“`html

Ford Faces Challenges as Stock Prices Dip Amid Struggling EV Division

Last week, U.S. legacy automaker Ford F released its third-quarter 2024 results. The company’s net income during the quarter plunged 25% to $900 million, largely due to losses in its electric vehicle (EV) business. Discouragingly, the company also cut its full-year 2024 EBIT forecast. It now expects the metric to be around $10 billion, at the lower end of the previously guided range of $10-$12 billion. Since the results, Ford shares have slid 8.8%.

Overview of Ford’s Performance and Market Position

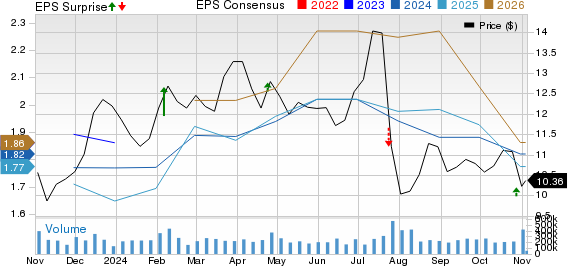

Ford Motor Company price-consensus-eps-surprise-chart | Ford Motor Company Quote

Stay up-to-date with the quarterly releases: See Zacks Earnings Calendar.

Meanwhile, Ford’s closest peer General Motors GM saw a 6% increase in its stock price after delivering a strong third-quarter performance and raising its full-year 2024 guidance for the third time this year.

With Ford shares falling around 9% in the past week, they are down 17% over the past six months, significantly underperforming the industry, sector, S&P 500, and its key competitor.

6-Month Price Performance Comparison

Image Source: Zacks Investment Research

Does the stock price decline represent a buying opportunity? Or are there enough near-term concerns to warrant skipping this investment for the time being? Let’s delve into the company’s fundamentals, growth drivers, and challenges to determine if the stock is worthwhile now.

Ford Pro: A Bright Spot Amid Challenges

Despite facing difficulties, Ford’s Pro unit shines as a promising growth driver. This division combines Ford’s commercial vehicles with a robust suite of software and repair services. In the third quarter, the segment saw strong growth in revenue and volume, increasing 13% and 9% year-over-year, respectively. EBIT for Ford Pro reached $1.8 billion, slightly up from $1.7 billion in the same period last year, making it the company’s most profitable division.

Subscriptions to Ford Pro’s software grew by 30% in the September quarter, and mobile repair orders completed by its 2,400-vehicle service fleet jumped 70%. Software subscriptions and repair services contribute approximately 13% to the segment’s EBIT, and there are expectations to increase this to 20% by 2026.

With strong order books, increasing demand signals, and the successful launch of the Super Duty, the Ford Pro segment is set for a bright future. Ford anticipates EBIT from this unit to rise to around $9 billion, up from $7.2 billion in 2023, fueled by continued growth across vehicles, software, and services. The company’s focus on software technology and service offerings will be a significant growth driver.

High Dividend Yield Appeals to Income Investors

Ford offers a high dividend yield exceeding 5%, significantly higher than the average S&P 500 yield of 1.24%. The company aims for a dividend distribution of 40-50% of its free cash flow going forward, showing commitment to returning value to shareholders. This attractive yield provides a cushion against the stock’s fluctuations and could appeal to those seeking reliable income amid market uncertainties.

Ford Motor Company Dividend Yield (TTM)

Ford Motor Company dividend-yield-ttm | Ford Motor Company Quote

Challenges in the Model e Segment

In contrast to the growth in the Ford Pro division, the company’s Model e segment, dedicated to electric vehicles, is facing significant challenges. The third quarter showed an 11% decrease in wholesale volumes, accompanied by a stark 33% drop in revenue. The segment’s loss before interest and taxes reached $1.22 billion. These setbacks arise from competitive pressures, pricing challenges, and high costs linked to developing next-generation EVs.

So far, Ford has suffered losses of $4.7 billion in its EV segment, with expectations for that figure to climb to $5 billion this year due to ongoing pricing struggles and increased investments in EV technology.

Warranty and Cost Pressures May Impact Margins

Ford has also struggled with warranty expenses, stemming from quality problems especially prominent in older models. Despite ongoing efforts to manage these costs, the company estimates it could take up to 18 months to see significant improvements.

Additionally, inflation is creating cost pressures, particularly impacting Ford’s joint venture in Turkey. Rising material costs for popular models, like the Transit van in Europe, are expected to squeeze profit margins further.

Given these cost challenges, Ford has revised its overall EBIT forecast for 2024 downward. The company now anticipates EBIT from its Ford Blue unit to drop from $7.5 billion in 2023 to $5 billion this year, largely due to escalating warranty and production costs.

CFO John Lawler acknowledged that while Ford achieved a $2 billion cut in material and manufacturing expenses, these savings have been overshadowed by inflation and warranty costs. Such factors have hindered Ford from reaching its financial goals for the current year.

The Zacks Consensus Estimate for the 2024 and 2025 EPS indicates declines of 9.4% and 2.5%, respectively.

A Cautious Outlook for Ford Stock

While Ford’s Pro division shows promise and the high dividend yield may attract income-focused investors, the overall outlook for the stock appears uncertain, largely due to numerous challenges that loom ahead.

“`

Ford’s Struggles: A Cautionary Look at the Auto Giant’s Future

Challenges Mount as EV Division Faces Tough Times

Ford Motor Company (F) is grappling with multiple challenges that hinder its growth prospects. Ongoing losses in the electric vehicle (EV) segment and increasing warranty costs are significant concerns. Additionally, heightened competition in the automotive market adds pressure as demand appears to be faltering, and inventory levels continue to rise. These factors create an environment where profitability becomes increasingly elusive.

Potential Risks for Investors

Given these challenges, investing in Ford may not be the safest choice at this time. Although the company is considered undervalued with a Value Score of A, its stock is likely to remain under strain as operational issues persist. It might be prudent for investors to wait for clearer signs of sustained growth and effective cost management before considering an investment in Ford.

Currently, Ford holds a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A Stock Pick with Double the Potential

In a search for emerging opportunities, five Zacks experts have identified their top picks, with Director of Research Sheraz Mian selecting one that he believes has the greatest potential to double in value. This company targets young consumers, particularly millennials and Gen Z, and recently reported nearly $1 billion in revenue for the last quarter. A recent decline in its stock price may present a timely entry point for new investors. While past selections like Nano-X Imaging have achieved remarkable gains (up 129.6% in just over nine months), it’s important to remember that investment can carry risks.

Free: See Our Top Stock And 4 Runners Up

For those interested in investment opportunities, download “5 Stocks Set to Double” for free.

Ford Motor Company (F): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

To read more on this topic, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.