Microsoft (NASDAQ: MSFT) faced a surprising decline in stock value after releasing its first-quarter fiscal year 2025 results, which ended on September 30. Despite surpassing earnings expectations, the stock dropped, signaling potential concerns for investors.

Such a reaction can be telling, warranting a closer examination of the company’s outlook. While exceeding forecasts is often seen as positive, in this case, another issue may indicate further challenges for Microsoft.

Weak Guidance Raises Eyebrows

During the first quarter, Microsoft achieved earnings of $3.30 per share, outpacing analyst predictions of $3.10. This came alongside a strong 16% revenue increase, showcasing solid growth in the tech giant’s extensive operations.

However, analysts noted concerns regarding Microsoft’s guidance for the upcoming quarter. The company anticipates only 11% revenue growth for Q2. Although still in the double digits, this figure does not align well with the company’s current high valuation.

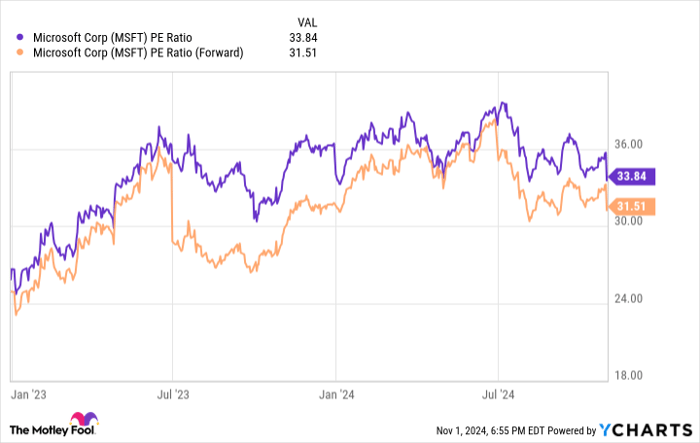

Microsoft is recognized as one of the frontrunners among high-priced tech stocks, yet its growth rate falls short compared to some competitors. Currently, it trades at 31.5 times forward earnings, representing a substantial premium for any company.

MSFT PE Ratio data by YCharts.

When comparing Microsoft’s valuation with its peers, the rationale for investing in its stock becomes less convincing.

Comparing Alternatives in Big Tech

To further analyze the situation, let’s look at other significant tech companies. Most companies within Microsoft’s “Magnificent Seven” cohort released their earnings reports for the recent quarter.

| Company | Q3 Revenue Growth | Q3 EPS Growth | Forward P/E |

|---|---|---|---|

| Microsoft | 16% | 10.7% | 31.3 |

| Apple | 6.1% | (34%) | 30.2 |

| Amazon | 11% | 52.1% | 38.9 |

| Alphabet | 15.1% | 37.2% | 21.4 |

| Meta Platforms | 18.6% | 37.8% | 25.2 |

Data source: YCharts. Note: Q3 is for the quarter encompassing July through September; each company may have a different fiscal year quarter.

Microsoft and Apple are both trading at high premiums despite their recent difficulties. For companies to justify their valuations, they must deliver substantial growth, especially compared to the S&P 500, which trades at 23.8 times forward earnings.

The outlook for Microsoft’s next quarter is not particularly optimistic. Analysts project its full-year performance to remain steady, forecasting 14% revenue growth and a 10% increase in earnings per share (EPS) for FY 2025. This lackluster promise may lead to a downward adjustment in Microsoft’s valuation throughout the year, likely exerting downward pressure on its stock price.

Investors are keen to know where funds might flow instead. Companies like Alphabet, Meta Platforms, or Amazon appear to be drawing interest. All three posted robust results recently, and despite their better performance, Alphabet and Meta offer lower valuations than Microsoft. Amazon, while pricier, compensates for that with strong earnings growth.

As investors, the focus should be on finding stocks with the potential for superior performance. Given Microsoft’s and Apple’s sluggish results alongside their high valuations, they may not be the most appealing investment choices at this time. Therefore, it may be sensible to consider selling some Microsoft shares and reallocating those funds into more attractively valued tech companies like Alphabet, Meta Platforms, or Amazon.

Is $1,000 in Microsoft Worth It Right Now?

Before committing to Microsoft’s stock, you should consider this:

The Motley Fool Stock Advisor team has identified what they believe to be the 10 best stocks for investors currently… and Microsoft didn’t make the list. These selected stocks have the potential for impressive returns in the coming years.

For reference, when Nvidia was on this list in April 2005, a $1,000 investment at that time would be worth approximately $857,383!*

Stock Advisor aims to provide clear, actionable strategies for investors, including portfolio-building advice, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has substantially outperformed the S&P 500, more than quadrupling its returns.*

Explore the 10 recommended stocks »

*Stock Advisor returns as of November 4, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet, Amazon, and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.