Empty promises about housing from the presidential hopefuls … why their policy proposals won’t work … where home prices will go … how to trade it

As Americans prepare to elect a new president, U.S. home prices are up nearly 40% since 2020, while the average 30-year fixed rate mortgage has more than doubled.

Not a great combination for affordability.

Since summer of 2023, overall affordability has become so bad that the average age of a homebuyer has jumped from 49 to 56, according to the National Association of Realtors (NAR).

Meanwhile, the share of first-time homebuyers has dropped from 32% to 24%. This the lowest percentage since the NAR began tracking the metric back in 1981.

CNBC points out that the median house price in the U.S. is now 5.8 times more than the median annual income of $80,000. For context, back in 1990, prices were only 2X median income.

Here’s Hannah Jones, senior economic analyst at Realtor.com with the bottom line:

[Today’s housing market] is the least affordable in 40 years and suffers from low inventory levels.

Buyers in today’s market face high prices, high mortgage rates, and low levels of affordable inventory, making it exceptionally challenging to purchase a home as a first-time buyer.

In the background, we have both Vice President Harris and former President Trump claiming they’ll fix this broken housing market…

Neither is correct.

The empty promises from our presidential candidates

One of Harris’ proposed solutions is to give $25,000 in down payment assistance to first-time homebuyers. First, let’s look not overlook that price tag.

Using data from the NAR and the U.S. Census Bureau, we find that, historically, first-time homebuyers average around 30% – 35% of home sales.

In 2023, the NAR estimated roughly 5.2 million existing home sales annually in recent years, translating to around 1.65 million first-time buyers per year.

So, $25K times 1.65 million first-time home buyers equals $41.25 billion.

Peanuts!

What’s another $41ish billion in light of today’s fiscal deficit of $1.7 trillion? Chump change!

Forgetting who will eventually pay for this in one form or another (you, the above-average-earning taxpayer), will it help the broken housing market?

No. It’ll simply make home prices even more expensive, rewarding those who currently own homes today.

Stepping back, though we can’t reduce the explosion in home prices since 2020 to a single variable, what’s one of the most significant influences?

The trillions of dollars of federal stimulus that flooded the economy, eventually funneling into the housing market.

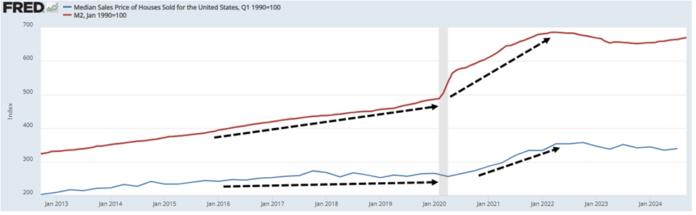

Below, you can see M2 Money stock (in red) exploding higher beginning in 2020 thanks to pandemic-related federal money-creation/flows. Shortly thereafter, the median sales price of U.S. homes (in blue) ramps up as money floods the housing market.

Source: Federal Reserve data

If a tsunami of free money had this impact before, might a mini tsunami of free money have a similar-yet-reduced impact again?

Well, let’s follow the logic. What happens when millions of would-be homebuyers suddenly have thousands more dollars to use for a home purchase?

- They raise their offer prices or bid on higher priced homes than otherwise…

- So, there are now more bids for those homes, with some of those bids now at higher prices than before…

- Homeowners do the logical thing based on this added demand and higher offer prices – they raise their asking prices…

- The highest government-aided bid wins at a higher price than would have otherwise been the transaction price…

- The housing market continues to be frozen, penalizing the next generation of would-be homebuyers…until some new politician promises another free money giveaway (most likely, on your dime).

Now, Harris has also proposed incentivizing new home construction. Adding new supply to the market would help.

Unfortunately, the biggest obstacle to new housing construction comes from state and local bureaucracy with its zoning and policy restrictions. The federal government has limited, if any, ability to fix this. We’ll circle back to this point in a bit.

Meanwhile, Trump has said he would fix the broken housing market by bringing down mortgage rates

Great. How?

Even if Trump forced the Federal Reserve to slash interest rates (which he can’t do), that wouldn’t necessarily relieve elevated mortgage rates. We’re currently living through this reality.

The Fed cut interest rates 50-basis points in mid-September. Since then, then the average 30-year fixed rate mortgage has jumped from 6.09% to 6.93% as I write Tuesday morning.

This is because the biggest influence on mortgage rates isn’t the Fed and the Fed Funds Rate (which Trump can pressure), it’s the 10-year Treasury yield. And the 10-year Treasury yield is impacted by many variables that no president can directly influence.

Unfortunately, Trump cannot bring down mortgage rates any more than I can.

As we’ve pointed out here in the Digest, there are really only three paths for rates and home prices over the next 12ish months

One, mortgage rates remain somewhat elevated, which maintains the deep freeze in today’s housing market. Bad for would-be homebuyers.

Two, mortgage rates fall significantly. This leads to a stampede of buyers who push home prices higher. So, whatever affordability gains were achieved from lower borrowing costs are offset by higher listing prices. Again, bad for would-be homebuyers.

Three, we don’t get a soft landing. We fall into a painful recession which has a deflationary impact on the housing market. Mortgage rates and home prices come down in a major way, but for reasons no one wants. Bad for would-be homebuyers and everyone.

Fortunately, this is unlikely. Unfortunately, what’s equally unlikely is Harris or Trump waving their respective policy magic wands and lowering home prices nationally over the next 12 months.

We see (at least) two knock-on effects from this distorted housing market…

One, a continuation of the widening division between the “haves” and “have nots” here in the United States.

Those with assets (like homes) will continue watching their net worths climb. Those without assets will continue to feel the strain of the last four years of higher prices on basic cost-of-living goods/services. Remember, even though inflation has fallen, absolute prices haven’t dropped.

We’ve spilled plenty of ink on this division in recent quarters. If you’re new to the Digest, here’s a quick snippet from The Wall Street Journal that sums up the issue:

The third year of America’s inflation fight is widening a split at the heart of the economy.

The stock market is soaring, household wealth is at record levels and investment income has never been greater. At the same time, some families’ pandemic-era savings are running dry, and delinquencies on credit card and auto-loan payments have jumped.

Warning signals are flashing for more low- and middle-income Americans, exposing a division between people whose gains are being whittled down by elevated inflation and borrowing costs and those who are benefiting from high asset prices and bond returns. The crosscurrents are scrambling the outlook for the U.S. consumer—a bedrock of economic growth, corporate business plans and Wall Street investments.

This angle is huge, and we’re going to continue tracking it, though not in today’s Digest due to limited space.

The second knock-on effect will be a tailwind for homebuilding stocks

Harris is correct in identifying new home construction as a huge part of the answer to today’s frozen housing market.

Now, state-by-state regulation issues we highlighted earlier leave us skeptical on a president’s ability to address this problem, but this frozen housing market is favorable for homebuilders in targeted areas.

This is why we’re still bullish on our homebuilders trade, the iShares Home Construction ETF, ITB. It holds homebuilding heavyweights including DR Horton, Lennar, NVR, Pulte, and Toll Brothers.

We suggested aggressive traders could buy ITB back on April 20, 2022. Since then, ITB is up 107% while the S&P is up just 29%.

But let’s take it one step farther, building on my “targeted areas” qualifier a moment ago…

If you want to pick specific homebuilding stocks that should outperform a broad ETF, keep your eye on two variables: population migration and state regulations. Clearly, you want to buy homebuilders that operate in states with population inflows, that also have friendly stances toward construction.

Based on data from the U.S. census and the World Population Review, we know that people are leaving California, New York, Illinois, and Hawaii. Plus, restrictive zoning and construction regulations make building new homes in some of those states incredibly challenging.

On the other hand, states seeing huge inflows include Florida, Texas, Arizona, and the Carolinas. These states’ regulations are also generally far more friendly to new home construction.

To help you begin your research, DR Horton and Lennar Corporation have big footprints in Florida and Texas. Meanwhile, LGI Homes is active in the Carolinas.

KB Home and Toll Brothers operate in some of those blue states with more restrictive policies. So, you’ll want to investigate how much of their revenue comes from those states.

Circling back to ITB…

In recent weeks, it has pulled back as mortgage rates haves jumped higher and election anxiety has weighed on the market. ITB has fallen nearly 7% since mid-October. And based on how today’s election turns out, it could fall further.

We would view any such pullback as a buying opportunity. In other words, volatility would be a good thing.

Speaking of “volatility as a good thing,” one week ago, legendary investor Louis Navellier and Charles Sizemore, the Chief Investment Officer at our corporate partner, The Freeport Society held their “Day After” Summit. Much of it focused on how to trade election-based volatility. Louis even gave away a free trade, noting “I believe it will pay off no matter who’s eventually declared the winner.”

We’ve made a free replay of the event over the last week. But I’m told that we’re taking it down tonight at midnight. If you’d like to watch it for free before then, here’s your chance.

Hopefully, by this time tomorrow, we’ll know our next president without any uncertainty

But if not, expect market volatility – which means look for opportunities.

As to housing, neither Harris nor Trump can bring down home prices. But that’s going to be a tailwind for ITB and well-positioned homebuilding stocks as we look ahead to 2025.

Have a good evening,

Jeff Remsburg