Carvana Gets a Boost from Morgan Stanley: What You Need to Know

On November 5, 2024, Morgan Stanley updated its outlook for Carvana (NYSE: CVNA), moving it from Underweight to Equal-Weight.

Price Forecast Indicates Potential Decline

As of October 21, 2024, the consensus one-year price target for Carvana stands at $168.15 per share. This target suggests a fall of 28.69% from the current share price of $235.79, with estimated forecasts ranging from a low of $72.72 to a high of $241.50.

Positive Revenue Growth Expected

Carvana’s projected annual revenue is estimated at $17.55 billion, marking a significant increase of 39.86%. However, the projected annual non-GAAP EPS indicates a loss of -5.49.

Growing Institutional Interest

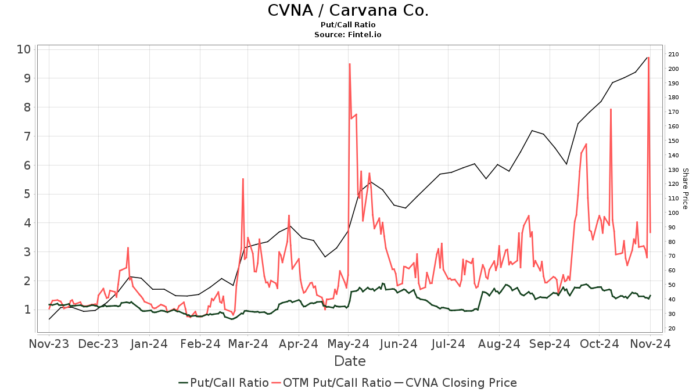

Currently, 893 funds and institutions are invested in Carvana, which is an increase of 198 owners, or 28.49%, over the last quarter. The average portfolio weight of these funds in CVNA is 1.01%, up by 4.48%. However, total institutional ownership has dipped by 2.52% in the past three months, with institutions now holding 124,479K shares. The put/call ratio for CVNA is at 1.56, indicating a generally bearish market sentiment.

Price T Rowe Associates has increased its holdings to 12,053K shares, representing 9.38% ownership, up from 7,459K shares—a notable increase of 38.12%. In contrast, CAS Investment Partners remains steady with 6,531K shares, reflecting no changes in the last quarter.

Greenoaks Capital Partners now holds 5,855K shares, down from 6,015K, indicating a 2.73% decrease. The firm still increased its overall allocation by 16.40% last quarter. Meanwhile, Spruce House Investment Management continues to hold 5,000K shares, with no change in its position. T. Rowe Price Blue Chip Growth Fund raised its holdings to 4,677K shares—an increase of 29.29% from the previous 3,307K shares, growing its overall allocation in CVNA by an impressive 95.85% in the last quarter.

A Brief Look at Carvana

(This description is provided by the company.) Founded in 2012 and headquartered in Phoenix, Carvana aims to transform the car buying experience. By leveraging technology and focusing on excellent customer service, Carvana has removed traditional dealership elements. Its online platform enables customers to browse over 20,000 vehicles, manage financing, trade in or sell their cars, finalize contracts, and even schedule next-day delivery through Carvana’s unique automated vending machines.

Fintel serves as a comprehensive investing research platform catering to individual investors, traders, financial advisors, and small hedge funds.

Fintel’s data encompasses a broad scope, including fundamental analysis, ownership information, fund sentiment, insider trading details, and much more, empowering investors with the tools needed for informed decisions.

This article originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.