Datadog Receives Buy Rating Boost: Analyst Sees Significant Future Growth

Fintel reports that on November 7, 2024, Monness, Crespi, Hardt upgraded their outlook for Datadog (XTRA:3QD) from Neutral to Buy.

Analyst Price Projections Indicate 20.93% Growth Potential

As of October 22, 2024, the average one-year price target for Datadog is 139.11 €/share. Forecasts range from a low of 108.09 € to a high of 222.80 €. This average target suggests an increase of 20.93% from its latest closing price of 115.04 € per share.

Explore our leaderboard highlighting companies with the greatest price target upside.

Company’s Revenue and Earnings Expectations

The projected annual revenue for Datadog stands at 2,748 million €, reflecting an increase of 8.35%. Analysts anticipate the annual non-GAAP EPS to be 1.52.

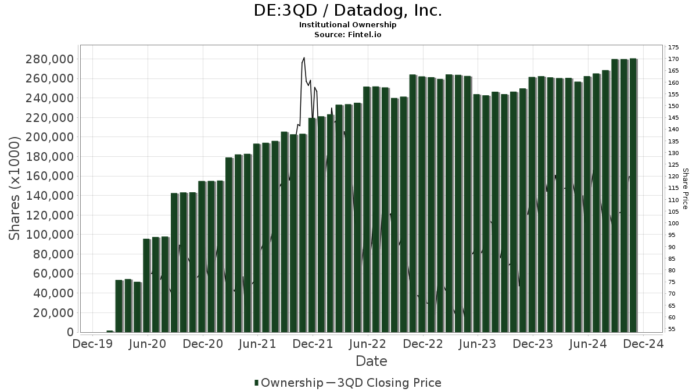

Institutional Investors’ Sentiment

Currently, there are 1,522 funds or institutions reporting positions in Datadog, marking an increase of 11 owners, or 0.73%, over the last quarter. The average portfolio weight of all funds invested in 3QD is 0.47%, up by 4.36%. Institutions have collectively increased their shares owned by 3.63% in the past three months to 280,532K shares.

Baillie Gifford reports holding 9,421K shares, or 3.03% of the company. This is a decrease from their last filing, where they owned 9,493K shares, indicating a drop of 0.77%. Over the last quarter, their allocation in 3QD decreased significantly by 68.20%.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) owns 8,777K shares, equating to 2.82% ownership. Previously, the firm held 8,559K shares—a rise of 2.48%. Their allocation in 3QD increased by 4.63% in the last quarter.

Jennison Associates holds 6,147K shares for 1.98% ownership. This is a striking increase from the 422K shares reported in the firm’s last filing, boosting their stake by an impressive 93.14% and a portfolio allocation increase of 679.87% over the last quarter.

The Vanguard Mid-Cap Index Fund Investor Shares (VIMSX) holds 5,947K shares, or 1.91% of the company. They reported an increase from 5,909K shares, amounting to a 0.64% rise in ownership. Their portfolio allocation in 3QD rose by 9.02% recently.

The Invesco QQQ Trust, Series 1 possesses 5,941K shares, representing 1.91% ownership. Their previous holding was 5,741K shares, reflecting a 3.36% increase, albeit with a slight reduction in portfolio allocation in 3QD by 2.27% over the last quarter.

Fintel offers one of the most extensive research platforms for investors, traders, financial advisors, and small hedge funds, covering fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, and much more. Our exclusive stock selections are backed by advanced, tested quantitative models aimed at optimizing profit.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.