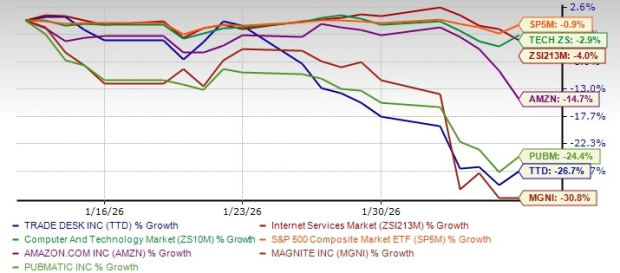

Market Rally Fuels Interest in Top Zacks Growth Stocks

In today’s episode of Full Court Finance at Zacks, we examine the stock market’s remarkable ascent to new heights post-presidential election. Our focus will center on three high-growth stocks with a Zacks Rank #1 (Strong Buy)—Shopify, Nu Holdings, and Vertiv—that investors may want to consider purchasing and holding for the next decade.

Keep an eye on the Zacks Earnings Calendar for important market news updates.

The stock market soared to record levels on Wednesday after the presidential election, with the Nasdaq and S&P 500 further increasing their mid-week gains on Thursday. This uptick comes as Wall Street celebrates decreased uncertainty and anticipates reduced corporate taxes, less regulation, and a focus on economic growth in a second Trump term.

It’s important to recognize that stock market performance isn’t solely influenced by political parties. For example, the average annual returns during the Trump and Obama presidencies—including instances of both unified and divided governments—were strikingly similar at 16.0% and 16.3%, respectively.

Additionally, this bull market is still relatively young, having begun two years ago. Historically, bull markets last an average of five and a half years, and the period from November to January has historically been the strongest three-month stretch for Wall Street since 1971.

Given this favorable backdrop, investors may wish to increase their participation in the stock market this November. Let’s dive into three growth-oriented Zacks Rank #1 (Strong Buy) stocks to consider for long-term investment.

Is Shopify a Smart Buy Trading 50% Below Its Highs?

Shopify Inc. SHOP has significantly outperformed both Amazon and the tech sector since its IPO in 2015. However, SHOP is currently trading at about 50% less than its all-time highs ahead of its Q3 2024 earnings report on November 12.

Since 2018, Shopify’s revenue has surged from $1 billion to $7 billion in 2023, thanks to its extensive range of services aimed at entrepreneurs, small businesses, and larger companies.

The company offers an easy-to-use platform for website creation, marketing, sales, payments, inventory management, and shipping, supporting both digital and physical stores.

Despite the dominance of Amazon in e-commerce, Shopify stands out by focusing on empowering businesses rather than competing for consumer attention.

To counteract slower sales growth, Shopify raised its pricing plans by roughly 30% for the first time in over ten years and is working to optimize profitability.

Image Source: Zacks Investment Research

Shopify is projected to boost sales by approximately 22% in 2024 and 20% in 2025, driving revenue from $7 billion last year to over $10 billion next year. The company’s adjusted earnings are anticipated to increase by 51% and 19%, respectively, leading to a Zacks Rank #1 (Strong Buy). Shopify also maintains a solid balance sheet.

Since its 2015 IPO, Shopify’s stock has surged roughly 2,900%, significantly outperforming Amazon’s 900% and Tech’s 300%. Currently, it trades about 50% below its 2021 highs, even after a remarkable 160% increase over the past two years.

Although Shopify has regained its 21-day moving average and is trading above its 200-week moving average once again, high valuations are keeping the stock constrained at present. However, its PEG ratio at 2.3 suggests an 84% markdown from its recent highs, with a modest premium compared to the Zacks Tech sector’s 1.6.

Consider Nu Holdings as a Budget-Friendly Tech Investment Under $20

Nu Holdings Ltd. NU has skyrocketed 83% in 2024, helping it double the performance of its well-regarded Technology Services industry, with an overall increase of 200% in the past two years. Despite this growth, NU shares are currently priced around $15 each. This stock found support at its 21-day moving average prior to its Q3 FY24 earnings release on November 13.

Nu excels as a digital financial services leader with a customer base of roughly 105 million across Brazil, Mexico, and Colombia. This fintech firm is disrupting the banking and financial services sectors in regions with large population bases.

As the largest digital banking platform outside of Asia and the fourth-largest financial institution in Latin America by customer count, Nu boasts that over 50% of Brazilian adults are active customers of its platform.

Nu Holdings and Vertiv: High-Growth Stocks to Watch

Nu Holdings Experiencing Remarkable Growth

Image Source: Zacks Investment Research

Nu Holdings Ltd. (NU) reported a 25% year-over-year increase in its customer base last quarter. Looking ahead, the company forecasts a significant rise in adjusted earnings, projecting growth of 71% in 2024, followed by 52% in 2025. Its bottom line improved from $0.02 in 2022 to $0.24 in 2023, highlighting a successful expansion strategy.

Furthermore, Nu’s revenue anticipates a substantial increase of 49% in 2024 and 34% in 2025, aiming to double its revenue from $8 billion in the previous year to $16 billion by fiscal year 2025.

Image Source: Zacks Investment Research

NU has received a Zacks Rank #1 (Strong Buy) thanks to its positive earnings revisions. Currently, its stock is trading at a 55% discount to previous highs at 25.4X forward earnings, providing a value proposition of 40% compared to its industry peers.

Notably, with a PEG ratio of 0.5, factoring in growth expectations, it indicates a 200% discount to its industry, despite NU’s impressive performance over the past two years.

Vertiv: A Strong Contender in AI Infrastructure

Vertiv Holdings Co VRT has emerged as a standout player in the artificial intelligence sector, with its stock soaring 155% year-to-date and an astonishing 1,100% over the last five years, outpacing the broader tech industry.

This company operates behind the scenes of major technology and AI operations, supporting data centers and communication networks. Vertiv provides hardware, software, analytics, and services targeted at power, cooling, and IT infrastructure management.

By ensuring that critical computing power essential for data centers, AI, cryptocurrencies, and more runs smoothly around the clock, Vertiv plays a vital role in the modern economy. Their partnership with Nvidia NVDA is aimed at tackling challenges related to data center efficiency and cooling.

Image Source: Zacks Investment Research

In its latest earnings report, Vertiv exceeded expectations, earning a Zacks Rank #1 (Strong Buy). Management projects a 52% increase in adjusted earnings per share for fiscal year 2024 and 30% for 2025, building on a remarkable 230% growth last year. Revenue is also expected to grow by 14% in 2024 and 16% in 2025.

Currently, VRT trades at a 10% discount from its highs at 35.6X forward earnings, despite a recent surge in stock price. It provides a relative value of 7% compared to its rapidly-growing Computers – IT Services industry.

Over the last three years, Vertiv’s stock has risen 350%, far outperforming its industry, which has seen a slight decline. All twelve brokerage recommendations from Zacks are categorized as “Strong Buys.”

Key Investments Amid Infrastructure Spending Boom

With trillions of dollars in Federal funding directed towards upgrading America’s infrastructure, a portion of this investment is expected to flow into AI data centers and renewable energy.

This environment opens doors for several surprising stocks poised to benefit significantly from the upcoming spending spree.

For further insights, download the report titled “How to Profit from the Trillion-Dollar Infrastructure Boom” for free today.

Interested in Zacks Investment Research’s latest stock recommendations? You can access “5 Stocks Set to Double” at no cost.

Free Stock Analysis Reports:

- Amazon.com, Inc. (AMZN)

- Nu Holdings Ltd. (NU)

- NVIDIA Corporation (NVDA)

- Shopify Inc. (SHOP)

- Vertiv Holdings Co. (VRT)

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.