Datadog Gets a Lift: Analysts Upgrade Stock to ‘Buy’

On November 7, 2024, Monness, Crespi, Hardt boosted their rating for Datadog (NasdaqGS:DDOG) from Neutral to Buy.

Analysts See 16.18% Growth Potential

As of October 22, 2024, Datadog’s average one-year price target sits at $150.79 per share. This target ranges from a low of $117.16 to a high of $241.50. The estimated price represents a potential climb of 16.18% from its recent closing value of $129.79 per share.

For more insights, check out our list of companies projected for significant price target increases.

Datadog’s Revenue and Earnings Projections

Projected revenue for Datadog stands at $3,063 million, marking a robust increase of 20.77%. Analysts estimate the non-GAAP earnings per share (EPS) to be $1.68.

Fund Sentiment Trends

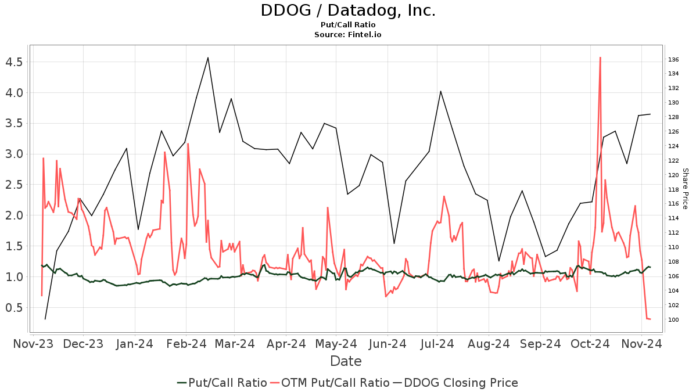

Currently, 1,524 funds and institutions report holdings in Datadog, reflecting an increase of 11 owners, or 0.73%, over the previous quarter. The average portfolio weight of all funds in DDOG has risen by 4.36% to 0.47%. In the past three months, institutional ownership of Datadog shares has grown by 2.11%, bringing total shares owned up to 280,532,000.  Notably, DDOG’s put/call ratio stands at 1.10, indicating a generally bearish outlook among investors.

Notably, DDOG’s put/call ratio stands at 1.10, indicating a generally bearish outlook among investors.

Baillie Gifford currently holds 9,421,000 shares, accounting for 3.03% of the company. This shows a slight decline from their previous holding of 9,493,000 shares, representing a 0.77% decrease. The firm has reduced its overall investment in Datadog by 68.20% this past quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) owns 8,777,000 shares, or 2.82% of Datadog, having increased their holdings from 8,559,000 shares by 2.48% over the last filing period. This firm stepped up its investment by 4.63% recently.

Jennison Associates recorded a significant increase in their holdings, now owning 6,147,000 shares (1.98%). This is a major jump from their earlier holding of just 422,000 shares, which reflects a striking 93.14% increase in their position.

The Vanguard Mid-Cap Index Fund Investor Shares (VIMSX) holds 5,947,000 shares, representing a 1.91% stake, which is up slightly from their previous report of 5,909,000 shares, marking a 0.64% increase this quarter.

Meanwhile, Invesco QQQ Trust, Series 1, owns 5,941,000 shares, representing 1.91% ownership, an increase from 5,741,000 shares, although they decreased their portfolio allocation in Datadog by 2.27% this past quarter.

About Datadog

(This information is provided by the company.)

Datadog is known for its monitoring and security platform designed for cloud applications. Its SaaS platform offers integrated solutions for infrastructure monitoring, application performance tracking, and log management, which provides clients with comprehensive, real-time insights into their entire technology setup. The platform is adopted by a range of organizations to facilitate digital transformation, enhance collaboration, speed up application rollout, and maintain robust security measures.

Fintel serves as a premier research platform for individual investors, traders, financial advisors, and small hedge funds.

Our global data includes various aspects such as fundamentals, analyst insights, ownership statistics, fund sentiment, options analysis, insider trading, and more. In addition, our unique stock recommendations are driven by sophisticated, backtested quantitative models aimed at maximizing profits.

For more details, click to learn more.

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.