Rivian Automotive Faces Challenges as Investors Await Key Update

Investors in the electric vehicle sector are keenly watching Rivian Automotive (NASDAQ: RIVN). The company, while ambitious in its goals, has encountered hurdles that have hindered its progress toward profitability. Its stock has seen significant declines, falling approximately 57% this year. Nevertheless, there may still be silver linings ahead, especially with the company’s quarterly report set for November 7, which could provide clues about its recovery trajectory.

Rivian’s Financial Struggles: A Brief History

From the beginning, Rivian had grand ambitions, announcing a plan to invest $5 billion in a second manufacturing facility in late 2021. However, in that same year, the company produced only 1,015 EVs and delivered just 920. Despite the initial struggles, Rivian successfully ramped up production, delivering over 50,000 vehicles just two years later. Unfortunately, increased operational costs, driven by high material prices and supply chain issues, forced the company to scale back its growth plans.

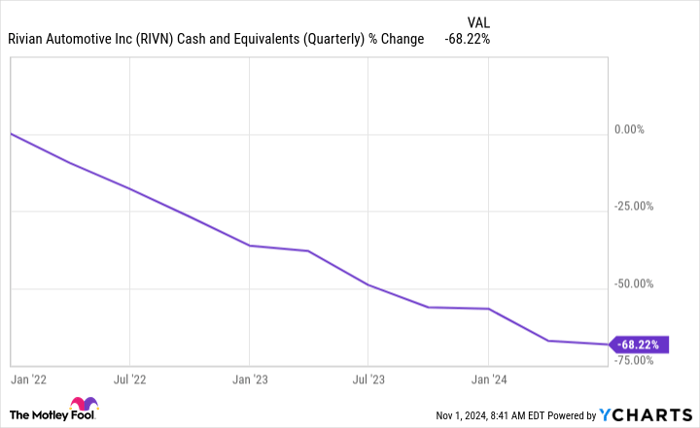

In 2023, Rivian raised nearly $3 billion, which included a $1.5 billion bond issue last October. Despite these efforts, the company’s cash reserves have sharply decreased over the past three years. As of June 30, Rivian reported $7.9 billion in cash and equivalents, bolstered by a $1 billion investment from Volkswagen Group as part of a broader $5 billion commitment, which also includes a technology joint venture.

Anticipating Rivian’s Nov. 7 Report

The upcoming quarterly update may focus on three key areas. First, if management reassures investors that they have enough capital to sustain production and development for the next-generation R2 SUV, it could be a significant positive signal. Plans for the R2 platform are set to be followed by the R3 and R3X models, expected in 2027. A strong financial outlook could bolster the company’s stock in anticipation of the R2’s launch in 2026.

Secondly, Rivian’s production expectations for 2025 will be a topic of interest. The company doesn’t expect to exceed its 2023 production numbers in 2024 due to necessary upgrades to its Illinois plant for R2 production. An increase in production targets could attract more investor interest.

Lastly, management’s comments on ongoing cost-reduction strategies will be crucial. Higher volumes will not translate into stock improvement if they do not lead to profitable sales. The Nov. 7 update might serve as a critical moment for Rivian, shaping future investor perception.

While potential risks exist regarding the adequacy of information provided in the third-quarter report, careful consideration of investment allocation is advised. If the report meets expectations, the stock may be poised for significant growth.

Should You Invest $1,000 in Rivian Automotive Now?

Before making any stock purchase in Rivian Automotive, take note of this:

The Motley Fool Stock Advisor team has highlighted what they consider the 10 best stocks for current investors, and Rivian Automotive is not among them. The selected stocks have strong potential for substantial returns in the coming years.

Reflect on when Nvidia made this list on April 15, 2005… if you invested $1,000 at that time, your investment would be worth $833,729 today!*

Stock Advisor provides a straightforward guide for investors, including portfolio-building strategies, regular updates, and two new stock picks each month. Since 2002, the Stock Advisor service has delivered returns more than four times greater than the S&P 500.*

See the 10 recommended stocks »

*Stock Advisor returns as of November 4, 2024

Howard Smith holds positions in Rivian Automotive and Tesla. The Motley Fool has positions in and recommends Tesla and Volkswagen. The Motley Fool also recommends Volkswagen Ag. The Motley Fool has a disclosure policy.

The views expressed are those of the author and may not reflect the views of Nasdaq, Inc.