ltd. is a late-stage biopharma company focused on enhancing surgical outcomes through localized, controlled, extended-release therapeutics. Utilizing its proprietary PLEX (Polymer-Lipid Encapsulation matriX) technology, PolyPid pairs medication with this system to enable precise drug delivery over various effective release rates, ranging from several days to months. The company’s lead product candidate, D-PLEX100, is currently in Phase 3 clinical trials aimed at preventing sternal and abdominal surgical site infections (SSIs).

Fintel serves as a comprehensive investment research platform for individual investors, traders, financial advisors, and small hedge funds.

Fintel’s data spans global markets, including fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, its exclusive stock picks are driven by advanced, backtested quantitative models that aim to enhance profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.