Northern Trust Soars 19.8% in Six Months: Q3 Earnings Impress

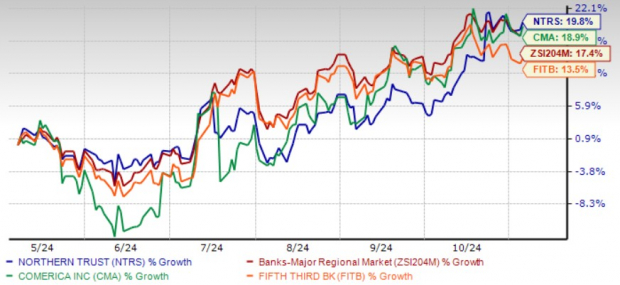

Northern Trust Corporation NTRS shares have gained 19.8% in the past six months, outperforming the industry’s growth of 17.4%. The stock has also outperformed its close peers like Comerica Incorporated CMA and Fifth Third Bancorp FITB during the same period.

Analyzing Six-Month Price Trends

Image Source: Zacks Investment Research

Strong Q3 Earnings Highlight Northern Trust’s Resilience

On October 23, Northern Trust reported its third-quarter 2024 earnings. With adjusted earnings per share at $1.96, it exceeded the Zacks Consensus Estimate of $1.73 and rose from $1.49 per share in the same quarter last year. The quarter’s success stemmed from increased fee income and an uptick in assets under custody and management. Capital ratios also exhibited strength.

Key Factors Boosting NTRS Performance

Interest Rate Cuts from the Fed May Enhance NII: In September, the Federal Reserve cut interest rates by 50 basis points and suggested additional reductions could follow. These cuts could improve Northern Trust’s net interest income (NII) since funding costs are likely to stabilize. This is a beneficial outlook for banks such as NTRS, FITB, and CMA.

Northern Trust’s NII grew at a compound annual growth rate (CAGR) of 11.2% over the past three years, reflecting the impact of rising rates. In 2023, the net interest margin (NIM) increased to 1.52%, compared to 1.36% in 2022 and 0.96% in 2021. Both NII and NIM have continued to rise in the first nine months of 2024.

As interest rates decline, demand for loans is expected to improve. This increase should further boost NII and NIM, enhancing profitability as Northern Trust earns more from lending.

Management anticipates steady NII for 2024, forecasting it to remain consistent at $1.98 billion, the same as in 2023.

Organic Growth as a Priority: Northern Trust is dedicated to organic expansion. Its non-interest income has grown with a CAGR of 1% over the past three years, and this momentum carried into the first nine months of 2024.

Revenue growth, driven by increasing NII and fee income, saw a CAGR of 3.5% during the same period.

The company’s loan and lease balance averaged a CAGR of 7.7% over the last three years. Though loans dipped in early 2024, management views this as a temporary shift. With its expanding client base, Northern Trust expects to see loan activity rebound soon.

Debt Management Efforts: As of September 30, 2024, Northern Trust’s total debt, which includes long-term debt and other borrowings, stood at $11 billion. Meanwhile, Federal Reserve and central bank deposits reached $40.8 billion on the same date. This larger volume of liquid assets compared to obligations suggests that their debt levels are manageable.

With strong liquidity, the company is well-positioned to meet upcoming debt obligations, regardless of economic conditions.

Strong Capital Returns for Investors: Northern Trust has announced notable capital distributions. In October 2021, it initiated a share repurchase program for 25 million shares without a set expiration. In the first nine months of 2024, nearly 8.1 million shares were repurchased, leaving 13.3 million shares available for future buybacks as of September 2024.

Additionally, the bank maintains a quarterly dividend policy. On October 22, 2024, it declared a quarterly dividend of 75 cents per share, slated for payment on January 1, 2025, to shareholders recorded by December 6, 2024.

The company has raised its dividend once in the last five years, yielding a five-year annualized growth rate of 2.08% and a current payout ratio of 43%. These factors foster investor confidence and enhance shareholder value.

Northern Trust is well-equipped with capital ratios surpassing regulatory requirements. As of September 30, 2024, the Common Equity Tier 1 ratio was 12.6%, and the total capital ratio was 15.6%.

Given its robust capital position, the company’s distribution activities appear sustainable in the long term.

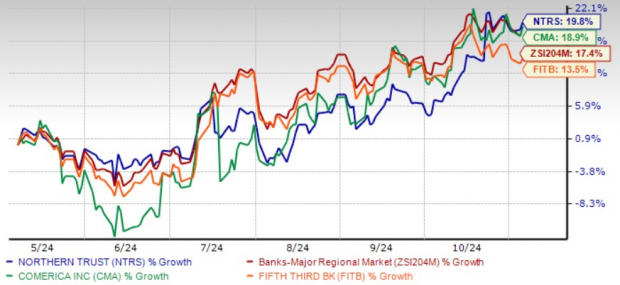

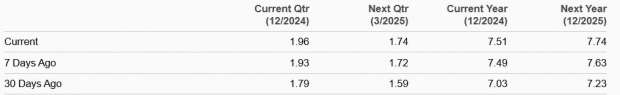

Analysts’ Outlook for Northern Trust

Recent adjustments in the Zacks Consensus Estimate for earnings in 2024 and 2025 indicate growing optimism among analysts regarding Northern Trust’s future performance.

Trend in Estimate Revisions

Image Source: Zacks Investment Research

Final Insights on NTRS Stock

Northern Trust’s commitment to organic growth, alongside robust capital support, positions it for improved financial performance over time. The Federal Reserve’s interest rate cuts are predicted to lower funding costs, enhancing NII and NIM expansion. Consequently, the stock appears to have further potential for appreciation.

With solid fundamentals and promising long-term prospects, NTRS stock is seen as an appealing option for investors at this time.

Northern Trust currently holds a Zacks Rank #1 (Strong Buy). Discover the complete list of today’s Zacks #1 Rank stocks here.

Discover Zacks’ Top Semiconductor Stock

Though it represents just 1/9,000th the size of NVIDIA—which surged over +800% since our recommendation—this new semiconductor stock has even greater growth potential.

With strong earnings and a growing customer base, it’s poised to meet the soaring demand in Artificial Intelligence, Machine Learning, and the Internet of Things. Projections suggest that semiconductor manufacturing will balloon from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock for Free >>

Fifth Third Bancorp (FITB) : Free Stock Analysis Report

Comerica Incorporated (CMA) : Free Stock Analysis Report

Northern Trust Corporation (NTRS) : Free Stock Analysis Report

Read the full article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.