Datadog Gears Up for Q3 2024 Earnings: What to Expect

Datadog DDOG is set to reveal its third-quarter results for 2024 on Nov. 7.

For Q3, Datadog estimates revenues will be between $660 million and $664 million. The Zacks Consensus Estimate stands at $662.55 million, indicating a 21% increase compared to the same period last year.

Expected non-GAAP earnings per share range from 38 to 40 cents. The Zacks Consensus Estimate is unchanged at 39 cents per share, reflecting a decline of 13.3% from the previous year.

Image Source: Zacks Investment Research

Stay updated with the latest EPS projections and surprises using Zacks Earnings Calendar.

In the last quarter, Datadog surprised analysts by exceeding expectations by 22.86%. Furthermore, the company has consistently surpassed the Zacks Consensus Estimate in each of the last four quarters, with an average surprise of 21.74%.

Datadog, Inc. Price and EPS Surprise

Datadog, Inc. price-eps-surprise | Datadog, Inc. Quote

Earnings Outlook

Currently, our model does not indicate a definitive earnings beat for Datadog this quarter. A positive Earnings ESP combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) typically enhances the likelihood of surpassing earnings expectations. Presently, Datadog holds an Earnings ESP of +0.60% but carries a Zacks Rank #4 (Sell).

Key Considerations

Datadog’s performance in Q3 is likely driven by its cloud-based monitoring and analytics platform. The ongoing shift towards digital transformation and cloud migration is expected to elevate the demand for Datadog’s offerings, potentially leading to notable growth in its customer base and revenues.

In Q1 2024, Datadog reported excellent customer growth metrics, which likely continued in Q3. The company had 3,390 customers with an annual run rate (ARR) of $100,000 or more, representing a 13% increase year-over-year. These customers contributed approximately 87% of the entire ARR.

By June 30, 2024, 83% of customers utilized two or more products, up from 82% the previous year, while 49% adopted four or more products, compared to 45% in 2023. This trend underscores Datadog’s effectiveness in attracting and retaining enterprise clients.

Datadog’s ability to provide a multi-cloud and multi-vendor solution allows customers to monitor their entire cloud infrastructure from a single platform, regardless of the provider. This comprehensive view helps organizations enhance performance, troubleshoot issues, and ensure robust security across various cloud environments.

However, Datadog faces stiff competition in the observability and monitoring sector from companies like New Relic, Dynatrace DT, and Splunk. While Datadog stands out with its unified platform and multi-cloud integrations, these competitors offer competitive solutions and have established market presence. Further, major players like Microsoft MSFT and Amazon AMZN present additional challenges with their in-house monitoring tools.

The substantial investments in sales and marketing aimed at attracting customers and enhancing brand recognition are likely to have impacted profit margins for the upcoming report.

Innovative Products to Benefit Clients in Q3

As Datadog approaches its Q3 earnings report, recent product innovations are expected to significantly drive growth and client acquisition. Recently, Datadog announced the general availability of LLM Observability, specifically designed for AI developers and machine learning (ML) engineers to easily monitor, improve, and secure large language model applications.

Additionally, Datadog expanded its security product suite with Agentless Scanning, Data Security, and Code Security, providing DevOps and security teams with tools to secure their code, cloud environments, and production applications.

Moreover, the launch of Datadog Kubernetes Autoscaling enables automatic resource optimization for Kubernetes environments based on real-time and historical utilization metrics.

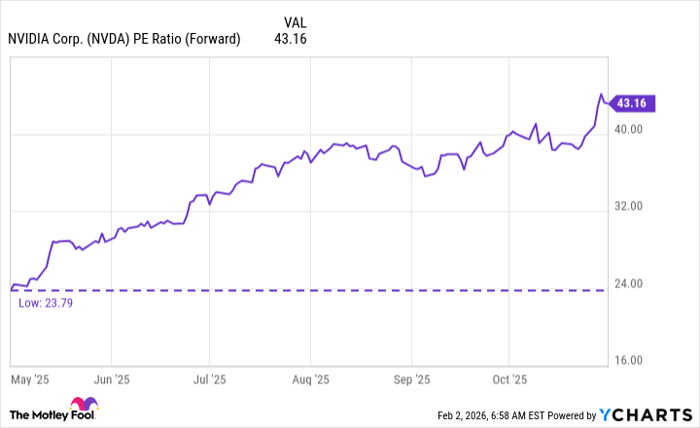

Recent Stock Performance and Valuation

So far this year, Datadog’s stock has increased by 3.4%, underperforming the Zacks Computer and Technology sector’s gain of 23.9%. This lackluster performance raises questions for some investors regarding whether this presents a buying opportunity for the high-growth software firm ahead of the upcoming earnings announcement.

Year-to-Date Performance

Image Source: Zacks Investment Research

Investors may also have concerns regarding Datadog’s current valuation, as its stock trades at a premium compared to the broader Zacks Internet – Software industry. As of the latest assessment, Datadog’s forward 12-month P/S ratio stands around 13.7, reflecting high expectations for growth among investors. This valuation is backed by Datadog’s solid revenue growth, expanding customer base, and increasing product adoption.

Datadog’s P/S Ratio Suggests High Valuation

Image Source: Zacks Investment Research

Investment Considerations

While Datadog continues to lead the cloud observability market, caution arises ahead of its Q3 2024 earnings as competition intensifies and macroeconomic conditions impact tech spending. Strong platform capabilities and a good customer retention rate are commendable, yet profit margins might come under pressure due to aggressive sales and marketing efforts. The competitive landscape, particularly with established players like Microsoft, Amazon, and the implications of the Splunk-Cisco merger, raises concerns about future profitability. Additionally, Datadog’s premium valuation could come under strain if growth rates slow, if enterprise budgets tighten, or if pricing pressures within the observability sector increase.

Cautious Outlook for Datadog as Third Quarter Approaches

Considerations Ahead of Earnings

While long-term trends remain positive for Datadog, concerns about market saturation and near-term challenges warrant careful consideration as the third-quarter earnings approach.

Key Takeaways

Investors may want to think twice before jumping into Datadog stock due to its high valuation and rising competition, especially following the Splunk-Cisco merger. Although Datadog boasts a strong market presence and a diverse product range, pressures from aggressive sales efforts are affecting profit margins. Additionally, potential constraints in enterprise IT spending and overall economic uncertainties suggest that a cautious stance could be prudent. While current holders of the stock might maintain their positions due to positive long-term trends in cloud observability, new investors may find better opportunities after the third-quarter earnings report provides clearer insights into financial trajectories and competition.

Expert Stock Picks Unveiled

In a recent analysis, Zacks Investment Research identified several stocks predicted to skyrocket by over 100%. Among these, Sheraz Mian, the Director of Research, has singled out one company deemed the best pick for explosive growth.

Targeting millennial and Gen Z consumers, this company generated nearly $1 billion in revenue last quarter alone. A recent decline in its stock price presents an attractive buying opportunity. Historically, Zacks has made accurate predictions, such as with Nano-X Imaging, which surged by +129.6% in just over nine months.

To discover more about this standout stock and its potential, you can explore Zacks’ report on “5 Stocks Set to Double.”

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Dynatrace, Inc. (DT): Free Stock Analysis Report

Datadog, Inc. (DDOG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.