OGE Energy Reports Third-Quarter Earnings Below Expectations

OGE Energy Corp. reported earnings for the third quarter of 2024, coming in at $1.09 per share. This result fell short of the Zacks Consensus Estimate of $1.12 per share by 2.7%. Furthermore, earnings decreased by 9.2% compared to $1.20 per share recorded in the same quarter last year.

Check the Zacks Earnings Calendar for up-to-date market news.

Revenue Overview of OGE Energy

OGE’s operating revenues reached $965.4 million, reflecting an increase of 2.1% from $945.4 million in the previous year’s quarter. However, this result missed the Zacks Consensus Estimate of $1.12 billion by 13.4%.

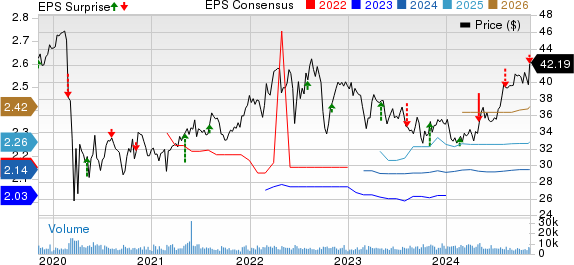

OGE Energy Price, Consensus, and EPS Surprise

OGE Energy Corporation price-consensus-eps-surprise-chart | OGE Energy Corporation Quote

Operational Performance Insights

Total sales were 9.7 million megawatt-hours (MWh), up from 9.3 million MWh in the same quarter last year. The customer count also grew by 1.2%, totaling 904,900.

In the third quarter, costs for fuel, purchased power, and direct transmission rose by 4.9% to $350.1 million.

Operating expenses increased by 7.7% to $302.1 million, driven by higher depreciation, amortization, operation and maintenance costs, as well as other taxes.

The operating income for OGE totaled $313.2 million, down 5.4% from the previous year’s $331.1 million.

Interest expenses climbed to $64.2 million, an 11.8% rise from the $57.4 million reported in the same quarter last year.

Segment Breakdown

The company’s net income in the third quarter was $218.7 million, marking a 9.6% decline from $241.9 million the year before.

In the OG&E segment, net income was $225 million, down from $246.1 million in the prior year, a drop of 8.6%. This decrease resulted from escalated depreciation, interest expenses, and higher operational costs.

The Other Operations segment experienced a net loss of $6.3 million, worsening from the loss of $4.2 million reported in the same quarter last year, primarily due to increased interest expenses.

Financial Position of OGE Energy

As of September 30, 2024, OGE held cash and cash equivalents amounting to $9.9 million compared to $0.2 million at the end of 2023.

The long-term debt increased to $5.02 billion, up from $4.34 billion at the end of December 2023.

In the first nine months of 2024, OGE generated $683.2 million from operating activities, down from $921.3 million during the same period last year.

Revised Guidance for 2024

OGE Energy has updated its guidance for earnings per share (EPS) for 2024. The company now expects to achieve earnings at the high end of its previous range of $2.06-$2.18 per share. The Zacks Consensus Estimate for EPS currently stands at $2.14.

Current Zacks Rank for OGE Energy

Currently, OGE Energy holds a Zacks Rank #4 (Sell).

You can find a complete list of stocks with a Zacks #1 Rank (Strong Buy) here.

Latest Updates from Other Utility Companies

Edison International (EIX) reported adjusted earnings of $1.51 per share for the third quarter, which exceeded the Zacks Consensus Estimate of $1.39 by 8.6%. This figure also rose 9.4% from $1.38 per share a year ago.

Operating revenues for EIX hit $5.20 billion, surpassing the consensus estimate of $4.76 billion by 9.4%, and also increasing by 10.6% from $4.70 billion in the previous year’s quarter.

FirstEnergy (FE) announced third-quarter operating earnings of 85 cents per share, falling short of the Zacks Consensus Estimate of 95 cents by 6.6%. The earnings decreased by 3.4% compared to 88 cents per share last year.

FE’s operating revenues totaled $3.73 billion but missed the consensus estimate of $3.98 billion by 6.4%, though revenues increased by 6.9% year-over-year from $3.48 billion.

CenterPoint Energy, Inc. (CNP) reported adjusted earnings of 31 cents per share for the third quarter, missing the Zacks Consensus Estimate of 36 cents by 13.9%, and down 22.5% from the previous year.

CNP’s revenues were $1.86 billion, just below the consensus estimate of $1.88 billion by 1.2%, and 0.2% lower than last year’s figure.

Exploring Opportunities in Nuclear Energy

The demand for electricity is rapidly increasing, leading to a growing interest in reducing reliance on fossil fuels. Nuclear energy presents a viable alternative.

Recently, leaders from the US and 21 other nations pledged to triple the world’s nuclear energy capacity. This ambitious goal could yield significant returns for investors engaged with nuclear-related stocks during this transformative period.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, details the companies and technologies involved, highlighting three standout stocks positioned to benefit as the market evolves.

Download your free copy of Atomic Opportunity: Nuclear Energy’s Comeback today.

Stay informed with the latest recommendations from Zacks Investment Research. Today, you can download “5 Stocks Set to Double” for free.

Edison International (EIX): Free Stock Analysis Report

FirstEnergy Corporation (FE): Free Stock Analysis Report

OGE Energy Corporation (OGE): Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.