Understanding Philip Morris: A Potential High-Yield Dividend Stock

Investors often seek out dividends for their reliability, especially during unpredictable market conditions. Over the past five years, market volatility has become somewhat of a norm. Steady dividend payments can help individuals navigate these ups and downs.

However, when the S&P 500 only yields an average dividend of 1.32%, many investors find themselves questioning where to look for better annual returns—especially when short-term Treasury bills offer more attractive rates at this time.

Thus, investors should search for stocks boasting higher starting dividend yields combined with earnings growth that supports increased dividends over time. Such stocks are rare, particularly with the market at its peak.

One notable stock that fits this bill is Philip Morris International (NYSE: PM). Regarded as a misunderstood giant in the nicotine space, Philip Morris is experiencing strong revenue and earnings growth and currently offers a dividend yield exceeding 4%. Here’s why this dividend-focused stock may outperform the S&P 500 over the next decade.

Expanding Into Safer Nicotine Products

Philip Morris is primarily known as a cigarette seller outside the U.S., with iconic brands like Marlboro and Chesterfield. Yet, this portrayal overlooks significant progress the company has made in recent years.

Through strategic investments and acquisitions, Philip Morris has shifted its focus toward products like heat-not-burn tobacco, electronic vapor, and nicotine pouches. These items are considered less harmful and have steadily garnered market share from traditional cigarettes, with Philip Morris leading this transition.

In the last quarter, these modern nicotine offerings accounted for 38% of the company’s total revenue, growing faster than the overall business. Notably, sales in its smoke-free division surged 16.8% year-over-year, driven by the popularity of Zyn nicotine pouches in the U.S. and Iqos devices in Europe and Japan. Additionally, this expansion enhanced gross margins, achieving a 20.2% increase in gross profit within that segment.

As these innovative products continue to gain traction in the market, they are poised to drive substantial revenue growth for years to come.

Consistent Earnings from Traditional Cigarettes

Do not overlook the legacy cigarette business at Philip Morris International. The company has effectively maintained earnings growth in this area through consistent price increases.

Cigarette prices have risen by over 5% annually in 2022, 2023, and into 2024, contributing to an 8.6% increase in cigarette revenue last quarter.

Philip Morris appears well-positioned to continue growing cigarette sales via price hikes. Should nicotine users choose to stop smoking due to these increases, the company can rely on its leading nicotine products, such as Iqos and Zyn, to retain these customers. This strategy offers Philip Morris a robust advantage in the evolving nicotine landscape.

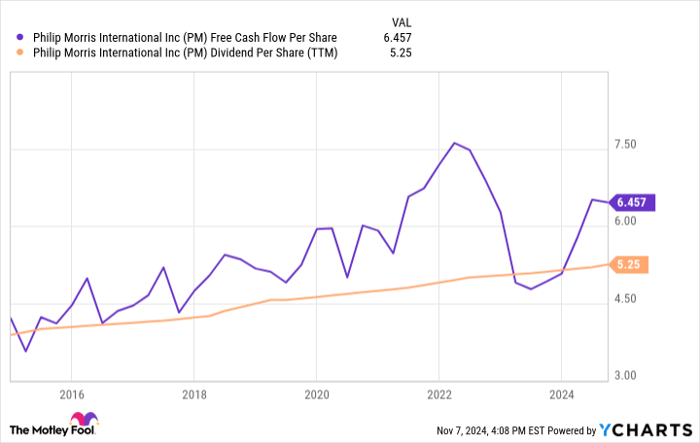

PM free cash flow per share, data by YCharts; TTM = trailing 12 months.

A Promising Dividend Growth Outlook

As of now, Philip Morris offers a dividend yield of 4.4%, with a dividend payout of $5.25 per share that is fully supported by its free cash flow of $6.46 per share. Both figures have increased steadily over the past decade, and there’s a strong likelihood they will continue this trend.

With the rapid expansion of nicotine alternatives, the company is expected to achieve revenue growth of 5% to 10% annually over the next five years. Furthermore, increased scale should drive profit margins higher, allowing free cash flow per share to grow by over 10% in the long run. Consequently, management may raise the dividend by about 10% each year.

This scenario appears favorable for long-term investors. Should Philip Morris successfully compound its dividend at this rate over the next decade, the yield could reach 11%, based on the current share price of $124. This growth in dividend income, paired with potential stock appreciation, would benefit investors looking to grow their wealth.

Such an advantageous combination exemplifies why Philip Morris International could significantly outperform the S&P 500 index over the next ten years.

A New Opportunity to Invest

Have you ever felt as if you missed your chance to purchase major successful stocks? If so, consider this your moment to act.

Our team of expert analysts occasionally issues a “Double Down” stock recommendation, highlighting companies they believe are on the verge of significant gains. If you worry about missing out, now represents a prime time to invest before it’s too late. The strong track record of past recommendations underscores this point:

- Amazon: A $1,000 investment in 2010 would now be worth $23,446!*

- Apple: A $1,000 investment in 2008 has grown to $42,982!*

- Netflix: Investing $1,000 in 2004 would yield $428,758!*

Currently, we are providing “Double Down” alerts for three remarkable companies—this may be one of your last chances to capitalize on such investments.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 4, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends Philip Morris International. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.