Steve Cohen Shifts Investments: Selling Broadcom, Buying Apple

Steve Cohen, known for his impressive $21 billion net worth, continues to make waves in the investment world. After founding S.A.C. Capital Advisers in 1992, Cohen transitioned operations to Point72 Asset Management in 2014 following an insider trading charge against S.A.C. He remains co-chief investment officer at Point72, showcasing his enduring influence in the industry.

While it’s unwise to blindly follow large investors like Cohen, examining their moves can provide valuable investment insights. Notably, Cohen recently sold most of his shares in Broadcom and invested heavily in a stock favored by Warren Buffett. Here’s what you need to know.

Significant Sale: 3.17 Million Shares of Broadcom

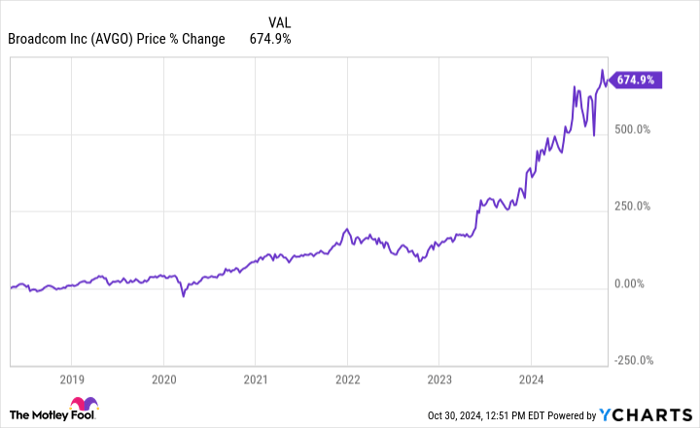

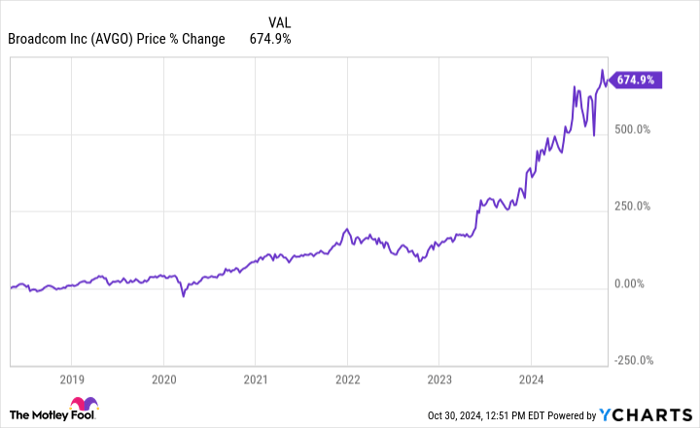

In the second quarter, Point72 offloaded over 3 million shares of Broadcom (NASDAQ: AVGO), which represents about 67.5% of its total holdings. Point72 began buying into Broadcom in 2018 and has seen the stock perform well since. This year alone, Broadcom’s stock has risen approximately 50% and even completed a 10-for-1 stock split in June, a move often used to attract smaller investors.

AVGO data by YCharts

The strong AI momentum this year has benefited companies like Broadcom. However, with its stock priced close to 140 times trailing earnings, Cohen may have felt it was time to take profits. This sentiment is echoed by recent insider selling at Broadcom and current analyst price targets estimating a 12% growth. While this potential upside is notable, the risk-reward scenario may not be as attractive as before.

Stepping Into a Buffett Classic: Apple

Cohen’s new investment strategy included purchasing 1.57 million shares of Apple (NASDAQ: AAPL) at around $186.50 each. This move ranks Apple as the third-largest holding in Point72’s portfolio. Historically, Cohen has invested in Apple multiple times, yet this is his first re-entry after previously selling his shares.

Apple stands as the largest asset in Berkshire Hathaway’s portfolio, highlighting its significant presence in the market. Curiously, Buffett’s firm reduced its Apple stake by about 70% this year, although Apple still constitutes over 20% of Berkshire’s approximately $312 billion equity portfolio.

Point72’s investment in Apple aligns with Cohen’s ongoing interest in technology. Apple’s forward price-to-earnings ratio has decreased to 30.3 from previous highs. The company recently exceeded expectations with its fiscal fourth-quarter earnings, driven by a 6% increase in iPhone revenue. The new iPhone 16, released in late September, is anticipated to boost consumer demand.

Adding to its appeal, Apple introduced Apple Intelligence, an AI feature for its latest devices. This innovation is expected to renew interest in iPhones, especially as consumer demand in China has been softening. Cohen likely values these AI developments and the company’s robust cash flow along with its stock buyback strategies.

A Second Chance at Investments That Could Pay Off

Do you feel as if you missed opportunities to invest in successful companies? The present moment might be ideal for a second chance.

Occasionally, investment analysts highlight a “Double Down” stock, indicating a potential price increase. If you’re concerned you’ve missed your chance, now could be the perfect time to invest:

- Amazon: if you invested $1,000 in 2010, you’d have $22,469!*

- Apple: if you invested $1,000 in 2008, you’d have $42,271!*

- Netflix: if you invested $1,000 in 2004, you’d have $411,970!*

Currently, three remarkable companies are under “Double Down” recommendations, and this may be your opportunity for investment.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 4, 2024

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.