Maxim Group Downgrades Gilead Sciences: A Shift in Investment Sentiment

Funds Show Mixed Reactions to Gilead’s Outlook

Fintel reports that on November 8, 2024, Maxim Group downgraded their outlook for Gilead Sciences (SNSE:GILDCL) from Buy to Hold.

Fund Sentiment: A Closer Look

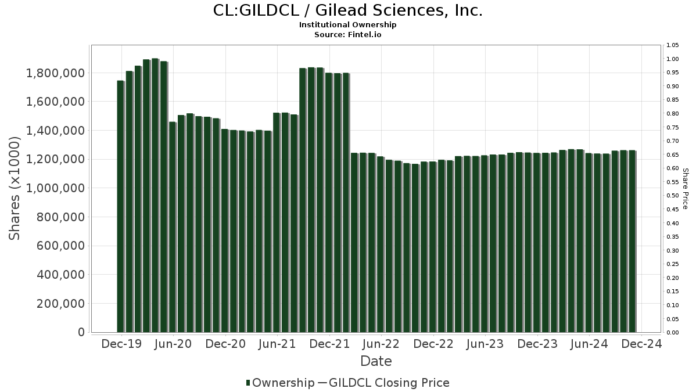

There are 2,850 funds or institutions reporting positions in Gilead Sciences, reflecting a decrease of 20 owners or 0.70% in the last quarter. The average portfolio weight of all funds dedicated to GILDCL is 0.40%, which marks an increase of 5.09%. Furthermore, total shares owned by institutions rose by 2.17% over the past three months to 1,262,285K shares.

Capital World Investors currently holds 76,250K shares, which represents 6.12% ownership of Gilead. Previously, they reported owning 84,497K shares, indicating a decrease of 10.82%. The firm’s portfolio allocation in GILDCL was reduced by 16.72% last quarter.

Another significant player, Capital Research Global Investors, has 60,428K shares, accounting for 4.85% ownership. Their prior report indicated ownership of 61,246K shares, resulting in a decrease of 1.35%. They also lowered their portfolio allocation for GILDCL by 10.38% in the past quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares has increased its holdings slightly to 39,368K shares, which is 3.16% ownership. Their previous filings showed 39,174K shares, reflecting a 0.49% increase. However, their portfolio allocation in GILDCL fell by 8.46% over the last quarter.

Dodge & Cox holds 33,122K shares, or 2.66% ownership, down from 33,167K shares, marking a decrease of 0.14%. The firm reduced its portfolio allocation by 3.23% last quarter.

Finally, VFINX – Vanguard 500 Index Fund Investor Shares has increased to 31,976K shares, representing 2.57% ownership, up from 31,400K shares. This reflects an increase of 1.80%, yet their portfolio allocation in GILDCL dropped by 9.71% in the last quarter.

Fintel offers a robust investing research platform, catering to individual investors, traders, financial advisors, and small hedge funds.

Our data encompasses a variety of metrics, including fundamentals, analyst reports, ownership data, options sentiment, insider trading, options flow, and more. Our exclusive stock picks are driven by advanced, backtested quantitative models aimed at enhancing profitability.

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.