Understanding Analyst Ratings: What’s the Buzz Around Amazon’s Stock?

Investors often turn to analyst recommendations for guidance on buying, selling, or holding stocks. While these insights can impact stock prices, their true importance is sometimes debated. Let’s explore the insights from brokerage analysts regarding Amazon (AMZN).

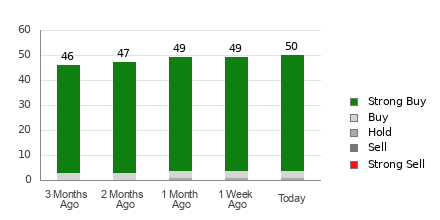

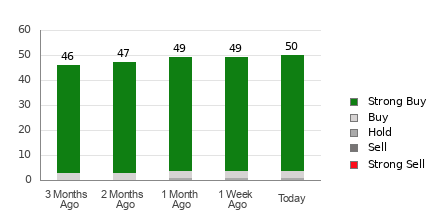

Currently, Amazon has an average brokerage recommendation (ABR) of 1.10 on a scale from 1 to 5 (where 1 is Strong Buy and 5 is Strong Sell). This score is based on ratings from 50 brokerage firms. An ABR of 1.10 falls between Strong Buy and Buy.

Of the 50 recommendations that inform this ABR, 46 are classified as Strong Buy and three as Buy, indicating that 92% of recommendations strongly favor purchasing the stock, while 6% suggest holding.

Trends in Brokerage Recommendations for Amazon (AMZN)

For the latest price target and stock forecast for Amazon, click here>>>

The ABR indicates a buying opportunity for Amazon, yet relying solely on it could be misleading. Research indicates that brokerage recommendations often lack effectiveness in directing investors toward stocks poised for significant price increases.

This happens primarily due to the potential biases of brokerage firms. Analysts often have a conflicting interest when they recommend stocks, issuing five “Strong Buy” ratings for every one “Strong Sell” rating. Thus, their recommendations may not align with the true potential of the stock.

Accordingly, the best approach is to use these ratings in conjunction with your own market research or other reliable indicators that have a proven track record of predicting price movements effectively.

The Zacks Rank, an externally audited stock rating tool, categorizes stocks from #1 (Strong Buy) to #5 (Strong Sell). It serves as a reliable predictor of a stock’s short-term performance, making it a valuable complement to the ABR in your investment decisions.

Distinguishing Between Zacks Rank and ABR

Though Zacks Rank and ABR are both rated on a scale of 1 to 5, they measure different things.

The ABR comes strictly from brokerage recommendations and is often presented with decimal points (like 1.28), while the Zacks Rank is based on earnings estimate revisions and is expressed as whole numbers.

Historically, analysts have maintained a more optimistic view in their recommendations. Their ratings often do not reflect the actual potential supported by their research, which can mislead investors more frequently than it guides them. Conversely, the Zacks Rank relies heavily on earnings estimate revisions, which have shown to correlate strongly with short-term price trends.

Additionally, the Zacks Rank applies uniformly across all stocks analysts evaluate, providing a balanced assessment. Its timely nature stands out; while the ABR may not be updated promptly, the Zacks Rank quickly reflects any shifts in analysts’ earnings estimates, ensuring it accurately depicts future price movements.

Is Amazon (AMZN) Worth Your Investment?

In terms of earnings estimate revisions for Amazon, the Zacks Consensus Estimate for the ongoing year has risen by 6.2% over the past month to $5.07.

The rising optimism from analysts regarding the company’s earnings, indicated by the general agreement in raising EPS estimates, suggests the stock could see significant gains in the near term.

Based on these recent trends and other key factors related to earnings estimates, Amazon currently has a Zacks Rank of #2 (Buy). For a comprehensive view of today’s Zacks Rank #1 (Strong Buy) stocks, click here>>>>

As such, the Buy-equivalent ABR for Amazon may serve as a beneficial reference for investors.

Top Stock Pick: A Bold Forecast for Growth

Among thousands of available stocks, five Zacks experts have selected their favorites expected to rise significantly in the upcoming months. From their top choices, Sheraz Mian, Zacks’ Director of Research, has identified one with the most potential for explosive growth.

This targeted company focuses on millennial and Gen Z consumers, raking in nearly $1 billion in revenue last quarter alone. A recent decline in its stock creates an ideal buying opportunity. While not every pick guarantees success, this one is viewed as having potential that could rival earlier successes, such as Nano-X Imaging, which surged +129.6% in just over nine months.

If you’re interested in Zacks Investment Research’s latest recommendations, download the report on “5 Stocks Set to Double” for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.