Two AI Stocks to Watch: Dell Technologies and Amazon

The surge in artificial intelligence (AI) has significantly boosted many tech stocks this year. Here, we highlight two companies worth considering for your investment portfolio.

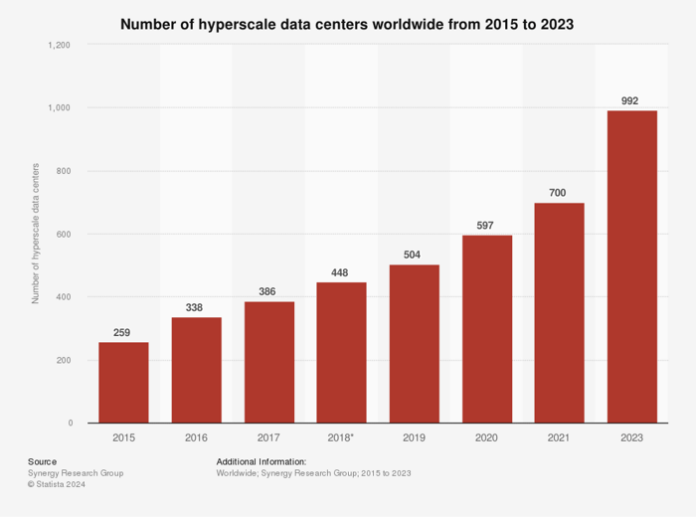

The demand for AI software requires a massive amount of data processing power, which needs to be stored in large facilities. This has driven the growth of hyperscale data centers—those exceeding 100,000 square feet—which are expanding rapidly. Recent data shows a notable increase in their numbers.

By 2024, the number of these data centers surpassed 1,000, with experts forecasting an additional 120 to 130 to go online each year. Major tech companies are investing heavily in this area; for example, Elon Musk’s xAI data center will span 750,000 square feet and house 100,000 GPUs, while Microsoft’s upcoming data center in Wisconsin will cover an area of two square miles.

Dell Technologies: A Key Player in AI Infrastructure

Why does this matter for Dell Technologies (NYSE: DELL)? These vast data centers require essential infrastructure such as racks, storage, servers, and software—products that Dell manufactures.

Dell estimates that its addressable market for AI infrastructure will reach $91 billion in 2025, growing to $124 billion by 2027. Meanwhile, one of its main competitors, Super Micro Computer (NASDAQ: SMCI), is currently facing difficulties. After a short-seller highlighted serious allegations against Supermicro and the resignation of its auditor raised concern about accounting practices, the company’s stock has declined sharply. This situation could lead to increased business opportunities for Dell.

Fueled by the demand from data centers, Dell’s sales in servers and networking jumped to $7.7 billion last quarter, marking an impressive 80% growth year over year. Overall, Dell generated $25 billion in total sales for the same quarter, up 9% from last year, with operating income rising by 15% to $1.3 billion. While Dell’s PC sales have remained stagnant due to economic slowdown, the company anticipates a potential boost from demand for AI-compatible computers—though that remains to be seen. Moving forward, data center sales are expected to drive substantial earnings growth.

Dell’s approach appeals to investors interested in returns, as the company plans to return 80% of its free cash flow to shareholders through dividends and stock buybacks. Recently, the quarterly dividend was increased by 20% to $0.445 per share, resulting in a yield of 1.3%. In the first two quarters of fiscal 2025 (ending August 2), Dell repurchased $1.4 billion in shares—representing 1.6% of its current market cap—within just six months.

Currently, Dell’s stock trades at a price-to-earnings ratio of 24, which drops to 14 when looking ahead. Analysts are optimistic, with 21 out of 24 recommending it as a buy or strong buy, and offering an average price target of $146, suggesting a potential 12% upside from the current price. However, these estimates could be conservative, as they haven’t yet incorporated the additional business that Dell may capture from Supermicro’s difficulties. If Dell’s performance exceeds analysts’ expectations, the stock could rise quickly.

Amazon’s Hidden Growth Potential

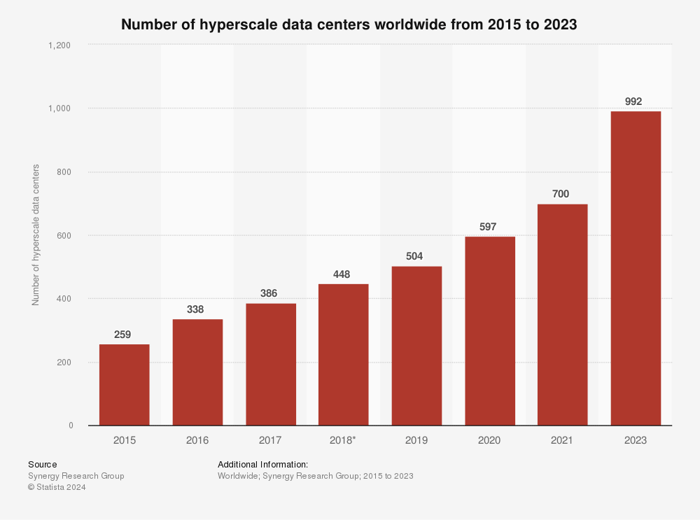

Amazon is making significant strides in the AI space, particularly through Amazon Web Services (AWS) and its AI chip development initiatives. As the largest cloud data provider worldwide, AWS stands to benefit tremendously from the increasing data needs generated by AI technologies. Recent revenue growth in this segment has been noteworthy.

Data source: Amazon. Chart by the author.

In Q3, AWS revenue soared 19%, totaling $27.5 billion. More impressively, the segment achieved $10.4 billion in operating income, resulting in a substantial 38% profit margin, up from 30% in the same quarter last year—indicating strong demand for cloud data services.

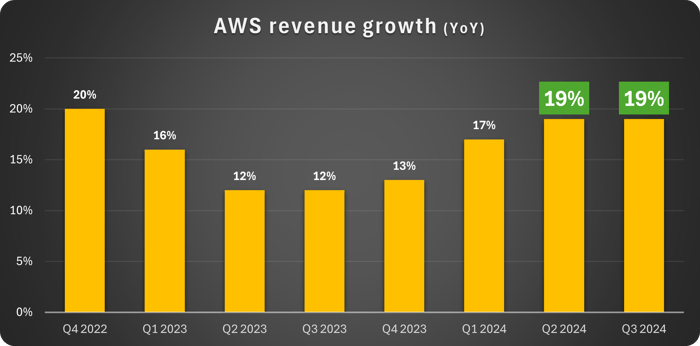

Amazon’s overall income for Q3 grew 11% to $159 billion, with total operating income rising sharply to $17.4 billion, up from $11.2 billion last year. Operating cash flow has shown remarkable growth, exceeding even the peaks observed during the pandemic, as illustrated below.

AMZN Cash from Operations (TTM) data by YCharts

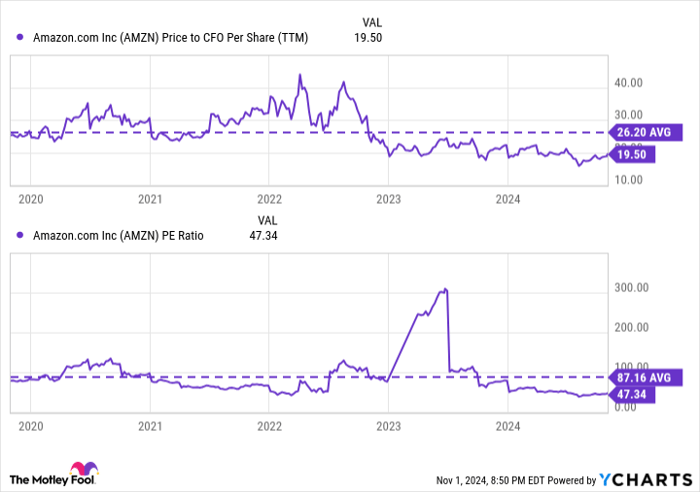

Despite these favorable results, Amazon’s stock appears undervalued historically in terms of operating cash flow and earnings, as shown in the chart below.

AMZN Price to CFO Per Share (TTM) data by YCharts

Wall Street is cautious about Amazon, fearing that a slowdown in consumer spending might affect product sales. However, it’s likely that the more profitable AWS segment will help fill any potential gaps in revenue. Given its historical undervaluation, Amazon’s stock presents a compelling long-term investment opportunity.

What to Consider Before Investing

If you’re thinking about investing $1,000 in Dell Technologies, keep the following in mind:

The Motley Fool Stock Advisor team has identified what they believe are the 10 best stocks to buy right now, and Dell Technologies is not one of them. The stocks that made the list have the potential for significant returns in the future.

For instance, consider Nvidia—it was on this list back on April 15, 2005. If you had invested $1,000 then, you’d have $833,729!*

Stock Advisor provides investors with a clear strategy for success, including portfolio guidance, expert updates, and two new stock picks each month. Since its inception in 2002, the service has more than quadrupled the return of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of November 4, 2024

Disclosure: John Mackey, former CEO of Whole Foods Market (an Amazon subsidiary), is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also on the board. Bradley Guichard holds positions in Amazon and Dell Technologies. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, and Nvidia. It also has options on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.