Virgin Galactic Sees Improved Q3 Losses as Focus Shifts to New Spaceships

Virgin Galactic Holdings Inc. SPCE experienced a 3.5% jump in its stock price on Wednesday, closing at $7.12. This surge followed the announcement of a narrower net loss of $75 million for the third quarter, compared to a larger loss of $105 million during the same period last year. The company credited this improvement to reduced operating expenses.

Key Financial Insights: The total operating costs for Virgin Galactic decreased to $82.1 million in the latest quarter, down from $116 million last year. Despite these savings, the company’s revenue also saw a significant decline, dropping to $0.4 million from $1.7 million in the previous year due to a standstill in commercial spaceflights.

Looking ahead, Virgin Galactic is channeling its resources towards developing the Delta Class spaceships, which are slated to start commercial operations in 2026. These vessels aim to succeed the VSS Unity spaceplane, which completed its final commercial flight in the second quarter of this year.

New Funding Initiative: On Wednesday, Virgin Galactic announced the launch of an “at the market” equity program. Through this arrangement, the company plans to sell common stock amounting to $300 million over time. Funds from this initiative are intended to expedite the creation of its next-generation fleet, which includes adding another carrier plane like the VMS Eve and constructing third and fourth Delta Class spaceships.

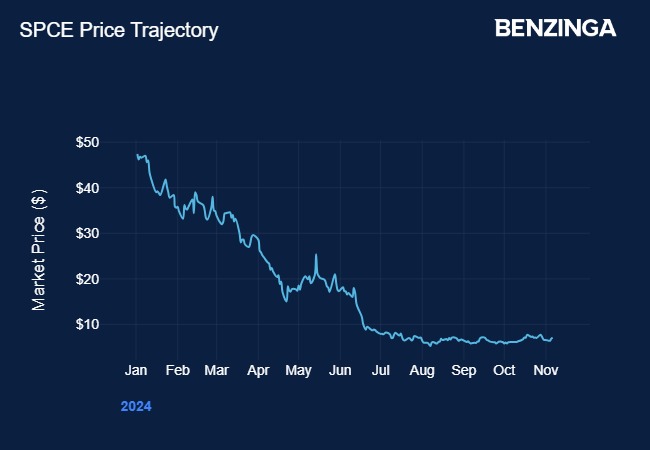

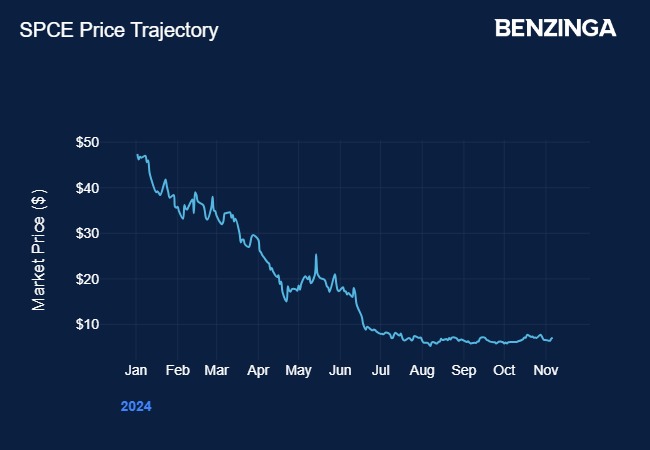

Stock Performance Overview: Even with Wednesday’s growth, Virgin Galactic’s stock has fallen approximately 85% year-to-date, according to data from Benzinga Pro, reflecting ongoing challenges for the company in the commercial space sector.

For more insights on the future of mobility, be sure to check out Benzinga’s coverage by following this link.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs