Investing in AI: Three Promising Stocks to Watch

The recent surge in tech stocks is largely attributed to the rise of artificial intelligence (AI). Companies like Nvidia have seen record highs, driven by strong interest from investors looking to tap into AI technology.

However, there’s still room for growth. Investors have the opportunity to capitalize on three notable AI stocks that could yield significant returns.

Alphabet: A Giant in the AI Landscape

No discussion about AI is complete without Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG), the parent company of Google. Since 2001, Alphabet has incorporated AI into its operations. Analysts viewed it as a leader until the 2023 release of ChatGPT, which showcased the capabilities of generative AI.

Despite early doubts about its leadership, Alphabet quickly introduced Google Gemini, demonstrating its competitiveness in the generative AI sector.

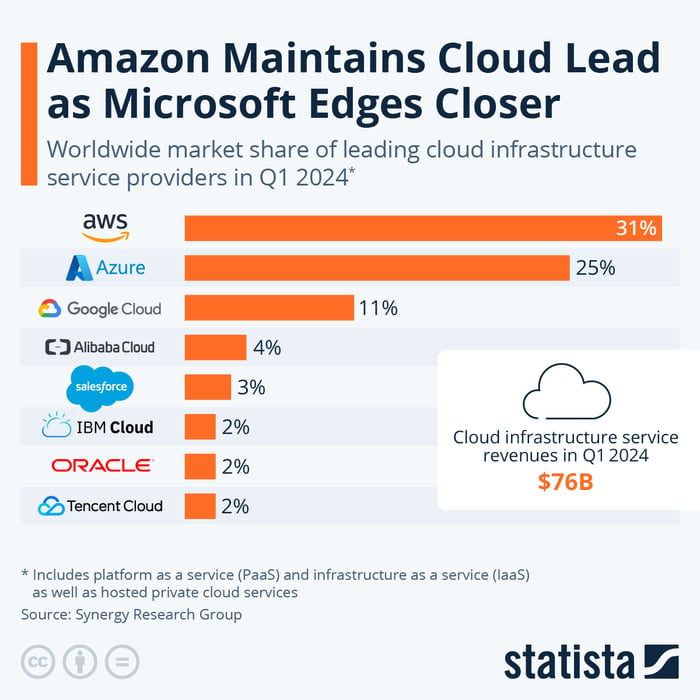

Moreover, Google Cloud is essential for processing AI workloads. Although it generated only $11 billion of Alphabet’s total revenue for the third quarter of 2024 out of $88 billion, it experienced a notable annual growth of 36%, while the company overall grew by just 15%.

With the company investing vigorously in AI, it spent $18 billion of its liquidity in the last nine months; however, it still retains $93 billion. This strong liquidity positions Alphabet well to pursue further AI projects. Additionally, Alphabet’s P/E ratio stands at 23, making it the most affordable option among the “Magnificent Seven” stocks—a potential attraction for more investors.

Alibaba: Overlooked Potential in AI

Another major player in AI, often overlooked by investors, is Alibaba (NYSE: BABA). The Chinese conglomerate is not only a retail giant but also a leading cloud computing company. While U.S. investors have largely focused on domestic AI companies, Alibaba has made significant strides in this arena.

Image source: Statista.

Recently, Alibaba launched over 100 new AI models, the Qwen 2.5 release, enhancing capabilities in areas like automotive and scientific research.

Despite these innovations, U.S. investors remain wary due to ongoing tensions between the U.S. and China, as well as fears related to potential Chinese stock delistings in 2022. Since its U.S. listing over ten years ago, Alibaba’s stock has struggled to gain traction.

Revenue growth in the second quarter of 2024 was modest at 4% year-over-year. However, comparing it to 2015, when Alibaba first reported its Q2 revenue, reflects tremendous growth: revenue surged from 20 billion renminbi to 243 billion renminbi ($33 billion) over the past nine years, illustrating the value offered to investors today.

With a P/E ratio of 26, Alibaba stocks present a solid opportunity for potential long-term growth.

Uber Technologies: Innovating with AI

Investors often overlook how much Uber Technologies (NYSE: UBER) relies on AI, considering it primarily a ridesharing app.

Currently, Uber utilizes AI to anticipate rider demand and adjust pricing, leading to reduced wait times and happier customers.

Looking ahead, Uber is focusing on autonomous driving. In collaboration with General Motors, it is starting to offer rides in self-driving Chevy Bolt vehicles, which is crucial for its growth strategy.

This technological development has translated into strong financial results. For the third quarter of 2024, Uber reported a revenue of $11 billion, representing a 20% increase compared to the previous year.

Uber has effectively managed its operating expenses, and a one-time income boost from non-core ventures of $1.85 billion contributed to a total profit of $2.6 billion. In the same quarter last year, the company earned only $221 million—a significant growth leap, not considering the one-time income.

With the stock rising 70% over the past year, its P/E ratio is around 79. Nonetheless, as profits climb, the forward P/E ratio lowers to 32, offering a favorable view of Uber’s AI-driven growth potential at a reasonable price.

A Second Chance for Investors?

Do you worry you missed out on investing in some of the most successful stocks? Now might be the time to consider your next steps.

Our expert analysts occasionally recommend a “Double Down” stock for companies they believe are on the brink of significant growth. If you feel you missed your chance, now could be the best time to invest. The statistics back it up:

- Amazon: If you invested $1,000 when we doubled down in 2010, you’d have $22,050!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $41,999!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $407,440!*

At this moment, we are also issuing “Double Down” alerts for three exceptional companies. Don’t miss another chance.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 4, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Nvidia, and Uber Technologies. The Motley Fool recommends Alibaba Group and General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.