Warren Buffett’s Berkshire Hathaway has found a way to quietly invest billions in a single company, a rare feat in the finance world. Last year, Berkshire gained a disclosure exemption from the Securities and Exchange Commission (SEC). Typically, such significant investments prompt a public announcement. This time, however, Berkshire was able to build its stake without drawing attention.

Earlier this year, the company was required to disclose its holdings, and it seems likely that Buffett will continue to increase his investment in this stock. There’s even a possibility he could aim to acquire the company entirely.

Berkshire’s Hidden Gem: Chubb

The stock in question is the insurance giant Chubb (NYSE: CB). The specifics behind the disclosure exemption remain unclear, but a plausible explanation is that Chubb directly competes with Berkshire in the insurance market.

Many recognize Berkshire for its vast investment portfolio managed by Buffett and his team. However, at its core, Berkshire Hathaway comprises a significant number of insurance companies offering various products, from health to commercial insurance. This sector generates steady billions in premiums, largely unaffected by market fluctuations. Consequently, it provides Berkshire with a consistent cash flow, giving the company a reliable source of capital to invest, especially when prices are favorable.

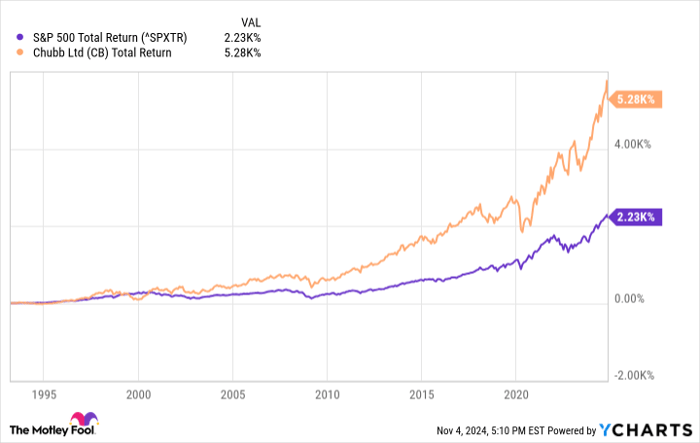

Unlike Berkshire, Chubb focuses primarily on property and casualty insurance. While this may not seem like the most exciting segment, it can still present a solid investment opportunity. Over the long haul, Chubb has consistently outperformed the S&P 500. Although its recent performance has leveled off—matching the S&P 500’s returns over the last five years—this trend can be attributed more to the exceptional rise of certain stocks, such as Nvidia, rather than any issues with Chubb itself.

When examining insurance companies, one of the first metrics to consider is the combined ratio. This ratio assesses how much profit an insurance company generates from premiums compared to its claims and expenses. Competition has driven this ratio to nearly 100% for many in the industry. Thus, profits primarily come from investing premiums, rather than underwriting performance.

In contrast, Chubb maintains a stringent underwriting approach, reporting a combined ratio of below 90% last quarter. This means the company only expects to pay out $0.90 in claims for every dollar earned in premiums. Chubb’s conservative strategy, especially in a competitive landscape, likely caught Buffett’s attention and has provided the company with a robust edge.

^SPXTR data by YCharts

Is Buffett Eyeing a Full Acquisition of Chubb?

Berkshire’s ongoing investment trend in Chubb suggests that Buffett is likely to continue increasing his stake. Notably, nearly every quarter since the initial acquisition, Berkshire has expanded its holdings. For instance, last quarter, it increased its position from 5.8 million shares to 6.9 million. Buffett clearly views Chubb as a strong company backed by its underwriting track record. This is also reflected in Berkshire’s cash reserves, which have surged to over $200 billion, a record high.

This year, Buffett remarked that cash is “quite attractive” compared to high-priced stocks, especially considering current global geopolitical conditions. Investing in Chubb offers him a way to achieve returns that exceed cash yields in a field he well understands. If Buffett finds Chubb compelling enough, he might consider acquiring the entire company, integrating it into Berkshire’s insurance sector. With a market capitalization of $110 billion, Chubb represents a substantial opportunity for Buffett to deploy some of Berkshire’s cash without venturing into more volatile industries.

A Potential Investment Opportunity Awaits

If you’ve ever felt like you’ve missed out on the top-performing stocks, now might be your chance.

Our team of experts occasionally highlights specific stocks expected to rise significantly, known as a “Double Down” stock. If you’re concerned that the opportunity has passed you by, now is an excellent time to invest before it slips away. Consider the following:

- Amazon: if you had invested $1,000 when we issued a double down in 2010, you’d have $23,324!*

- Apple: if you had invested $1,000 when we doubled down in 2008, you’d have $42,133!*

- Netflix: if you had invested $1,000 when we doubled down in 2004, you’d have $420,761!*

Currently, we are providing “Double Down” alerts for three impressive companies, and this opportunity may not arise again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 4, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Nvidia. The Motley Fool has a disclosure policy.

The views expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.