Nvidia (NASDAQ: NVDA) has proven to be an exceptional stock investor over the last two years, recording a staggering 239% return in 2023, 169% so far in 2024, and an impressive 800% overall since the beginning of 2023. Given this remarkable performance, investors are curious whether its success can continue into a third consecutive year.

While another doubling or tripling in stock value isn’t very probable, a more modest gain, such as rising to $200 per share, seems feasible. A stock price of $200 at the end of 2025 would mark a 50% increase from its current value.

Nvidia’s Success Linked to AI Innovations

To grasp Nvidia’s impressive stock performance, it’s essential to recognize the key factor driving it: artificial intelligence (AI). This technology has played a significant role in the entire stock market, particularly benefiting Nvidia more than perhaps any other company.

Nvidia manufactures graphics processing units (GPUs) that excel at training and operating AI models. Their ability to perform calculations in parallel allows them to process information much faster than traditional CPUs in laptops or phones. Furthermore, connecting multiple GPUs in clusters can achieve extraordinary processing speeds.

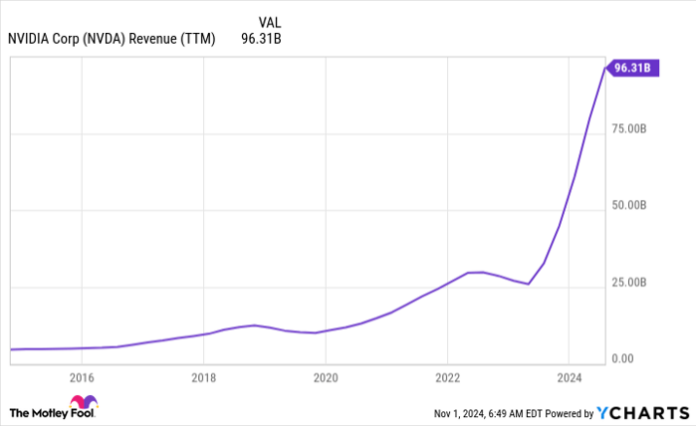

In recent years, tech giants have acquired thousands, if not hundreds of thousands, of GPUs from Nvidia, contributing to the company’s revenue surge.

NVDA Revenue (TTM) data by YCharts

During this explosive growth, Nvidia has seen its profit margins expand as well, climbing from around 30% to over 55%. These developments have driven Nvidia’s profits sky-high, thereby boosting its stock price.

The crucial question now is: how long can such strong catalysts last? It’s important to note that no company can sustain a year-over-year revenue doubling indefinitely.

Nvidia Faces Growth Challenges Ahead

As Nvidia’s financial results begin to face tougher year-over-year comparisons, a natural slowdown in growth has started to manifest, evident in current trends. In Q2 FY 2025 (ending July 28), Nvidia’s revenue rose by 122% year over year, down from a remarkable 262% in Q1. The projections for Q3 indicate similar patterns, with management forecasting $32.5 billion in revenue, representing an 80% increase from the previous year.

Although these growth figures remain impressive, they reflect a noticeable decline from the extraordinary growth rates investors have recently become accustomed to.

Wall Street analysts predict this moderation in growth will continue into 2025. For FY 2026 (ending January 2026), they expect approximately 43% growth, which is still remarkable considering Nvidia’s scale. Analysts also anticipate earnings per share growth to match revenue growth, with a similar 43% rise forecasted for the upcoming year.

While market sentiment and valuations can influence stock performance in the short term, long-term stock prices predominantly follow earnings growth. Therefore, achieving the threshold of $200 per share based on a 50% growth target might prove challenging for Nvidia.

Additionally, Nvidia’s stock carries a premium valuation.

NVDA PE Ratio data by YCharts

Nvidia’s stock trades at a high multiple of 62 times trailing earnings and 33 times FY 2026 earnings. These figures represent a lofty valuation likely to decrease as growth slows down.

Consequently, Nvidia’s path to a $200 stock price faces significant obstacles, given both the slowing growth and its elevated valuation. Shifting the goal to whether Nvidia can outperform the overall market could lead to a different conclusion.

I believe Nvidia has the potential for market-beating returns (above 10% per year), making it a solid long-term investment. However, doubling its stock price or reaching $200 is not a near-term expectation.

Seize This Potential Opportunity

Have you ever felt you missed out on investing in leading stocks? If so, pay attention to this opportunity.

Our expert analysts occasionally recommend what they term a “Double Down” stock, companies they believe are on the verge of significant growth. If you think you’ve missed your chance, this could be the ideal time to invest before conditions change. The historical numbers speak volumes:

- Amazon: A $1,000 investment when we doubled down in 2010 would be worth $22,469!*

- Apple: A $1,000 investment made when we doubled down in 2008 would have grown to $42,271!*

- Netflix: A $1,000 investment from our 2004 recommendation would now be an astonishing $411,970!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this opportunity may not come around again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 4, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.