B of A Securities Upgrades IDACORP: A Closer Look at Financial Outlook

On November 5, 2024, B of A Securities announced that it has upgraded its outlook for IDACORP (NYSE:IDA) from Neutral to Buy. This shift suggests growing confidence in the company’s prospects.

Analyst Price Target Shows Slight Increase

The average one-year price target for IDACORP, as of October 22, 2024, is $109.72 per share. This forecast ranges from a low of $98.98 to a high of $121.80. If realized, this average target would indicate a minimal increase of 0.19% from the last closing price of $109.51 per share.

For further insights, check out our leaderboard of companies with the greatest price target potential.

Company Revenue and EPS Projections

IDACORP’s projected annual revenue stands at $1,544 million, reflecting a decrease of 16.11%. Additionally, the projected non-GAAP earnings per share (EPS) is estimated at 5.51.

Fund Sentiment and Institutional Ownership

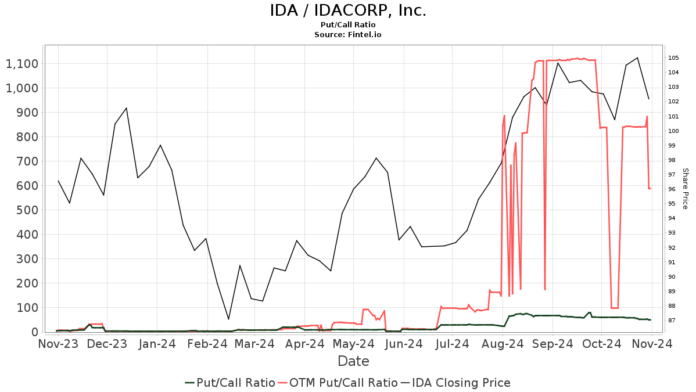

Currently, 829 funds or institutions hold positions in IDACORP, a decrease of 10 owners, or 1.19%, from the last quarter. The average portfolio weight allocated to IDA by these funds has risen slightly to 0.21%, an increase of 2.18%. However, total shares held by institutions have fallen by 1.93% in the past three months to 54,603K shares. The current put/call ratio stands at 50.00, indicating a bearish sentiment.

Wellington Management Group LLP currently owns 2,030K shares, which accounts for 3.81% of IDACORP. This is down from 2,206K shares, marking an 8.67% decrease. Their portfolio allocation in IDA has dropped by 86.90% over the last quarter.

T. Rowe Price Investment Management holds 1,649K shares, a decline from 2,054K shares, representing a decrease of 24.57% in ownership and a 16.96% reduction in portfolio allocation in IDA.

Vanguard Total Stock Market Index Fund Investor Shares owns 1,595K shares, an increase from 1,584K shares, reflecting a rise of 0.73%, although its portfolio allocation in IDA has fallen by 1.77% this quarter.

Meanwhile, the iShares Core S&P Mid-Cap ETF has increased its holdings slightly, from 1,576K to 1,577K shares, corresponding to a 0.07% rise and a 2.72% increase in portfolio allocation. Victory Capital Management has shown more substantial growth, increasing its shares from 1,446K to 1,448K, which translates to a 50.79% increase in portfolio allocation.

Background on IDACORP

IDACORP, Inc., based in Boise, Idaho, was established in 1998 and is comprised of several entities including Idaho Power Company, a regulated electric utility. Idaho Power has been operational since 1916 and serves a vast area in southern Idaho and eastern Oregon. The company’s aim is to achieve 100% clean energy by 2045, building on its legacy of providing affordable and reliable energy. It operates 17 low-cost hydropower projects, maintaining some of the lowest electricity rates in the nation for its more than 570,000 customers.

Fintel offers a comprehensive investing research platform utilized by individual investors, traders, financial advisors, and small hedge funds.

Our extensive data encompasses multiple aspects of the investment landscape, including analyst reports, fund sentiment, insider trading, and much more. By leveraging advanced models, we help refine investment strategies for greater profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.