Jefferies Boosts CMS Energy with Solid Buy Rating

On November 5, 2024, Jefferies initiated coverage for CMS Energy (NYSE:CMS), expressing a Buy recommendation for the company’s stock.

Analyst Forecast Indicates Potential Gains

The average one-year price target for CMS Energy sits at $72.70 per share as of October 22, 2024. This projection shows a range from a low of $58.69 to a high of $80.85. The average target suggests a potential upside of 5.19% from the latest closing price of $69.11 per share.

Explore our leaderboard highlighting companies with the highest price target upside.

CMS Energy’s projected annual revenue is $8,194 million, marking a significant increase of 9.60% from previous forecasts. The anticipated annual non-GAAP earnings per share (EPS) stands at 3.42.

Investor Sentiment and Fund Positioning

A total of 1,463 funds now report positions in CMS Energy, reflecting a rise of 36 new owners, or 2.52%, in just the last quarter. The average portfolio weight for these funds allocated to CMS Energy is 0.31%, up by 2.48%. However, the total shares owned by institutions dipped by 0.44% to 343,937K shares over the last three months.

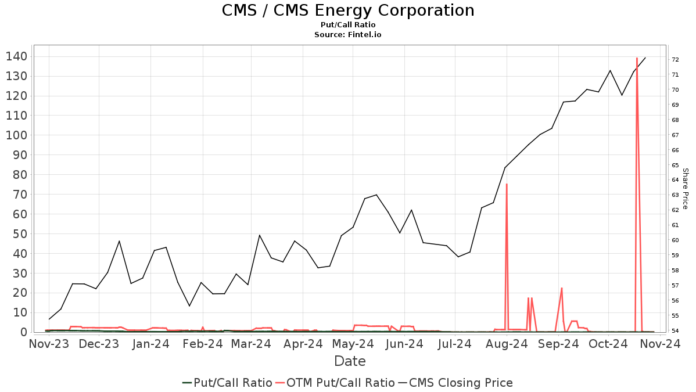

The current put/call ratio for CMS Energy is 0.46, signaling a bullish outlook among investors.

Institutional Holdings and Changes

JPMorgan Chase currently holds 25,055K shares, equating to an 8.39% ownership stake in CMS Energy. Their latest filing shows an increase from 22,663K shares, despite a significant 83.41% reduction in portfolio allocation over the last quarter.

Vanguard Total Stock Market Index Fund (VTSMX) possesses 9,433K shares, or 3.16% ownership, up from 9,166K shares—a 2.82% gain. However, this fund also reduced its allocation by 1.27% over the last quarter.

Similarly, Vanguard 500 Index Fund (VFINX) has increased its holdings to 7,665K shares, which is 2.57% ownership, rising from 7,417K shares—an increase of 3.23%, even as it trimmed its portfolio allocation by 3.49% in the same period.

Geode Capital Management now owns 7,405K shares, representing 2.48% of the company. Their holdings have risen from 7,116K shares (an increase of 3.90%), despite a drastic 49.13% decline in allocation.

Massachusetts Financial Services reported a substantial increase to 6,891K shares, equal to 2.31% ownership—up from 3,417K shares, marking a significant 50.41% increase, but simultaneously reducing its allocation by 68.58% in the last quarter.

CMS Energy Overview

(Description provided by the company.) Consumers Energy, the largest energy provider in Michigan, serves 6.7 million individuals, which is nearly 67% of the state’s population, throughout 68 counties in the Lower Peninsula.

Fintel aims to be a key resource for individual investors, traders, financial advisors, and small hedge funds, offering a wide range of data including fundamentals, analyst insights, ownership statistics, fund sentiment, and much more for informed investing.

Click to Learn More

This information originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.