MKS Instruments Reports Strong Q3 Earnings, Sets Optimistic Q4 Expectations

MKS Instruments (MKSI) announced adjusted earnings of $1.72 per share for the third quarter of 2024, a rise from $1.46 per share during the same period last year. This figure exceeded the Zacks Consensus Estimate by 21.13%.

Revenue reached $896 million, beating the consensus estimate by 2.62%, although it marked a decline of 3.9% from the previous year.

Product revenues, which account for 86% of total revenue, stood at $776 million, down 5.1% year over year. This amount surpassed the Zacks Consensus Estimate by 1.78%.

Conversely, service revenues, representing 13.4% of total revenues, experienced a 5.3% increase year over year, totaling $120 million, exceeding the Zacks Consensus Estimate by 6.92%.

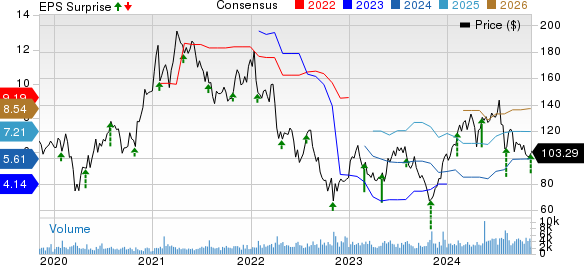

MKS Instruments, Inc. Financial Summary

MKS Instruments, Inc. price-consensus-eps-surprise-chart | MKS Instruments, Inc. Quote

Year-to-date, MKSI shares have increased by 0.4%, while the Zacks Computer & Technology sector has risen by 11.5%. An optimistic outlook for the future may support MKSI’s stock recovery.

Quarterly Breakdown from MKSI

Revenue from the Semiconductor market, which comprises 42.2% of total revenue, rose by 3% year over year to $378 million, beating the Zacks Consensus Estimate by 4.80%.

Revenue from Electronics & Packaging, making up 25.8% of total revenue, fell to $231 million, down from $243 million last year. This figure, however, surpassed the Zacks Consensus by 3.02%.

Specialty Industrial revenue, which constitutes 32% of total revenue, saw a significant decline of 10.9% year over year, totaling $287 million. This result missed the Zacks Consensus Estimate by 0.94%.

Operating Metrics of MKSI

The adjusted gross margin for MKS Instruments widened by 110 basis points (bps) year over year, reaching 48.2% in the third quarter.

Research & Development expenses increased slightly as a percentage of revenue, expanding 20 bps year over year. Sales, General & Administrative expenses also increased, up 70 bps year over year.

Non-GAAP operating income fell to $195 million, down 3.9% from the prior year, while the adjusted operating margin remained stable at 21.8%.

Adjusted EBITDA decreased by 3.7% year over year to $232 million, although the adjusted EBITDA margin improved by 10 bps to 25.9%.

Financial Position of MKSI

As of September 30, 2024, MKS Instruments reported cash and cash equivalents of $861 million, up from $850 million on June 30, 2024.

Cash flow from operations for the third quarter totaled $163 million, compared to $122 million in the prior quarter.

Free cash flow surged to $141 million, growing from $96 million reported the previous quarter.

During this quarter, the company also paid out cash dividends of $15 million, equating to 22 cents per share.

MKS Instruments Offers Q4 Guidance

Looking ahead, MKSI anticipates third-quarter revenues of approximately $910 million, with a potential variance of +/- $40 million.

For adjusted EBITDA, the company foresees figures around $226 million, with a variance of +/- $23 million.

On a non-GAAP basis, MKSI expects to deliver earnings of $1.95 per share, with a variance of +/- 32 cents.

MKSI’s Market Outlook

At present, MKSI holds a Zacks Rank #3 (Hold).

Investors may also look at other promising stocks in the sector, including Shopify (SHOP), BiliBili (BILI), and NVIDIA (NVDA). Shopify, currently a Zacks Rank #1 (Strong Buy), has seen its shares rise by 4.9% year to date and is set to report third-quarter 2024 results on November 12. Meanwhile, Bilibili has gained 82% for the year and will report results on November 14, and NVIDIA has surged by 194% year to date, with its results expected on November 20.

Explore the Future of Nuclear Energy

Electricity demand is skyrocketing while we strive to reduce reliance on fossil fuels. Nuclear energy presents a viable alternative.

Recently, leaders from the U.S. and 21 other countries pledged to triple global nuclear energy capacity. This bold move could create significant profit opportunities for nuclear-related stocks, benefiting early investors.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, details the key players and technologies behind this shift, highlighting three stocks likely to thrive the most.

Download our report on the nuclear energy comeback today.

If you’re seeking the latest recommendations from Zacks Investment Research, consider our report on 5 Stocks Set to Double.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

MKS Instruments, Inc. (MKSI): Free Stock Analysis Report

Shopify Inc. (SHOP): Free Stock Analysis Report

Bilibili Inc. Sponsored ADR (BILI): Free Stock Analysis Report

To view this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.