MasterCraft Boat Holdings Reports Mixed Q1 Results Amid Stock Surge

MasterCraft Boat Holdings, Inc. (MCFT) released its first-quarter fiscal 2025 results, showing earnings and revenues that surpassed the Zacks Consensus Estimate. However, both metrics experienced a decline compared to the previous year.

Stay informed on all quarterly releases: See Zacks Earnings Calendar.

The stock price jumped 25% during trading on Wednesday as investors reacted positively to a promising earnings forecast for fiscal 2025. Key factors driving this optimism included effective inventory management and improvements in shipping products. Additionally, the company emphasized its solid balance sheet and careful capital expenditures, highlighted by the recent sale of its Aviara brand and manufacturing facility, enhancing liquidity and operational focus.

Q1 Earnings and Revenue Overview

In its fiscal first quarter, MasterCraft reported an adjusted earnings per share (EPS) of 12 cents, exceeding the Zacks Consensus Estimate of 3 cents. This stands in contrast to the adjusted EPS of 60 cents from the same quarter last year.

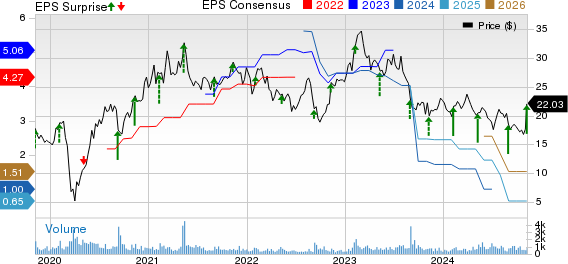

MASTERCRAFT BOAT HOLDINGS, INC. Price, Consensus, and EPS Surprise

MASTERCRAFT BOAT HOLDINGS, INC. price-consensus-eps-surprise-chart | MASTERCRAFT BOAT HOLDINGS, INC. Quote

Quarterly revenues reached $65.4 million, which surpassed the Zacks Consensus Estimate of $61 million by 6.4%. Nevertheless, this figure reflects a 30.7% decline compared to the previous year, largely due to lower unit volumes and an unfavorable mix of models and options.

To break it down further, net sales in the MasterCraft segment were $55.5 million, a significant decrease from $75.8 million reported in the same quarter last year. Meanwhile, net sales in the Pontoon segment dropped 46.8% year over year to $9.8 million.

Key Operating Highlights

Selling and marketing expenses for the quarter were down 6.8% year over year, totaling $2.9 million. General and administrative expenses amounted to $7.5 million, a reduction from $8.4 million in the prior-year quarter.

The gross margin for this quarter decreased by 570 basis points to 18.1%. This decline can be attributed to reduced cost absorption due to planned cuts in unit volume and increased dealer incentives.

Adjusted EBITDA for the quarter was $3.8 million, in contrast to $14 million in the same quarter of the previous year. The adjusted EBITDA margin also fell to 5.9%, down from 14.9% reported a year earlier.

Financial Position

As of September 29, 2024, MasterCraft had cash and cash equivalents of $14.2 million, a notable increase compared to $7.4 million on June 30, 2024.

Inventory was reported at $37.3 million, slightly higher than $37 million a year earlier.

Long-term debt, net of unamortized debt issuance costs, increased to $49.5 million from $44.9 million as of June 30, 2024.

Looking Ahead: Fiscal 2025 Forecast

For the second quarter of fiscal 2025, the company anticipates net sales to reach around $60 million, with adjusted EBITDA expected to be about $1 million. An adjusted loss per share of approximately 1 cent is projected for this period.

Throughout fiscal 2025, MasterCraft is forecasting total net sales between $270 million and $300 million. It aims for adjusted EBITDA of $17 million to $26 million, with capital expenditures estimated at $12 million. The expected adjusted EPS for 2025 has been revised to range from 55 cents to 95 cents, an increase from the prior estimate of 36 to 87 cents.

Current Zacks Rank for MCFT

MasterCraft Boat holds a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Other Recent Consumer Discretionary Reports

Royal Caribbean Cruises Ltd. (RCL) shared strong third-quarter 2024 results, surpassing the Zacks Consensus Estimate for both earnings and revenues. Year-over-year, both the top and bottom lines increased significantly.

In this quarter, higher pricing on close-in demand, along with ongoing growth in onboard revenues and lower costs due to timing, helped RCL exceed its targets. The company has raised its 2024 outlook, noting heightened demand heading into 2025.

Mattel, Inc. (MAT) also reported positive third-quarter 2024 results, with adjusted earnings and net sales exceeding the Zacks Consensus Estimate. Although the top line was adversely affected by declining sales across segments, adjusted earnings reflected growth, largely due to operational efficiencies.

Hilton Worldwide Holdings Inc. (HLT) released its third-quarter 2024 results, showing both earnings and revenues above the Zacks Consensus Estimate, demonstrating growth from the prior year.

The company benefited from increased RevPAR, owing to higher occupancy and average daily rates. Hilton opened 531 new hotels during the quarter, achieving a net room growth of 33,600, with plans for further expansion noted in its development pipeline.

Discover Energy’s Future: Nuclear Power Insights

As demand for electricity surges, the push to reduce reliance on fossil fuels like oil and natural gas intensifies. Nuclear energy presents a promising alternative.

Recently, leaders from the U.S. and 21 other nations pledged to triple the world’s nuclear energy capacity. This transition could yield significant profits for related stocks, especially for early investors.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, details key players and technologies driving this opportunity, including three standout stocks poised for significant benefits.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

For the latest recommendations from Zacks Investment Research, download our report on 5 Stocks Set to Double. Click for free access.

Royal Caribbean Cruises Ltd. (RCL): Free Stock Analysis Report

Mattel, Inc. (MAT) : Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

MASTERCRAFT BOAT HOLDINGS, INC. (MCFT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.