The KraneShares Electric Vehicles and Future Mobility Index ETF KARS has reached an important milestone by achieving a Golden Cross, which has caught the attention of investors and sparked optimism in the market.

This ETF, designed to track the global shift towards electric vehicles (EVs) and future mobility, is experiencing a notable price increase as it moves above its five, 20, and 50-day exponential moving averages. This shift indicates strong bullish momentum for the fund.

KARS is benefiting from a robust lineup of major holdings, featuring leading names in the EV industry. Top players include BYD Co Ltd BYDDF, Tesla Inc. TSLA, and Geely Automobile Holdings Ltd GELYF. The ETF also includes rising stars like Li Auto Inc LI, XPeng Inc XPEV, and Arcadium Lithium PLC ALTM.

Read Also: What’s Next for GM After Chevrollet Bolt’s Exit? Last Year’s Delivery Stats May Provide Insights

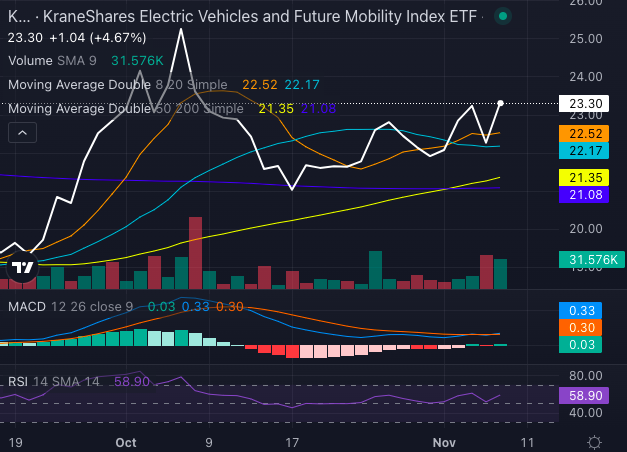

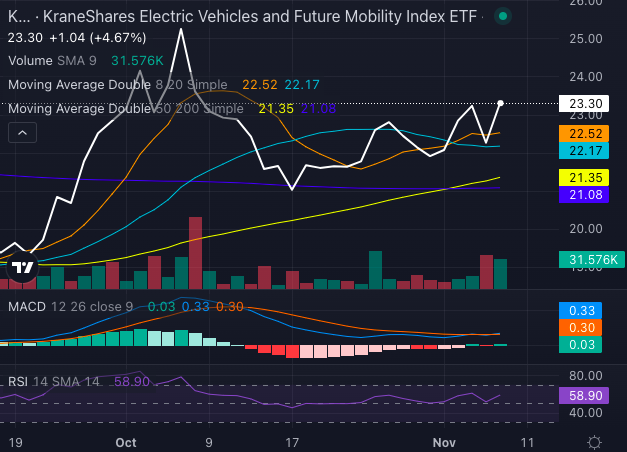

Chart created using Benzinga Pro

KARS ETF Hits a Bullish Milestone

Trading at $23.30, KARS has caught the eye of technical analysts. The ETF’s 50-day simple moving average (SMA) has moved above the 200-day SMA, marking the occurrence of a Golden Cross. Additionally, its eight-day SMA is at $22.52, the 20-day at $22.17, and the 50-day at $21.35. These indicators reinforce the positive momentum surrounding the ETF.

Currently, the ETF trades above its 200-day SMA of $21.08, strengthening its case for potential growth.

Over the past five days, KARS has gained 5%. Its 52-week high sits at $26.10, a target that may soon be within reach. Despite a slight year-to-date decline of 7.32%, the recent upward trend suggests KARS may be rebounding, largely due to the steady performance of its core holdings.

Strong Holdings Propel KARS Forward

Leading KraneShares’ KARS ETF are major players in the electric vehicle market. BYD, the Chinese EV giant, holds the top position, composing 4.15% of the fund. Following closely is Tesla (TSLA) at 4.13%, with Geely, Xpeng, and Li Auto also contributing to the ETF’s growth.

This year, BYD and Tesla have both performed exceptionally, gaining 36.61% and 19.52% year-to-date, respectively. In contrast, Li Auto has faced challenges, with a year-to-date decline of 25.96%, though interest in the electric vehicle market remains strong.

Cautious Optimism Amid Bullish Signs

While the Golden Cross typically points to positive trends, KARS’ Relative Strength Index (RSI) now stands at 58.9, suggesting it may be approaching overbought levels. The Moving Average Convergence Divergence (MACD) indicator sits at 0.33, indicating room for further gains. However, a note of caution is advisable as investors remain vigilant for signs of market cooling.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs