MercadoLibre Reports Third Quarter Results: Earnings Miss Expectations, But Revenue Grows

MercadoLibre MELI faced a challenging third quarter in 2024, with earnings of $7.83 per share falling short of the Zacks Consensus Estimate by 30.52%. However, this figure marks a 9.4% rise from the previous year.

Revenues climbed 35% year over year, reaching $5.3 billion, and surpassed the Zacks Consensus Estimate by 1.11%. This growth can be attributed to strong performance in both commerce and fintech, which saw increases of 48% and 21% year over year, totaling $2.12 billion and $1.79 billion, respectively.

Additionally, advertising services revenue rose 37% year over year, comprising nearly 2% of the gross merchandise volume (GMV) at the end of the quarter. Enhanced total payments volume (TPV) has been a key component of MercadoLibre’s success, supported by robust activity from Mercado Pago, and strong sales growth across Brazil and Mexico.

During the third quarter, MERCADO opened six new fulfillment centers, expanding its footprint with five located in Brazil and one in Mexico.

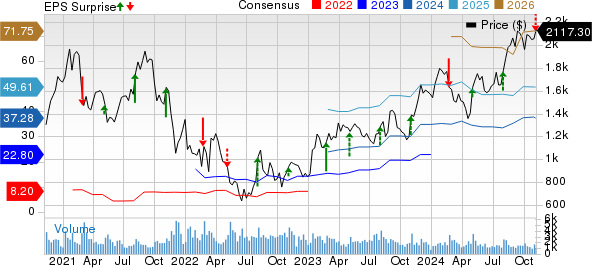

MercadoLibre, Inc. Price, Consensus and EPS Surprise

MercadoLibre, Inc. price-consensus-eps-surprise-chart | MercadoLibre, Inc. Quote

Quarterly Breakdown

Brazil: The region contributed $2.91 billion in revenues, accounting for 54.8% of total revenues and reflecting a year-over-year increase of 41.2%.

Argentina: Revenue from Argentina reached $1.03 billion, representing 19.4% of total revenues, with a year-over-year growth of 13.5%.

Mexico: In Mexico, revenues soared 44% year over year to $1.14 billion, which constituted 21.6% of total revenues.

Other countries: Revenues from other markets generated $221 million, reflecting a 39% increase year over year and making up 4.2% of total revenues.

Critical Metrics

The GMV reached $12.9 billion, up 71.2% on an FX-neutral basis year over year, exceeding the consensus estimate by 0.91%. Successful items sold increased by 27.7% to 456 million, while items shipped grew 29.4% to 453 million.

TPV surged by 72.7% year over year on a FX-neutral basis, totaling $50.6 billion, primarily driven by Mercado Pago’s impressive performance, and beating the Zacks Consensus Estimate by 2.96%. Total payment transactions rose 47.5% year over year to 2.93 billion.

Fintech saw monthly active users reach 56 million, marking a growth of 33.3% from the previous year.

Operational Insights

For the third quarter, the gross margin was 45.9%, a decline from 53.6% in the same quarter last year. Operating expenses increased by 43.7% year over year to $1.88 billion, raising the percentage of revenues to 35.4%, up 60 basis points year over year. Consequently, the operating margin fell to 10.5%, down from 20.9% a year prior.

Financial Position

As of September 30, 2024, cash and cash equivalents stood at $2.16 billion, a decline from $2.82 billion as of June 30, 2024. Short-term investments totaled $1.1 billion, while net debt was recorded at $1.9 billion by the end of the quarter.

Investment Outlook

Currently, MercadoLibre holds a Zacks Rank #2 (Buy). Other notable stocks in the retail-wholesale sector include Alibaba BABA, Boot Barn BOOT and Brinker International EAT, which each have a Zacks Rank #1 (Strong buy).

Year-to-date, shares of BABA are up 24.8%, with a long-term earnings growth estimate of 7.66%. Boot Barn shares have increased by 65.7% in the same timeframe, supported by a projected long-term earnings growth of 12.99%. Brinker International has seen an impressive gain of 168.3% this year, with anticipated long-term earnings growth at 32.44%.

Discover New Investment Insights

The demand for electricity is rising rapidly while efforts to reduce reliance on fossil fuels continue. Nuclear energy presents a viable alternative. Leaders from the US and 21 other countries have recently pledged to triple the world’s nuclear energy capacities, potentially offering significant profits for investors involved in this transition.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, explores key players and technologies in this space, highlighting three stocks that could greatly benefit from this development. Download your copy of Atomic Opportunity: Nuclear Energy’s Comeback today.

Want to stay ahead with the latest investment recommendations? You can download our report on 5 Stocks Set to Double. Click here to access this free report.

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

MercadoLibre, Inc. (MELI) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.