Election Results: What Wall Street Investors Should Expect

By tomorrow morning, much of the uncertainty overhanging Wall Street and Main Street will hopefully be resolved.

However, there’s a chance we may not immediately know the outcome of the presidential election.

If the race is close, as polls suggest, it may take time to count all the ballots. Additionally, the possibility of a contested election could further delay results.

When judges and lawyers get involved, predicting the timeline becomes tricky. During my recent “Day-After Summit” with Charles Sizemore from Freeport Society, we discussed the potential for significant market volatility until everything settles.

In today’s Market 360, I’ll outline the current situation and explain why the election is crucial for investors. I’ll also share strategies to help you prepare and potentially profit from any chaos that may arise as results start to roll in tonight.

The Current Election Landscape

As it stands, Real Clear Politics shows Donald Trump leading with 287 Electoral College votes, surpassing the required 270 for victory.

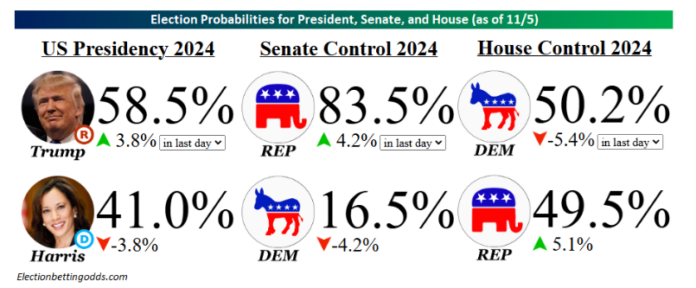

Betting markets reflect this trend, with Bespoke Investment Group giving President Trump a 58.5% chance of winning over Vice President Kamala Harris. Republicans are favored to take control of the Senate, while Democrats hold a slim chance of regaining the House of Representatives.

This scenario could lead to a divided government.

The traditionally Democratic “Blue Wall” states of Michigan, Pennsylvania, and Wisconsin are likely to play a key role in determining the winner tonight. Currently, Real Clear Politics indicates Trump may win Pennsylvania but lose Michigan and Wisconsin.

The U.S. manufacturing sector has faced challenges, entering a recession for over two years. The Institute of Supply Management (ISM) recently reported that its manufacturing index dropped to 46.5 in October, down from 47.2 in September. A reading below 50 suggests contraction, with 11 out of 16 industries reporting declines in October.

As voters in Pennsylvania, Michigan, and Wisconsin head to the polls, the state of manufacturing will likely be a crucial factor.

If a new administration can boost the manufacturing sector through tariffs against unfair foreign competition, lower interest rates (with the help of the Federal Reserve), and reduced energy prices, the U.S. could see a manufacturing resurgence. This shift would position the country favorably compared to Europe, Japan, and other global competitors.

Preparation in Uncertain Times

While it is hoped that clarity will return by midweek, we must also prepare for the possibility of further uncertainty. Regardless of the outcome, I wish the incoming president well.

Reflecting on history, during the 1990s, we experienced a significant peace dividend when Bill Clinton was president, following the collapse of communism. The dot-com boom led to a robust economy and strong stock market returns.

However, it’s wise to plan for any potential fallout, especially if the election results are delayed.

Panic often arises during chaotic circumstances, and prolonged uncertainty can cause market volatility.

To help you navigate this unpredictable landscape, you can view my discussion with Charles Sizemore. Experienced traders often stand to gain the most in chaotic situations. Charles is also sharing a free post-election pick that historically rises after presidential elections.

Don’t miss your chance to see “The Day-After Summit” before it’s taken offline at midnight tonight.

Sincerely,

Louis Navellier

Editor, Market360